"Sell The Rally"

The sword of Damocles is already starting to fall on the bulls.

On September 26, 2023, I published a serious warning on TalkMarkets entitled: “DJIA Trouble Ahead As Thirty-Year T Bond Yield Breaks Above Modified 4.5% Minimum”.

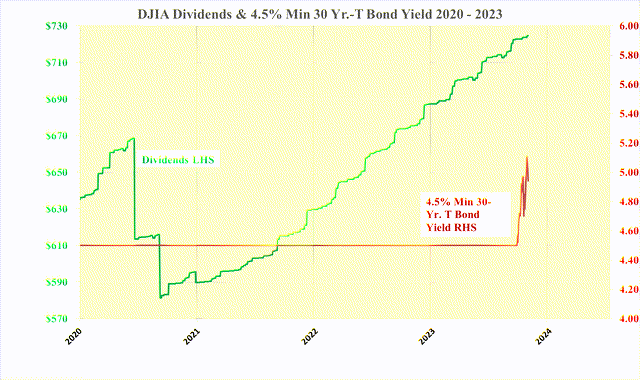

On September 21, 2023, the 30-year T bond yield had moved above 4.5% for the first time since 2011. At 4.57% the DDV of the DJIA was 36,532, while the price closed at 34,070. The price was 7% below its DDV.

There was no reason to panic and sell the DJIA. However, this was the first time since 2011 that any change in the 30-year T bond has had any impact on the DVD. All the heavy lifting of the DVD until then was entirely due to the rising dividends of the DJIA. Above 4.5% the yield of the 30-year T bond yield started, once again, to have an impact as the second vector in the DDV model. With the rate rising, it became a negative factor pushing the DDV lower.

The 30-year T bond yield continued to rise reaching 5.11% on October 19, 2023. The DDV of the DJIA fell to 32,717 while its price fell to 33,414. The next day the price of the DJIA dropped further to 32,717 even though the 30-year T bond yield fell back to 5.08% pushing the DDV back up to 32,948, helped along by a modest increase in the DJIA dividend to a new record level of $724.57.

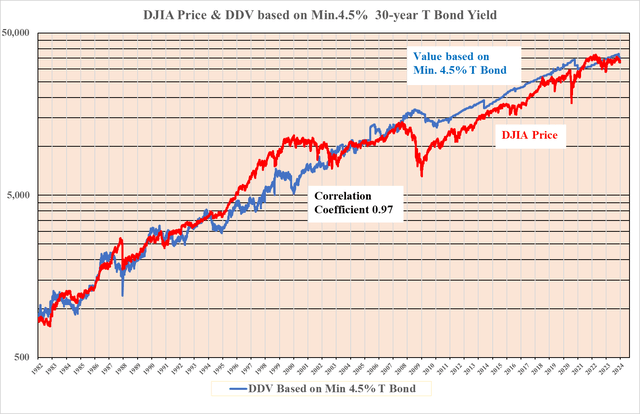

The empirical evidence of the last four decades confirms that the DDV of the DJIA, based on a minimum 30-year T bond yield of 4.5%, and its price are closely and causally interrelated with a correlation coefficient of 0.97.

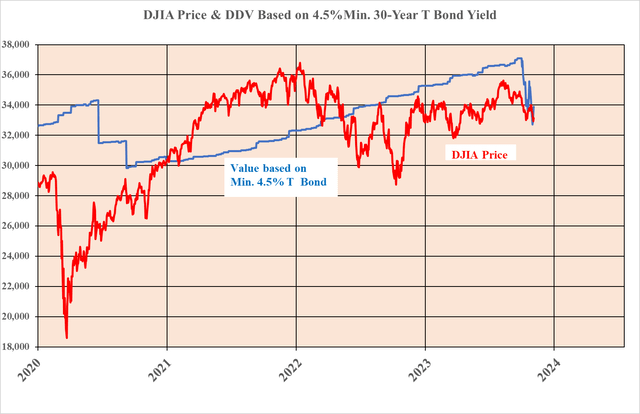

Over the last four years, the chart below demonstrates the impact on the DDV of the 30-year T bond yield moving above 4.5%.

The sharp drop in the DVD (the blue line above) is the direct result of the rise of the 30-year T bond yield rising above the 4.5% minimum as shown below. The rising bond yield is again having a serious negative impact on the DDV following a 12 to 15-year hiatus.

