DJIA On Cusp Of Correction As 30-Year T Bond Yield Hits 4.52%

Image Source: Pexels

This article is a follow-up to my last article on TalkMarkets: Caution, DJIA Price At Premium To Value

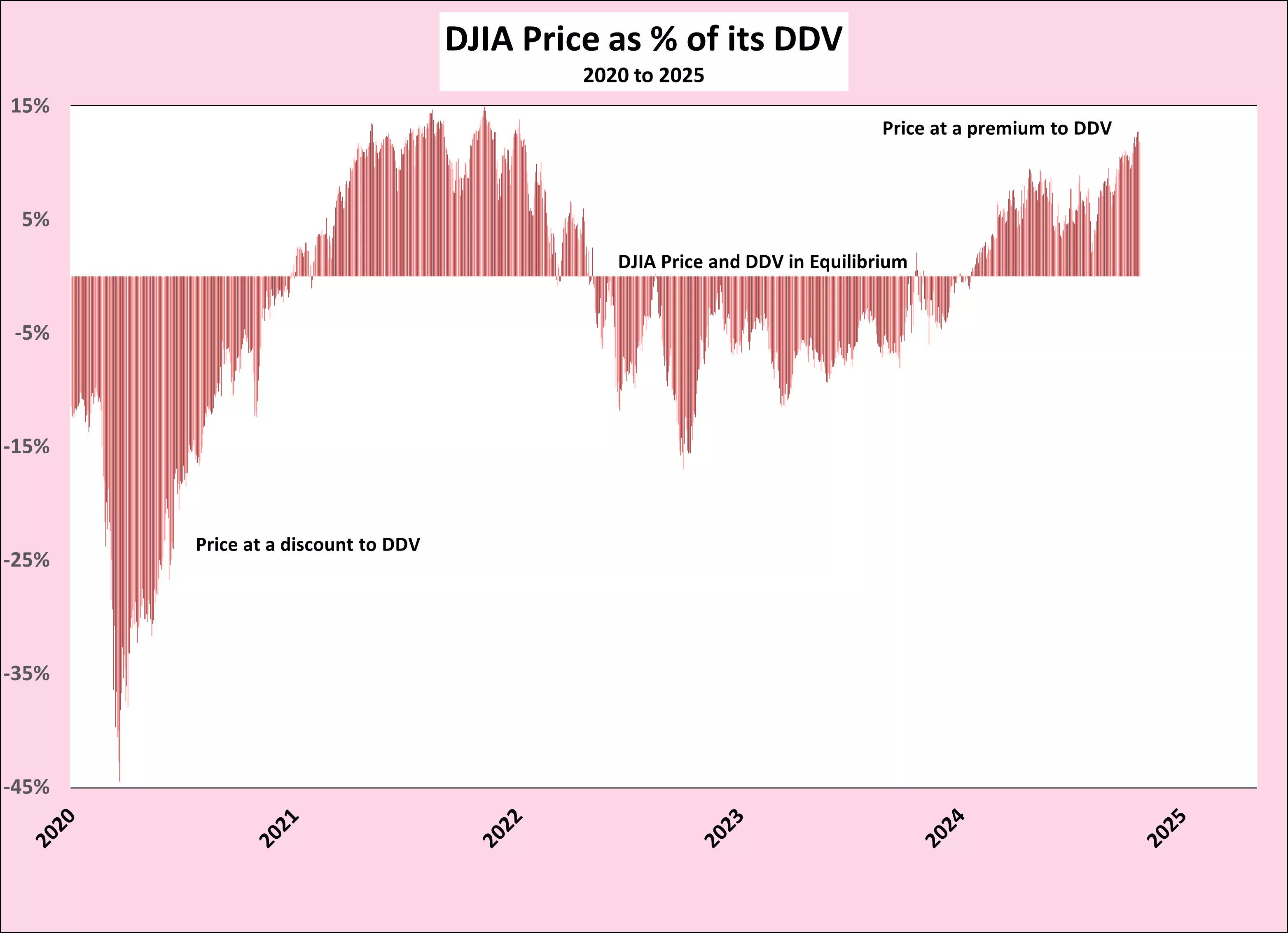

On Friday, October 19, 2024, the DJIA closed at a record 43,276, exactly 4,900 points or 12.8% above its Dividend Discount Value (DDV) of 38,376. On October 3, 2024, I cautioned that the DJIA price at 42,330 was at an 11.1% premium to its then DDV of 38,111, and there appeared to be little incentive to buy an over-priced DJIA.

