Generating Yield In A Volatile Market

It has only been a little more than a month since we last visited the topic of generating yield in an evolving market, but market conditions have changed so rapidly since then it is time to revisit it, and in fact, this will become a recurring topic. The Fed recently began its “rate hike cycle” as it attempts to balance economic growth against rampant inflation, the stock market has been volatile and geopolitical tensions are as high as they have been in decades.

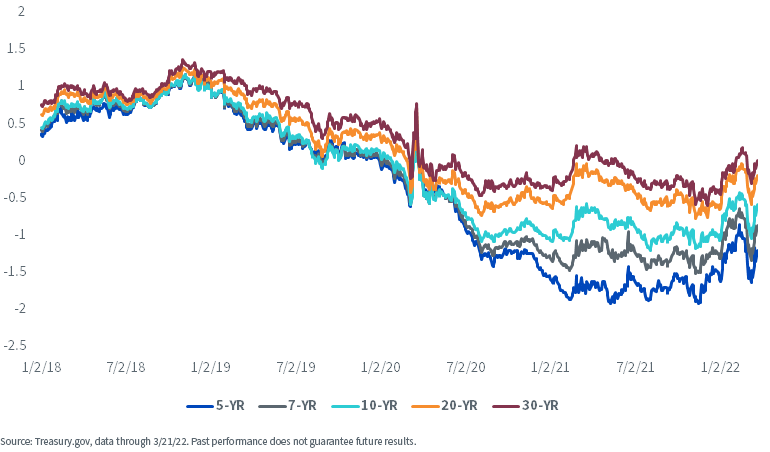

Let’s begin with rates, starting with the Treasury yield curve. Rates are rising without question as investors anticipate an aggressive Fed rate hike regime, but except for the 30-Year, Treasury real yields remain negative across the entire maturity spectrum.

U.S. Treasury Real Yields (%)

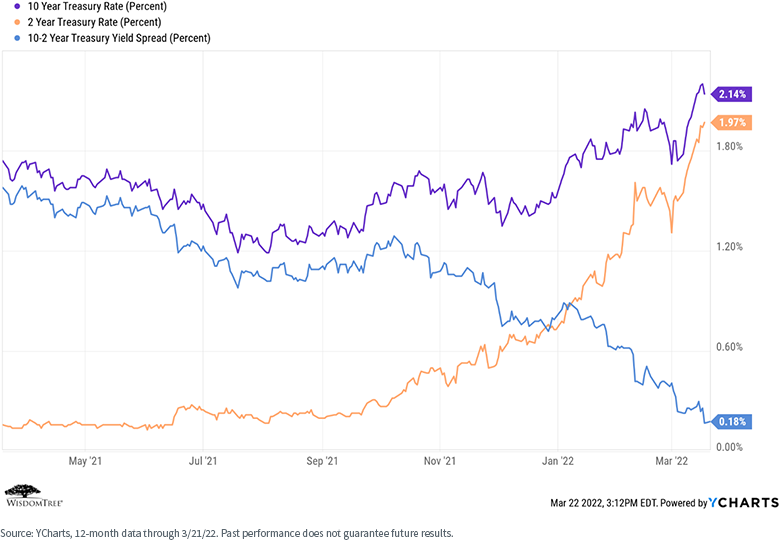

While nominal Treasury rates have also been rising, the real action has been at the short end of the curve, as we now approach a flat and perhaps inverted yield curve structure (we use the 10-Year minus 2-Year Treasury rates as a proxy for the “shape of the curve”). We think, with fits and starts, this upward trend will continue, but should the yield curve invert, we do not necessarily believe that signals an impending recession, as it has many times in the past. What is notable is how aggressively the 2-Year rate has risen in recent months even though the Fed has, thus far, only raised rates once.

