10-Year Treasury Yield ‘Fair Value’ Estimate - Thursday, Aug. 11

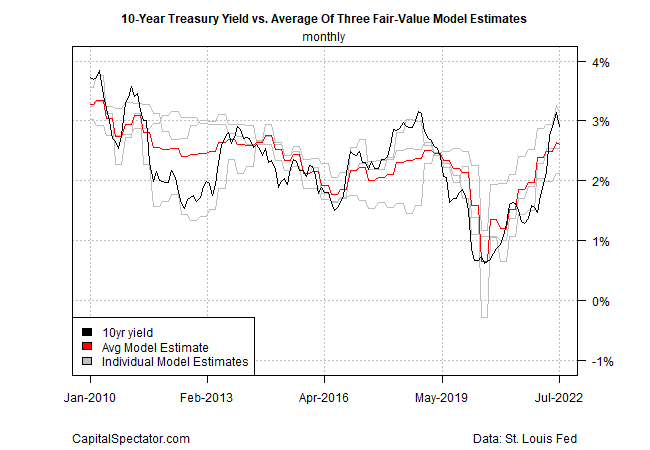

The US 10-year Treasury yield continues to trade below its recent peak. Yesterday’s softer-than-expected rise in consumer inflation for July supports a case for expecting the 10-year rate to stay below 3% for the near term. A similar analysis can be made based on today’s update of CapitalSpectator.com’s fair-value ensemble model for this benchmark yield.

The 10-year rate recently peaked at roughly 3.5% in June. As of yesterday’s trading (Aug. 10), the yield is moderately lower at 2.78%.

The average fair-value estimate for the 10-year rate — based on three models (see details here) — has in recent months remained below the market rate, a condition that implies that the actual 10-year yield set in the market will remain capped and biased toward falling. In last month’s update (July 19), for instance, the market rate was 2.96%, moderately above the average fair-value estimate of 2.66%. Since then, the 10-year rate in the market has fallen slightly. Notably, it remains slightly above today’s revised average 2.60% fair-value estimate.

Overall, the odds appear low for a sharp and/or sustained rise in the 10-year rate. July marks the fourth straight month of the market yield above the average fair-value estimate. Although there’s no guarantee that the model’s implied forecast will be correct, recent history for the modeling and market data suggest there’s a reasonable case for expecting the upside bias for the 10-year rate will remain constrained. That forecast will flip when the 10-year market rate falls below the average fair-value estimate.

More By This Author:

Modest Rebound Expected For US Q3 GDPU.S. Stocks Led Markets Last Week As Commodities Tanked

Book Bits: Four Recent Books, Examining Threats To Economies

Disclosures: None.