Bears In Tougher Spot With Small Caps & Junk Jumping

Tuesday’s market action in the downtrodden mid and small caps certainly answered the question as to whether Friday was a one-day wonder. It also kicked the bears right in the teeth. Do you remember those bears? The ones who claimed the mid and small caps couldn’t rally and were the “real” market indicating impending doom. Well, on the far right of the chart below, you can see a monster two-day rally in the Russell 2000. And it looks like it has further to go.

Of course, the wounded bears will say it was all “short-covering” which just means that the bears were running for cover. Geez, I hope some of them were. After all, they came into 2023 hanging on their Armageddon scenario, only seeing lower and lower prices this year. At some point, some of them have to throw in the towel and admit massive defeat.

(Click on image to enlarge)

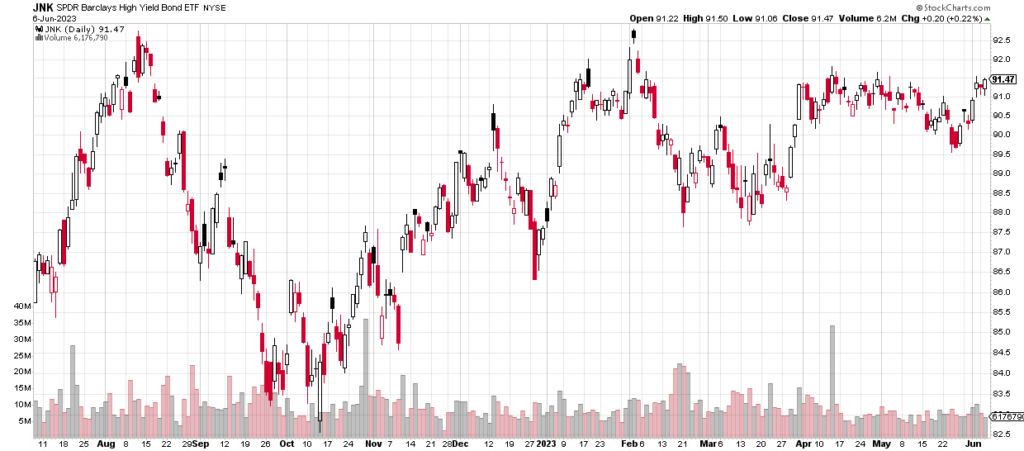

Below is another one of the bears’ assets they hang on to as evidence of impending gloom and doom. The high yield bond sector certainly feels every ripple in the liquidity pool of the economy and markets. 10 days ago, it looked like junk bonds were rolling over and heading toward their 2023 lows. That was before Friday’s blockbuster employment report. Almost two weeks later, we can see that junk bonds are in a much stronger position. It would be nice and tidy if they could move above their April highs sooner than later.

(Click on image to enlarge)

With the debt ceiling resolved, jobs report out of the way and inflation well under control, markets are now focused on the Fed meeting next week. You see, markets always focus on the negatives. The media lives to report them. There will always be negatives. The few times when no one can find fault, sell everything you own!

On Monday we bought more FUTY. On Tuesday we bought SPXL, more MU, more SOXL, more levered Russell 2000, more levered NDX and Dow. We sold SPXL.

More By This Author:

WHAT Will The Bears Say NOW?The Masses Remain Very Wrong

Behavior Befitting The Dotcom Bubble – Sell The Debt Ceiling News

Please see HC's full disclosure here.