Modest Rebound Expected For US Q3 GDP

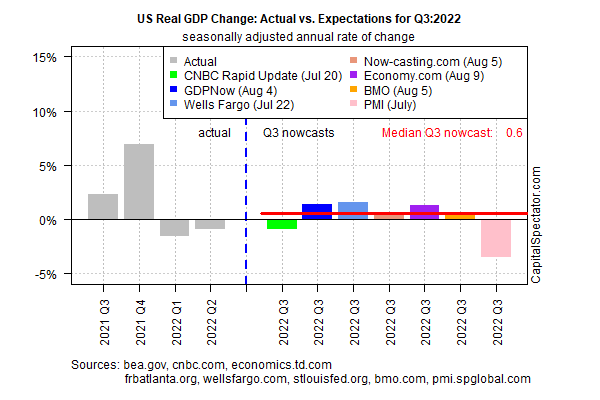

Early estimates for US economic activity in the third quarter point to a mild recovery in output following two straight quarterly declines, based on the median for a set of nowcasts compiled by CapitalSpectator.com.

The bounce is encouraging but should be viewed cautiously this early in the quarter. For the moment, however, a bit of relief appears to be brewing ahead of the government’s initial Q3 estimate, scheduled for release on Oct. 27 via the Bureau of Economic Analysis.

US GDP is projected to increase 0.6% in the July-through-September period, based on a real (inflation-adjusted) seasonally adjusted annual rate. If accurate, the rise marks the first increase this year.

A key reason for remaining cautious on Q3 is the uncertainty for the path of interest rates and how this strengthening headwind will impact economic activity. The Federal Reserve, which has been tightening monetary policy since March, is expected to raise interest rates again at the September 21 FOMC meeting. Fed funds futures are pricing in a near certainty of a hike, with a 68% probability for another 75-basis-points increase.

Note the downside outlier for Q3 nowcasts via S&P Global US Composite PMI, a GDP proxy. Using a regression model to analyze PMI history vis-à-vis GDP data implies that the weak PMI number for July – 47.7, which is below the neutral 50 mark and indicates contraction – translates to a 3.5% decline in economic activity, based on CapitalSpectator.com’s estimates. That’s probably excessively negative, but it’s a reminder that the case for anticipating a Q3 bounce remains a risky view at this point in the quarter.

“The S&P Global US Composite PMI Output Index posted 47.7 in July, down from 52.3 in June to signal a renewed contraction in private sector business activity,” S&P reports. “The decline in output was the first since June 2020 and broad-based.”

More By This Author:

U.S. Stocks Led Markets Last Week As Commodities TankedBook Bits: Four Recent Books, Examining Threats To Economies

High Dividend Yield And Value Are 2022’s Top US Equity Factors

Disclosures: None.