Better Returns Through Hedging

She looks like she hedged (Moose Photos/Pexels)

Hedging Comes In Handy

A few of the top names our system picked two months ago have done well since, but the rest are down so far, as stocks (and energy names in particular) got hammered this week. Let's look at what did well, what didn't, and how hedging improved returns.

Our Top Names From July 21st

These were our top ten names on July 21st.

Screen capture via Portfolio Armor on 7/21/2022.

Here's how those names have done so far, as of Friday's close.

Three names are up double digits so far: two bearish Treasury ETFs, ProShares UltraPro Short 20+ Year Treasury (TTT) and Direxion Daily 20+ Year Treasury Bear 3X Shares (TMV), and a bearish tech ETF, Direxion Daily Dow Jones Internet Bear 3X Shares (WEBS).

The worst performers so far are energy names: Chinese solar supplier Daqo New Energy Corp (DQ) and the ProShares Ultra Bloomberg Natural Gas ETF (BOIL). I would expect BOIL to bounce back, but currently it's down nearly 28% since July 21st, and DQ is down nearly 20%.

On average, our top ten names from July 21st are down 0.63% while the SPDR S&P 500 Trust ETF (SPY) is down 7.73%.

Our Hedged Portfolio From July 21st

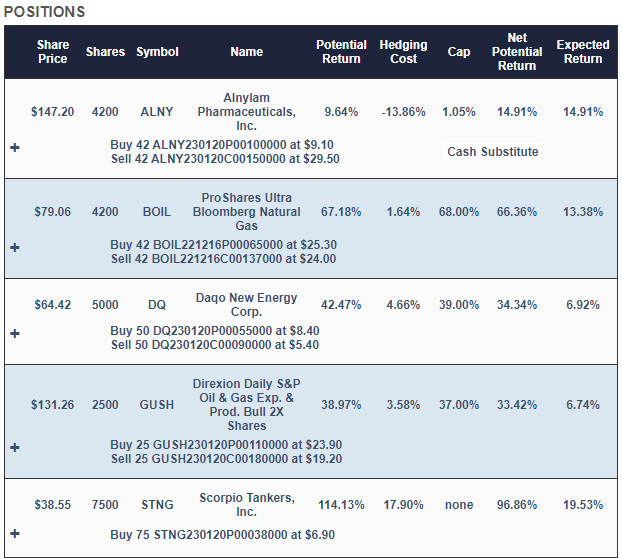

Seven of our top ten names from July 21st, including each of the names mentioned above, appeared in this portfolio hedged against a greater-than-20% decline over the next six months.

Screen captures via Portfolio Armor on 7/21/2022

Here's how that portfolio has performed so far:

The main reason for the outperformance of the hedged portfolio versus the unhedged top names is that the hedged positions in DQ and BOIL are down 9.9% and 6.6%, respectively, instead of being down ~20% and ~28%, respectively, unhedged.

More By This Author:

A New Phase In The Ukraine War

Ending The Ukraine War

Worse Than The 1970s

Disclaimer: The Portfolio Armor system is a potentially useful tool but like all tools, it is not designed to replace the services of a licensed financial advisor or your own independent ...

more