On September 30, the 30-year T bond yield stood at 4.12%, well below the critical 4.5% level above which any increase would negatively impact the DDV. The general euphoric obsession with the perceived impact of expected declines in the Fed funds rate drove the feverish buying of the DJIA to ever-higher premiums to its DDV.

Reliance on declines in the Fed funds rate to drive the DJIA higher was, and is, misplaced. It is the yield of the 30-year T bond and the dividend of the DJIA that determine its DDV. As outlined previously, the yield curve can steepen by either the 30-year T bond rising, the Fed funds rate falling, or both. On September 17, the eve of the Fed decision day, the 30-year T bond yield closed at 3.96%. By September 30, it had risen 16 basis points to 4.12%. At the close on October 21, it had risen a further 38 bps. to 4.50%. Meanwhile, the Fed funds rate has not changed since it was cut on September 18. 2024.

As the DDV model is impacted only by the 30-year T bond yield when above the minimum 4.5%, it will start to push the DDV of the DJIA downwards by approximately 85 points for every basis point the 30-year T bond rises above 4.5%. As the DJIA price is already at an 11.8% premium to its DDV, we could see a significant drop in the DJIA as we did in October of 2023 when the DDV was pushed down by the rise of the 30-year T bond yield above the 4.5% minimum.

Two brave “Buy-side” prognosticators suggest that long treasury yields could rise over the next few months. Arif Husain, the chief investment officer of fixed income, at T. Rowe Price, stated Treasury 10-year yields will test 5% in six months. While Mark Dowding, the chief investment officer at RBC Bluebay Asset Management, thinks the yield spread between U.S. two-year bonds and 30-year Treasuries could surge to 150 basis points, from around 35 basis points now, in “the fullness of time.”

