10-Year Treasury Yield ‘Fair Value’ Estimate - Tuesday, July 19

US headline inflation continues to set new four-decade highs and the Federal Reserve continues to signal that it will continue raising interest rates. The bond market, however, is starting to consider the possibility that peak inflation and peak policy tightening are approaching.

Expectations about the future always deserve a healthy dose of skepticism, but the Treasury market’s discounting efforts are beginning to weigh the odds that slowing growth (and perhaps recession) are becoming the main risk factor. It’s premature to say that inflation is yesterday’s problem, but the crowd is testing the waters for a possible shift in priorities.

Consider the 10-year Treasury yield for perspective. The benchmark rate closed at 2.96% yesterday (July 18), moderately below the previous peak – 3.49% set on June 14. The pullback could be noise, but as concerns about softer economic conditions resonate, investors overall appear to be reacting via a higher appetite for fixed income securities, which is trimming yields, if only on the margins. The reasoning is that if recession risk is rising, demand will also rise for bonds, a traditional safe-haven asset class.

Inflation could continue to increase, of course, which in turn would strengthen the Federal Reserve’s commitment to raising interest rates until pricing pressure reverses. But this policy track doesn’t operate in a vacuum. The longer the central bank tightens policy, the greater the threat of slower/negative economic growth. Modeling the feedback loop between rate hikes, inflation, and economic activity is tricky, but the bond is certainly eyeing the shifting probabilities.

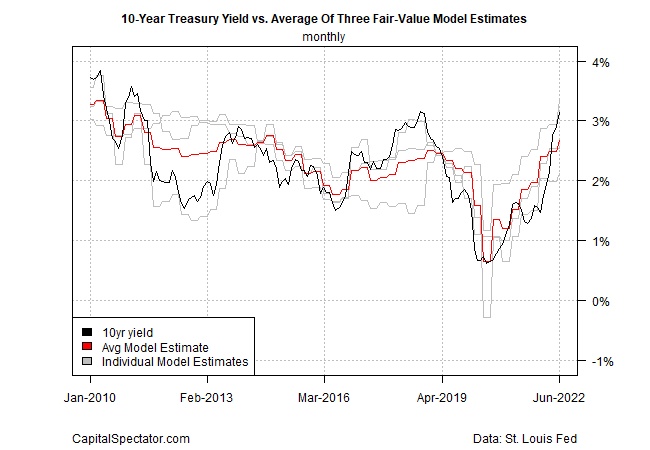

The case for expecting the 10-year yield to hold steady or perhaps edge lower finds support in today’s revised estimate of the rate’s ‘fair value’, which is based on averaging three models (see details here). Today’s update puts the fair value for the 10-year rate at 2.66% (mean estimate) for the month of June, which is well below last month’s 3.14% average market rate.

The gap marks the third straight month of market yield above the average fair-value estimate, a trend that suggests keeping expectations in check for assuming that the 10-year rate will continue to rise in the near term.

For context on how the model compares in previous updates, here are the last three columns: 16 June 2022, 12 May 2022, and 8 April 2022.

More By This Author:

US Bonds Rallied Last Week, Offering Ballast Vs. Losses ElsewhereBook Bits: 8 New Books Of Interest To Investors

S&P 500 Risk Profile - Friday, July 15

Disclosures: None.