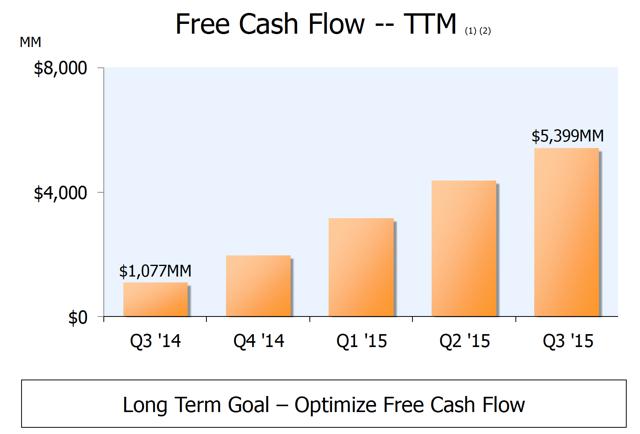

For the most part, Amazon (NASDAQ:AMZN) addressed a lot of issues in the past year. The cash issue has been resolved, and free cash flow metrics have improved. While there's a degree of subjectivity to Amazon's own reported FCF, I'm going to save that for another time. After reconciling the data, I have found that the cash balance increased, so the improvement in cash flow isn't imaginary accounting manipulation, but actual efforts to improve upon balance sheet fundamentals.

In terms of growth, we're starting to hear from industry analysts such as comScore that the retail season was strong. Obviously, a lot of discount purchasing has occurred, and various viral video uploads on YouTube confirmed how difficult it was to shop for bargains at brick-and-mortar. I, on the other hand, would prefer avoiding black Friday closeouts due to the convenience of shopping online, and the patience needed to wait in front of a PC is a lot less strenuous than camping out in front of Target (NYSE:TGT) or Wal-Mart (NYSE:WMT) for that matter. While I can acknowledge that Target and Wal-Mart put on some phenomenal door buster sales in the consumer electronics category, I am woefully hesitant to rely on black Friday sales for both margin and sales uplift for well-established retailers. Not only do retailers report very narrow margins, it's difficult to beat prior year comps on well-established retail brands.

According to a Mizuho Securities report:

Strong E-Commerce Growth Trends Heading Into Holiday 2015. U.S. ecommerce sales posted 15% Y-o-Y growth in 3Q15, flat from 2Q15 on a 1-point harder comp. Desktop e-commerce slowed to 8% for the quarter, but mobile commerce accelerated to make up the difference. Looking ahead, comScore, expects Y-o-Y growth of 13-15% for the Nov-Dec holiday period, aided by low gas prices and an extra shopping day between Thanksgiving and Christmas this year.

The Mizuho figures are based on comScore data. Furthermore, Adobe recently released data indicating that Black Friday and Thanksgiving sales, when combined, grew by 18.5% from prior year. Amazon offered guidance of roughly 14% to 25% y-o-y growth in their Q3'15 earnings release, so they're on solid track to deliver top line figures. Thankfully, no data point sticks out that indicates cyclical weakness or faltering consumption patterns among U.S. consumers. While weather played an important role in assessing the lead-up to black Friday, it doesn't seem to affect e-commerce companies as much. Nonetheless, it's fair to mention that worsening weather conditions can impact the pricing of shipments due to delays, but much of that abnormality tends to be balanced out with Amazon's ability to secure large-scale shipping contracts from the various carriers.

It's also worth mentioning that Amazon's actual revenue is usually several points higher than the comScore figures for retail. This is mostly driven by Amazon's ability to gain market share due to its ecosystem tie-in of Prime, which lowers shipping rates for average consumers. The company also competes aggressively on price during the holiday quarter, which is enabled by their large-scale warehouse infrastructure and pricing discounts due to their well-established wholesale network. In a sense, I view this competitive advantage as a key reason for holding onto this e-commerce retailer when compared to alternatives like eBay (NASDAQ:EBAY) and JD.com (NASDAQ:JD). Nonetheless, some view these companies under the spotlight of deep value, but given the way tech companies have been discounted aggressively for poor market positioning or weak growth prospects, I would be hesitant to buy deeply discounted e-commerce companies. There are significant advantages to scale.

Continue reading on Seeking Alpha.

Nice article, what else you got?

Nice article, I've added you to my follow list.

Nothing will be able to stop Amazon... unless $AMZN shareholders get fed up with it's decision to always sacrifice profits for growth. But I think most understand that Bezos has vision.