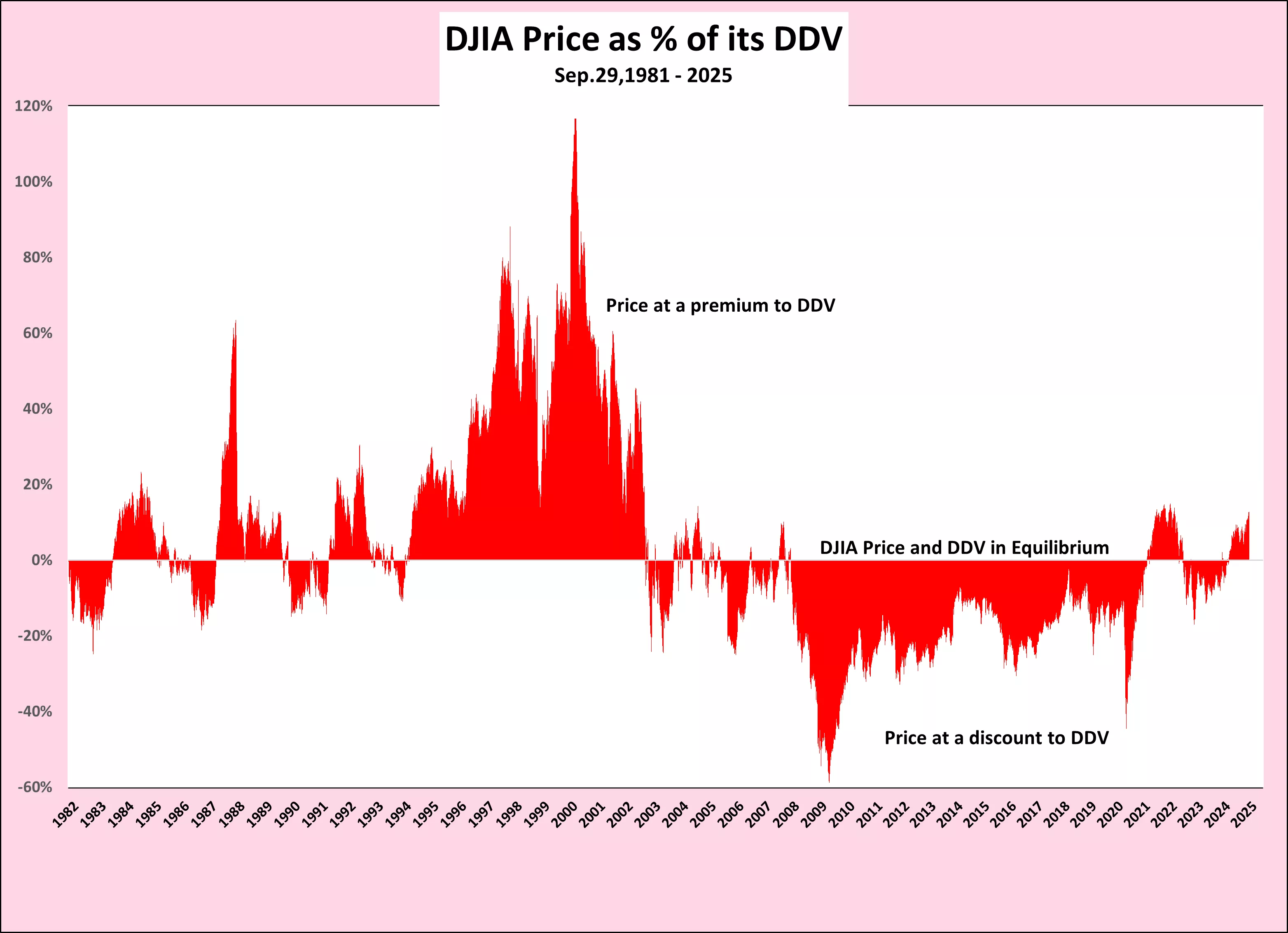

Should these forecasts prove correct, the yield of the 30-year T bond could rise to around 5.5%. At that level, the DDV would be 31,400. Should the DJIA remain at the current level it would stand at a 37% premium to its value. The premium would be at a level not seen since the days of irrational exuberance in the 1990s and the summer of 1987 when I started to develop my thoughts on the DDV model.

If long rates rise and the DDV falls to the low 30,000s, the price of the DJIA is more likely to fall in tandem, rather than with a crash as in October 1987. Should “Black Monday” be repeated there will be plenty of increasingly very loud warnings, at least by me.

The Analysis Since 2007

Let us turn to the period starting on October 9, 2007, the record peak of the DJIA price before the Great Recession. Once again, the 30-year T bond yield has remained below 4.5% for most of the period while the rising dividend was the driving force in the DDV model.

The rise in the T bond yield from 4.5% in mid-September last year to 5.11% in late October led to the 11.8% drop in the DDV from 37,101 to 32,717. Simultaneously, the price of the DJIA fell 7.1% from 34,907, which was already below its DDV at the time, to 32,418.

For most of the past 17 years, the price of the DJIA has been at a discount to its DVD. During two short periods in this decade, the price of the DJIA has been at a premium to its DVD in the later stages of COVID and the recovery from the same as well as the present.

