Bitcoin: Medium-Term Forecast

At the time of the last review, the Bitcoin exchange rate was around 48,000. It was expected that we could still see 57380 (if the correction channel is broken). However, in the end, having made this goal, we went to a new historical peak. Let's look at what happened and what to expect next.

In November 2021, the downward movement began, which could be considered an impulse. There were two options: 1. U-turn 2. This momentum was part of a flat correction (4). In any case, an upward rebound was expected, but then it was necessary to look at the structure of the movement. There were no clear downside impulses, and important levels were not passed (42500 and 41400), so the second scenario was implemented.

The main chart is shown below, and another peak is expected, the target is around 76000. An alternative is a shortened 5, possibly even without a new vertex. While this scenario is unlikely, it can be considered only after breaking the trend line (red). Now it passes in the region of 61,000.

(Click on image to enlarge)

Traffic from 2014 is shown.

(Click on image to enlarge)

Serious divergences are forming on the weekly chart (RSI, MACD). The MACD shows that the breakout of the main line (blue) of the signal line indicated the end of the three, and after correction four was the final five. The situation is similar now.

(Click on image to enlarge)

04.05 there was such a comment in the closed section.

"Growth has started , we are testing the upper limit of the channel ( it has already been broken) . At the moment, there are two options . 1. Black. Series 1-2 1-2 down . 2. Red . Ended ((iv)), went to new historical heights in the wave ((v)) . These options are separated by level 67273 , if we pass , red will become the main one."

(Click on image to enlarge)

The scenario of updating the top correlates with a medium-term weakening of the dollar and a drop in bond yields. Also, as you can see, the US stock market is growing. As long as this trend continues, Bitcoin will have more or less good prospects. The only thing is that before a serious reversal of the markets, risky assets begin to fall first, and crypto is one of them.

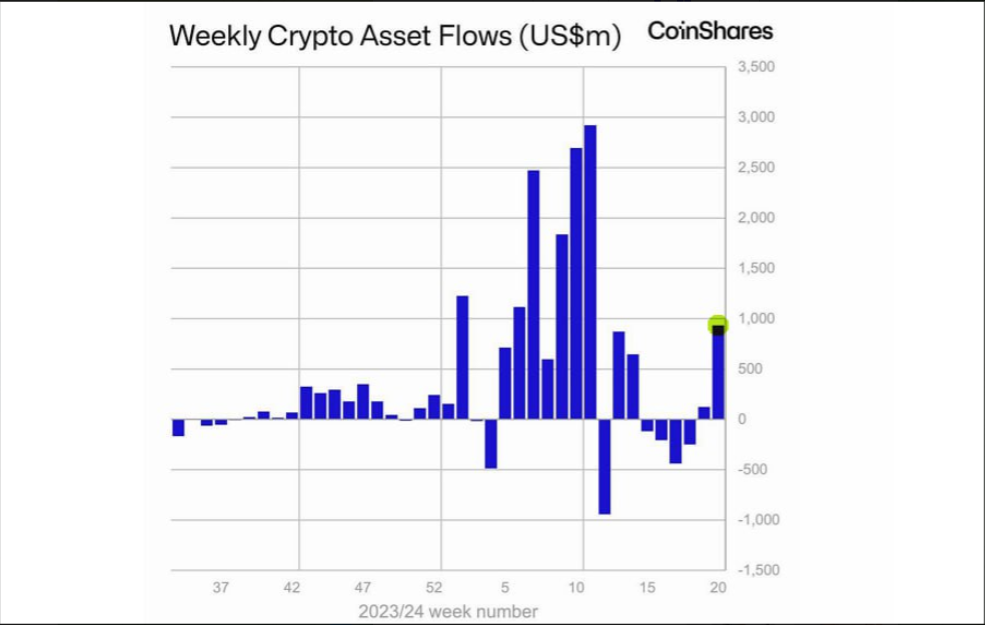

After the outflow, the inflow to crypto assets resumed, but as you can see, it is not at all the same as it was in March.

Conclusion:

Technical and fundamental factors so far point to continued growth of Bitcoin, the main target is 76,000. Below are important levels around 61000 and 56756(Wave 4 low).

More By This Author:

Dollar Index And Euro-Dollar Medium-Term Forecast

Crude Oil. Midterm Outlook

The US Stock Market; Correction Before A Serious Fall

Disclaimer: