Financial Conditions Make A Monetary Roundtrip And Undercut The Need For Rate Cuts

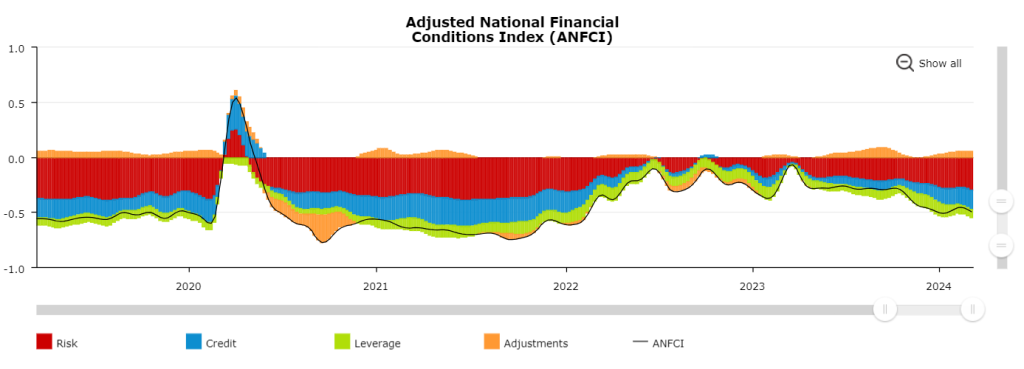

Last week, financial markets stared in dismay at “sticky” inflation numbers on the consumer and wholesale side. Both the CPI (consumer price index) and wholesale inflation (the producer price index or PPI) printed slightly higher than “expected” (headline and core). While overall momentum still favors an eventual confirmation for those who declared inflation dead last year, a more important reality looms to undercut the need for the Federal Reserve to cut interest rates. Financial conditions are just as loose as they were in the months leading up to the launch of the Fed’s aggressive campaign to tighten monetary policy (launched in March, 2022). This monetary roundtrip is evident in the Federal Reserve Board of Chicago’s National Financial Conditions Index (NFCI) (follow the black line for ANFCI):

I am tempted to say financial markets have already done the Fed’s work. However, it is very likely that the minute the Federal Reserve even hints that rate cuts could be delayed until next year, the resulting tantrum in financial markets could be epic. The Fed is loathe to disappoint markets, and the message from the last meeting and subsequently from Jerome Powell has been to promise a rate cut sooner than later. Financial markets have persistently focused on any and all dovish twinges in Fed-related pronouncements. For example, from Powell’s testimony to Congress on March 6th (emphasis mine):

“We believe that our policy rate is likely at its peak for this tightening cycle. If the economy evolves broadly as expected, it will likely be appropriate to begin dialing back policy restraint at some point this year. But the economic outlook is uncertain, and ongoing progress toward our 2 percent inflation objective is not assured. Reducing policy restraint too soon or too much could result in a reversal of progress we have seen in inflation and ultimately require even tighter policy to get inflation back to 2 percent. At the same time, reducing policy restraint too late or too little could unduly weaken economic activity and employment.”

Powell can insert all the standard caveats he wants. Markets read this statement as saying rate cuts are on their way!

A Nervous Bond Market

Yet, bond markets have been a little “nervous” all year. For example, the iShares 20+ Year Treasury Bond ETF (TLT) has trended downward (meaning higher bond yields) so far this year with lower highs and lower lows. From TradingView:

(Click on image to enlarge)

TLT is just a fresh low of the year away from finally catching the stock market’s attention again.

Copper, Lumber, and Oil – oh my!

The bond market has good reason for some jitters. Several commodities have sprung back to life this year. Copper miner Freeport-McMoRan Inc (FCX) is welcoming the upcoming Fed meeting with a 7+ month high. FCX is up 19.8% in less than two weeks. (FCX has been stuck in a trading range since the beginning of 2021).

(Click on image to enlarge)

Lumber bottomed out in early 2023. This month, lumber broke out above last summer’s high and is back to levels last seen in August, 2022.

(Click on image to enlarge)

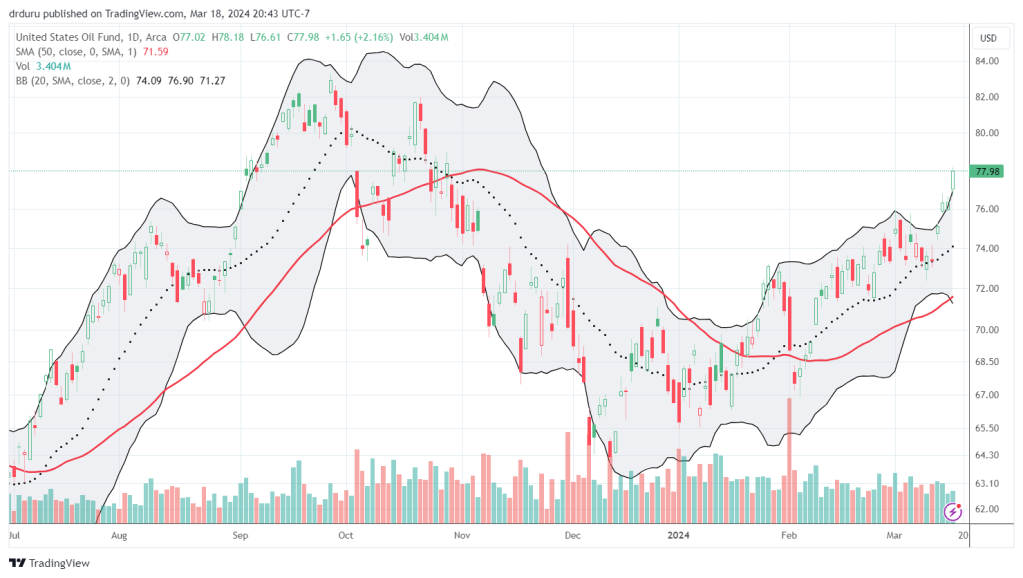

Oil, everyone’s favorite non-core component of inflation, has been in “stealth” rally mode all year. The United States Oil Fund, LP (USO) looks ready to launch parabolically on the wings of rate cuts.

(Click on image to enlarge)

Where will these prices go with rate cuts? I vote higher.

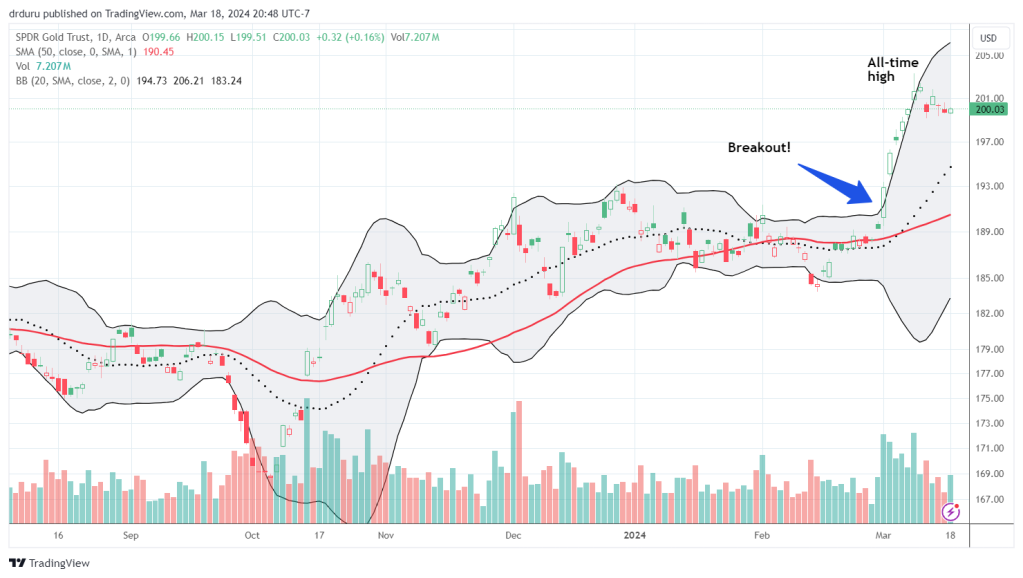

The Golden Touch

Speaking of getting ready for rate cuts, gold, my favorite hedge enjoyed a spectacular (and overdue) breakout this month. SPDR Gold Shares (GLD) traded at an all-time high at its peak this month.

(Click on image to enlarge)

I like buying the dips in GLD going forward. The odds seem sufficiently high for the Fed to feel “forced” into easing into a sea of market liquidity.

Staining to See the Weakness in Labor Markets

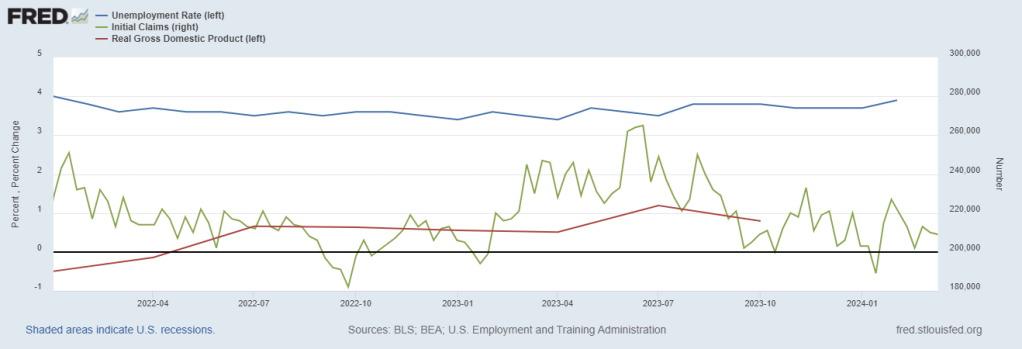

So maybe the Fed can strain its economic gaze and find an excuse to do a “proactive” rate cut. The graph below shows the unemployment rate has likely bottomed out (left axis and blue line) Yet, it remains near historic lows. Initial unemployment claims have been trendless with a recent peak set last summer (right axis and green line). Finally, real GDP quarter-over-quarter growth has levitated in positive territory and for the last two years has defied overly persistent expectations for a recession (right axis and red line). From my perch, I see no excuse for a rate cut here, but perhaps I am not creative enough with the data.

(Click on image to enlarge)

Sources: U.S. Bureau of Labor Statistics, Unemployment Rate [UNRATE], retrieved from FRED, Federal Reserve Bank of St. Louis; U.S. Employment and Training Administration, Initial Claims [ICSA], retrieved from FRED, Federal Reserve Bank of St. Louis; U.S. Bureau of Economic Analysis, Real Gross Domestic Product [GDPC1], retrieved from FRED, Federal Reserve Bank of St. Louis.

The Stock Market’s Giddy Anticipation

The stock market’s giddy anticipation of rate cuts is poetic. The stock market has soared on loosening financial conditions and has been able to ignore just about any bad news the macro environment tries to toss out there. Recent successive all-time highs speak volumes to the buffer the Fed can enjoy if it so chooses to wait out the Presidential election before making changes to monetary policy.

(Click on image to enlarge)

Conclusion

With market breadth increasingly lagging the stock market’s ascension, I have been a skeptic about the overall rally for several weeks. The Federal Reserve is probably the last catalyst between now and the Presidential election that has a chance of validating my skepticism. If the Fed complies with the market’s giddiness, there is no telling how high the market could soar in coming months. If the Fed decides to wait things out, the stock market will lose a major contributor to the upward and higher fund. Then again, maybe the Fed pulls off a magical “hawkish rate cut” (one and done rate cut with a warning about the potential for inflation to rise from the ashes). The Fed could figure out just the right balance between disappointing the stock market and fueling ever increasing levels of speculation and higher commodity prices…

Be careful out there!

More By This Author:

From Inflation Fizzle To Sizzle

Small Caps Join The Party - But Just In Time For A Rotation?

Bank Of Canada’s Macklem: The End Is In Sight But Rates Are Not Returning To Pre-Pandemic Levels