Updated Charts Since 2020

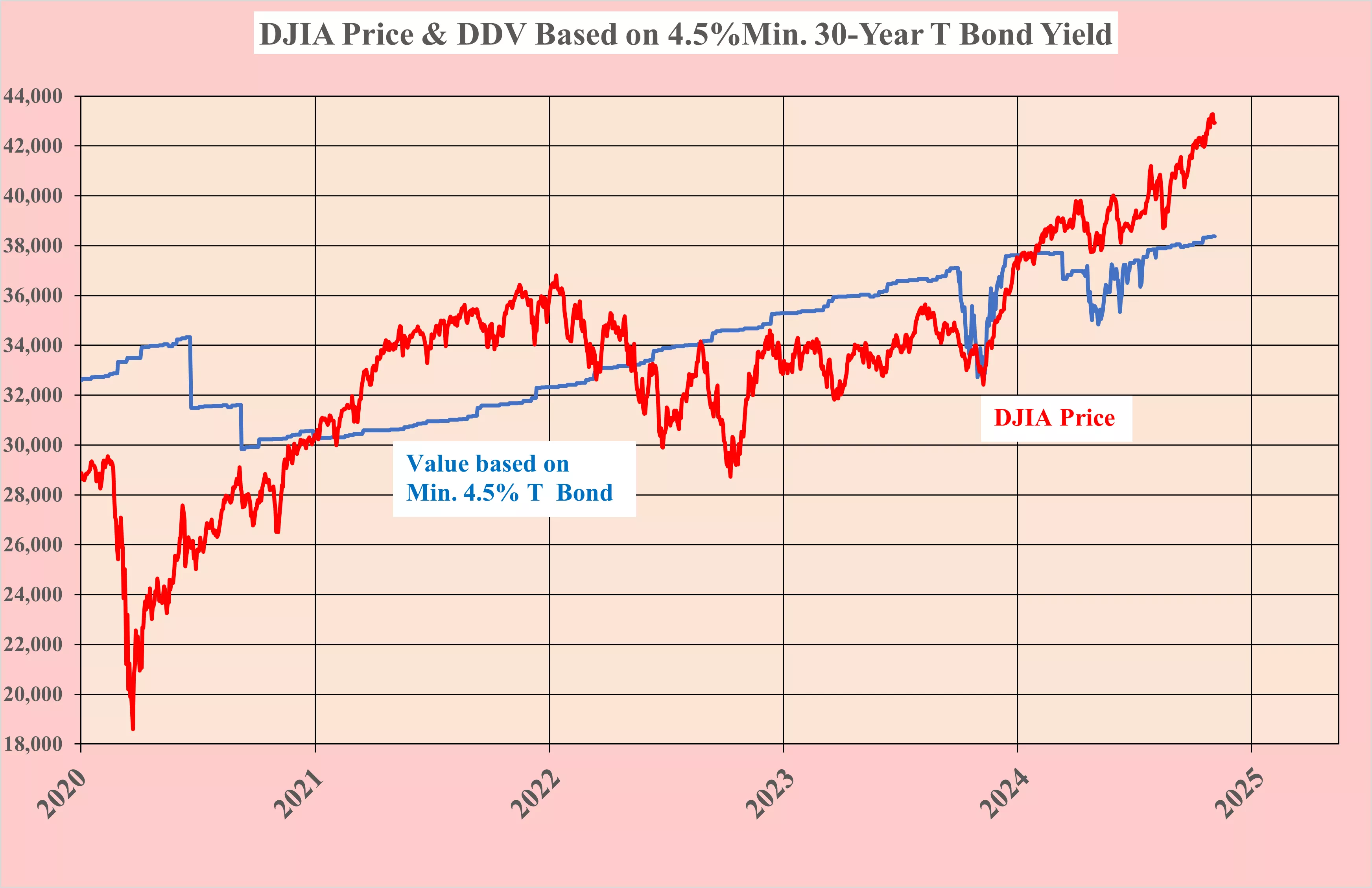

Magnifying the charts above shows what has happened since the start of COVID in 2020.

Dividends recovered nicely from 2020, while the 30-year T bond remained below the 4.5% minimum until the latter part of 2023 and correctly had no impact on the DDV.

From mid-September until the end of October 2023, the yield of the T bond rose 61 basis points above the minimum 4.5% to 5.11%. As it moved above the 4.5% minimum, this small increase significantly impacted the DDV, lowering it from 42,100 to 32,717 while the DJIA price fell to 32,418.

The euphoric buying continues to push the DJIA up to an ever-greater premium over its DDV which, even by itself, is already at risk of a substantial decline.

As the yield of the 30-year T bond moves above 4.5% it will resume its role as the other vector in the DDV model. If this happens quickly it will overwhelm any positive impact of the dividend vector which is still rising but slowly. The price of the DJIA should follow its DDV down to the low 30,000s. Hence, the warning “Look out below”.

More By This Author:

Caution, DJIA Price At Premium To Value

DDV Model Works; Forecasting T Bond Rates Is Problematic

"Sell The Rally"

I wrote this article myself based on my own research over many years. I receive no compensation for it.