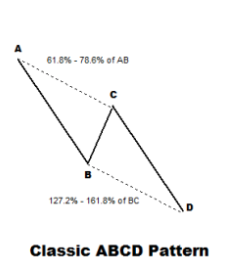

There is classic ABCD Pattern made on S&P 500 index. Rising wedge also broke today.

Classic ABCD: In this pattern, the BC is a retracement of 61.8% – 78.6% of AB, with CD being the extension leg of 127.2% to 161.8% (equal in price distance)

Attached is the image below for your reference.

The same pattern is made on S&P 500 index.

Below are the Four Hourly chart for S&P 500 Index for your reference.

One can go short below 2690 with SL 2810 for Target 2251. On Risk Reward, it's a 1:3.5 Trade.

Hope my view is helping my followers to manage their positions :)

Please feel free to ask any query related to any trade setup, I'll be glad to help!

Cheers