In the rapidly developing financial markets, spot metal trading is especially popular among investors who seek to expand the diversification of their investments. Spot metals are valuable due to their intrinsically recognizable wealth, historical stability, and their possible operationality both as short-term gain and long-term investment.

In this blog, you will find the rationale why the purchase of spot metal trading might be a good investment option to diversify your stock portfolio.

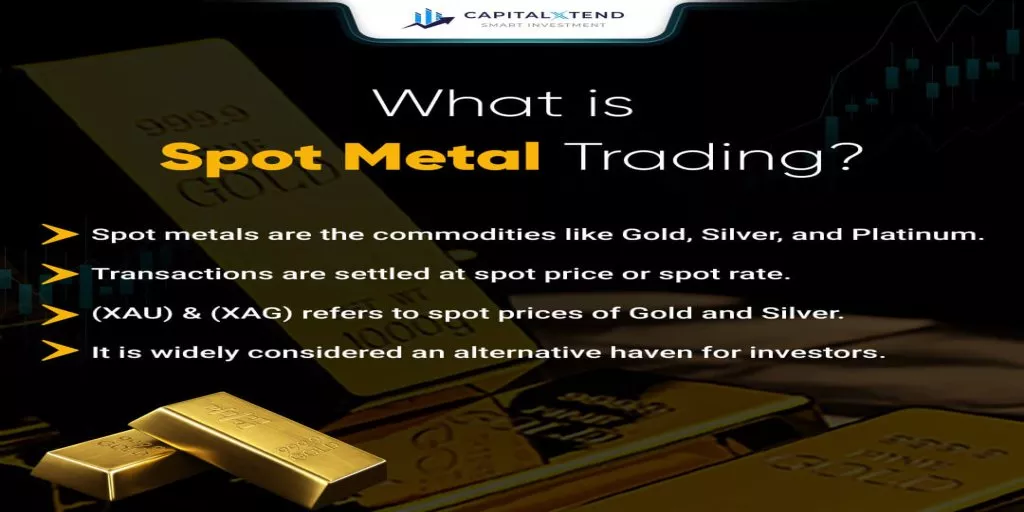

Understanding Spot Metal Trading

The term allotment refers to spot metal trading which means selling and purchasing metals like gold, silver, platinum palladium, etc, at the current price with physical delivery made immediately. Unlike futures contracts where future prices are agreed today and can be exchanged at a later date, spot trading transactions are done “on the spot” thus making them suitable for investors who require physical delivery of metals without unnecessary negotiations of the physical delivery date.

Why Invest in Spot Metals?

1. Portfolio Diversification and Risk Mitigation

Among the more crucial motives that investors are attracted to the trade of spot metal is to expand their diversification portfolio. Some of the metals more so gold and silver have low coefficients with other classes of preserving like stocks and bonds and hence can be viewed as insurance. Spot metals for the most part remain stable if not rally during a recession or during market fluctuations, thus acting as a hedge against other investments.

Incorporation of spot metals in a portfolio leads to general portfolio risk diversification because metals do not act in the same ways as inflation and other monetary units such as currencies. This characteristic makes them a very valuable part of a fine-tuned diversified investment portfolio.

2. Hedge Against Inflation

In times of inflation Traditional money loses its worth hence the purchasing power reduces. Physical precious metals, especially gold, have always held their value and thus act as a great inflation hedge investment. Any time there is an increase in inflation level, people invest in precious metals in large numbers thus an increase in prices. The inflation risk premia that demand for holding spot metals can help ensure that you keep your wealth intact and improve the quality of wealth longer-term.

3. High Liquidity

Spot metals are very easily marketable or liquid in their nature. The exploration of the subject requires understanding that gold, silver and other metals are easily accessible and Tradable the world over. This liquidity contributes to the versatility of spot metal trading for both short-run speculators and long-run hedgers. Depending on your strategy you may want to be able to quickly cash out or purchase spot metals with relative ease, no matter if it is a steadier long-term return you are after or the amusement of day trading.

Key Spot Metals to Consider

Investors have several options when it comes to spot metals. Here are some of the most popular choices:

-

Gold

Gold is perhaps the most widely recognized spot metal. Known for its intrinsic value and historic role as a store of wealth, gold is seen as a haven asset. It is especially attractive during geopolitical uncertainties and economic instability. Gold spot prices often reflect market sentiment and are less susceptible to devaluation, making it a strong long-term investment.

-

Silver

Silver offers an affordable entry point into spot metal trading. Though it is more volatile than gold, silver’s price movements often mirror those of gold, especially in response to economic events. Silver also has diverse industrial applications, including electronics, renewable energy, and healthcare, driving demand and influencing its price.

-

Platinum and Palladium

Platinum and palladium are less popular than gold and silver but still valuable in spot metal trading. Both metals are extensively used in the automotive and industrial sectors, especially in catalytic converters. As such, their prices can be influenced by industrial demand and trends in the automotive industry.

Benefits of Spot Metal Trading

1. Ownership of Tangible Assets

One advantage of investing in spot metals is that it presents the possessor with actual assets. Unlike stock or bonds where one is dealing with corporate operations and government regulations, spot metals have intrinsic value. This is perhaps because ownership of a physical asset is confidence-boosting, especially during an economic crunch or during inflation/ devaluation of currency.

2. High Leverage Potential

For those able to manage or fully understand risk, it can also offer unlevered spot metals trading meaning they can get more exposure with less money. But before you dive into leveraged trading, it is better to remember that leveraged trading means both profits and losses will be increased in size. Using spot metals as a hedging strategy if applied properly reaps big benefits, especially to investors with high risk-taking ability and insight into the market.

3. Relatively Lower Transaction Costs

Sometimes, it is easier and cheaper to trade spot metals relative to other assets. Such a purchase and sale usually attract lesser transaction costs than in extended participation agreements, options, or futures. This makes the case beneficial for active traders involved in frequent trading as they can be able to balance costs and increase their chances of making good profits.

Why Spot Metal Trading is Worth Considering

Spot metal trading has a lot of potential to be placed in a position where investors can secure their fate. But there are definite advantages associated with position metals that encompass high liquidity, the capability to protect against inflation and diversification, illuminate your investment choice, and shield it from several economic risks.

In selecting a foreordinate strategy and being aware of what goes on in the market, spot metal trading is a good way to make a quick buck while at the same time retaining an instrument of storing wealth in the future. When done properly investing in spot metals can be extremely effective, this holds for virtually every portfolio. That said for those willing to venture into this rewarding area, sites such as CapitalXtend give you all the tools and information necessary to trade spot metals effectively.