Foreign Term Spread Augmented Recession Model Prediction

Image Source: Pixabay

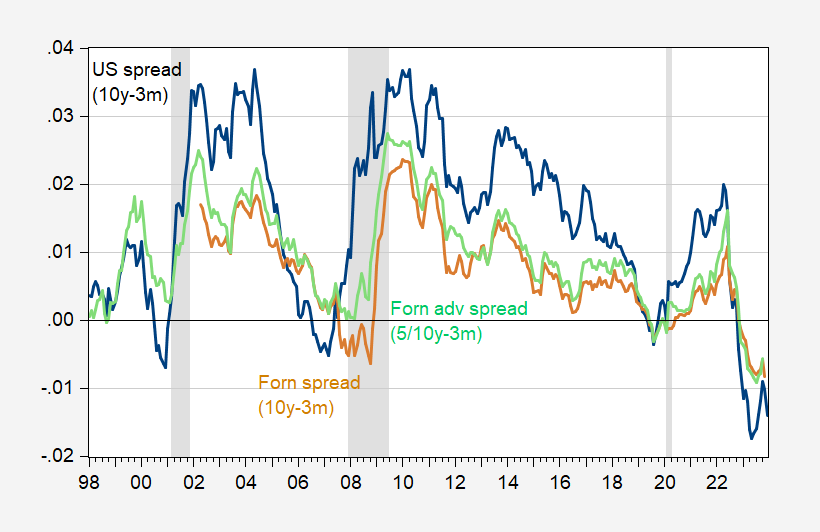

Ahmed and Chinn (2023), coauthored with Rashad Ahmed, accepted at JMCB. The US and Foreign 10yr-3mo inversion remain deep (although not as deep as in March when last I posted).

Figure 1: US 10 yr-3 mo term spread (blue), GDP weighted foreign (Canada, Germany, Japan, UK) 10 yr-3 mo term spread (tan), 5yr-to-10yr-3mo term spread for rest-of-advanced countries (light green), and NBER defined peak-to-trough recession dates shaded gray. Source: Fed via FRED, OECD, Dallas Fed DGEI, NBER, and author’s calculations.

Historical correlations, as recounted in Ahmed-Chinn, indicate a very high probability of recession using the foreign term spread. Note that while debt-service ratio is quite low, so that the prediction of recession is driven by the deep inversions, a specification augmented with the debt-service ratio (as in Chinn-Ferrara (2023)) still leads to a very high probability of recession (pretty close to 100% by mid-2024).

I always add the caveat that the conclusions are contingent on historical correlations holding. Things might be different this time, with (1) term premium incorporating inflation risk changing, (2) forward guidance in play, (3) different lag between foreign and US term spreads, among others (for just the term spread based model).

More By This Author:

FX Turnover Through 2022

Why I Don’t Cheer the Soft Landing (Yet)

Last GDPNow Of The Year

Disclaimer: This information is presented for informational purposes only and does not constitute an offer to sell, or the solicitation of an offer to buy any investment products. None of the ...

more