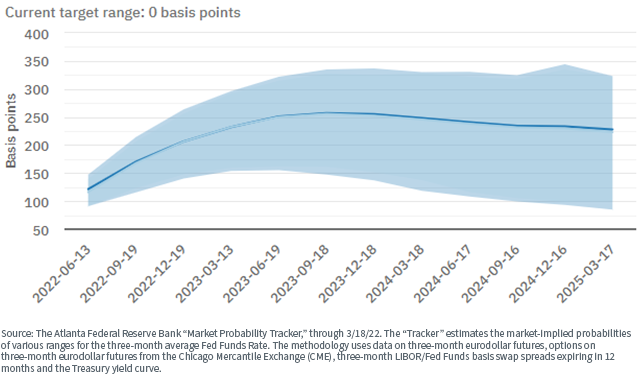

Speaking of the Fed, the market is now pricing in at least six rate hikes for the remainder of 2022, meaning at least a 25-basis-point hike in each of the remaining FOMC meetings, resulting in a Fed Funds Rate of at least 2.00% by year-end. There are others, like St. Louis Fed Governor James Bullard and our own Senior Investment Strategy Advisor, Professor Jeremy Siegel, who believe the Fed will have to be even more aggressive than that if it wants to get a handle on inflation.

The Expected Future Path of the Three-Month Average Fed Funds Rate

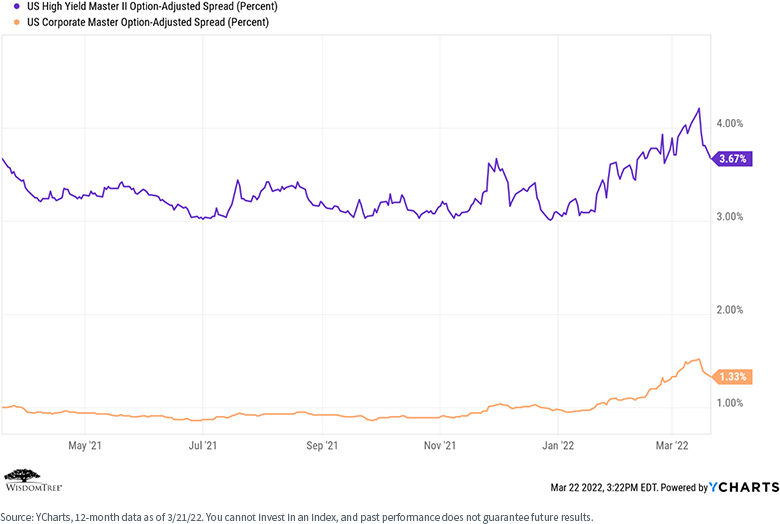

Finally, credit spreads awakened from their apparent somnambulance and have started to widen.

For definitions of terms in the table, please visit the glossary.

So, What Is a Yield-Seeking Investor to Do?

To summarize the above, we continue to believe rates will grind higher, and inflation remains the story through at least the first half of 2022. Rates are rising, and credit spreads are widening—it’s hard to be optimistic about the total return profile of the broader fixed income markets. We note, however, that corporate balance sheets are in solid shape, so we believe “coupons” (interest payments) have a reduced probability of default.

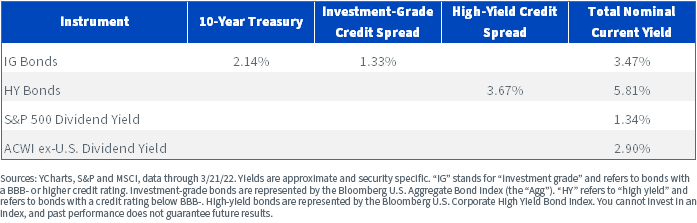

What about finding yield in the equity markets? Using the information from above, let’s compare current nominal fixed income yields to current equity dividend yields.

For definitions of terms in the table, please visit the glossary.

Investors can generate higher levels of current nominal income in the bond market than in the equity market (which historically is the more “normal” situation). At the same time, we see increased risk in the fixed income markets and believe that dividends and stock buybacks may represent a more sustainable approach to generating current income.

Our own fixed income Model Portfolios remain short duration and over-weight in credit, with an explicit focus on quality security selection, relative to the Bloomberg U.S. Aggregate Bond Index (the “Agg”). We are not looking to take excessive risk in our fixed income portfolios in a “reach for yield.”