Using the near record DJIA dividend of $724.18 as it was on November 3, 2023, the following DDVs can be calculated for a range of different 30-year T bond yields as per the table below:

| 30-year | DJIA | DJIA | DJIA | |

| T bond Yield | Dividend | DDV | Price | |

| 20-Sep-23 | 4.50% | $ 722.73 | 37,101 | 34,441 |

| Last Day the 30-year T bond yield was below 4.5% | ||||

| 03-Nov-23 | 4.77% | $ 724.18 | 35,090 | 34,061 |

| 4.78% | $ 724.18 | 35,016 | ||

| 4.80% | $ 724.18 | 34,870 | ||

| 5.00% | $ 724.18 | 33,476 | ||

| 5.50% | $ 724.18 | 30,432 | ||

| 6.00% | $ 724.18 | 27,896 | ||

| 7.00% | $ 724.18 | 23,911 | ||

| 8.00% | $ 724.18 | 20,922 | ||

| 10.00% | $ 724.18 | 16,738 | ||

Each basis point move in the 30-year T bond impacts the DDV by some 60 points. With a probability of 97%, the price of the DJIA should closely reflect the calculated DDVs.

Similarities to 1987

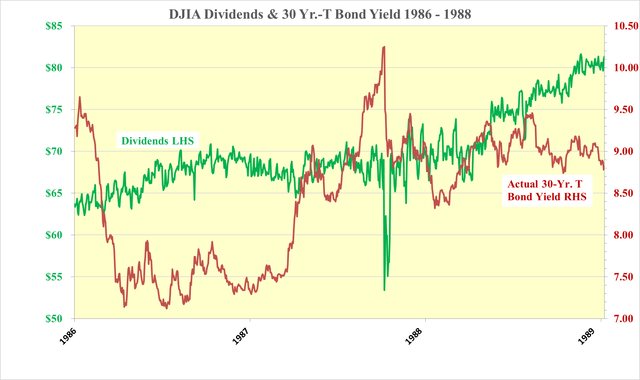

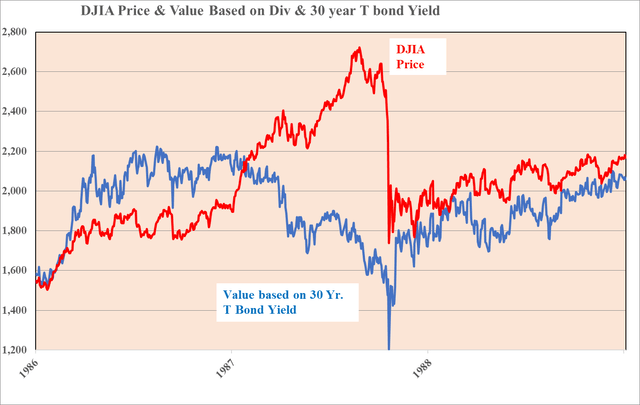

Some commentators have suggested that the period ahead will be a repeat of Black Monday, 1987. The driving force in both periods was, and is, the increase in the 30-year T bond yield.

In 1987, the yield moved up by 41% from 7.29% in January to 10.25% in October, driving the DDV down by 55% from 2,200 to 1,200 in October.

The price of the DJIA moved in the opposite direction from 2,200 in January to 2,722 in October, up 24%.

In the summer of 1987, I could not understand why the price of the DJIA continued to advance in the face of the DDV being pushed down by the ever-rising 30-year T bond yield. In retrospect, one could think of this as price momentum from the previous 5 years after 16 years up to 1982 of the DJIA going sideways between 600 and 1,000.

At the time, however, I concluded that the price was correct, and my thesis was wrong. Ah! the impatience of youth. I did not repeat that mistake in 1989 when I recommended the sale of the Nikkei at 36,000 and the purchase of the DJIA at 2.481.

This year the 30-year T bond has risen above the minimum 4.5% and the DDV is falling as expected. Furthermore, the price of the DJIA is moving down in tandem with the DDV. So far so good but remember there will be a great deal of daily volatility as the bond market waxes and wanes.

Where do we go from here?

Long-term rates are market-driven and are outside the control of the Fed, as Jay Powell stated on October 19, 2023, along with his message that short-term rates could remain higher for longer. Hence, we should not look for any QE to bail out either the bond market or the equity markets. Long rates will adjust to term needs.

Given the rising concerns about U.S. government debt of nearly $34 Trillion and counting, at a time when demand for U.S. Treasuries from Japan, China and even the Fed is falling, the outlook for rolling over existing debt appears bad. Particularly, the huge rise of U.S. Treasuries issued since 2020 that need to be refinanced.

It should also be noted that interest payments on U.S. Treasuries alone amount to over US$1 trillion per year, twice what they were just 19 months ago. There is thus a strong likelihood of 30-year T bond yields rising considerably, the DDV falling as rates rise and with it a much lower DJIA price, as per the table above.

Near-term volatility, such as that of the past two months, should be expected. The trading mantra should now become, "Sell the Rally".

More By This Author:

DJIA Trouble Ahead As Thirty-Year T Bond Yield Breaks Above Modified 4.5% Minimum

Gold Jumps as Money Reaches Main St Finally

Any Technicians Notice This Inverse Head And Shoulders?

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this ...

more