Debt Decline Is Underway

Image Source: Pexels

Bonds lose all of their value due to debt deflation.

All bond markets are based on trust. The Latin word cred, which literally means "believe," is where the word credit is derived. When belief or faith is lost, things can turn very ugly, as the 2008 financial crisis aptly

Debt decline is taking place.

Interest rates and asset yields have been rising steadily since 2020, and they got even faster last year.

Since 2020, the number of "zombie" businesses—those unable to generate enough revenue to pay off their debt—has increased dramatically. The Russell 3000 stock market gauge now contains 24% (almost a quarter!) zombies. The prior high occurred at 16% at the beginning of the dot.com bust.

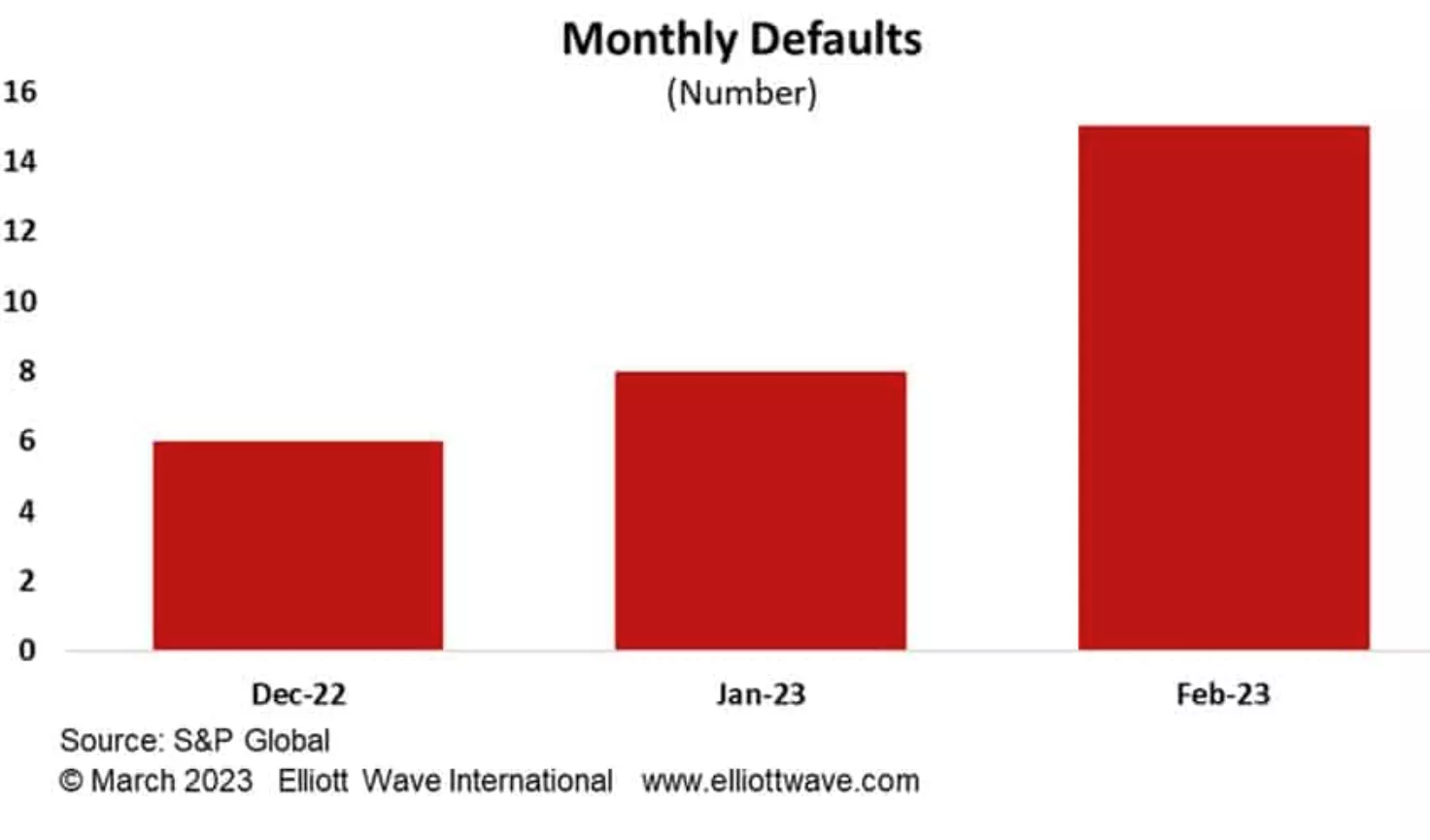

Evidence is now beginning to mount that debt deflation is intensifying. The graph below demonstrates how business defaults soared higher in the first two months of this year and are currently moving at the quickest rate for the year as a whole since 2009.

More By This Author:

Equities, Fixed, Commodities - April 1 Wave-Trend Summary

Deforestation Free Funds

Wave-Trend Summary - Equities, Fixed, Commodities

Disclaimer: These illustrations are not a solicitation to buy or sell any ETF.