Recent price: $2.38

Projected fair value:$2.50

Brief Overview

MGT Capital Investments (OTC:MGTI) aims to develop and acquire a diverse portfolio of cyber security technologies. The company has business segments in cybersecurity and gaming; they have shifted their primary focus to growing their crypto-assets materially and expanding their Bitcoin mining operations. MGT’s mining operations take place in central Washington State and have made numerous investments to increase computing power needed to ensure mining profitability.

Investment Thesis Points

· The company is positioned to become the largest Bitcoin (BITCOMP) miner in the United States; with the blockchain industry being so young, the company may have tremendous upside compared to other mining entities.

· The company has continuously invested in new mining equipment which may significantly increase their mining efficiency throughout 2018.

MGTI is taking advantage of hydroelectric energy in central Washington State and recently reported that they will be moving part of their operations to Sweden in order to gain access to more reliable electric power.

Industry Risks

· Lack of investment validity; the cryptocurrency industry is young and widely unaccepted by many investors and institutions.

· The cryptocurrency industry is extremely volatile; Bitcoin price commonly appreciates and declines thousands of dollars within hours.

· Mining profitably requires MGTI to invest ahead of revenue in order to remain profitable; Bitcoin is designed to become more difficult to mine as the 21 million limit is approached and has few barriers to entry. Declining total cash could inhibit the ability to stay ahead.

Company-Specific Risks

· The company’s balance sheet shows declining total cash; 87% decline between Q2 and Q3 of 2017.Funding operations has proven to be a struggle since mining operations began.

· Income relies solely on one commodity, Bitcoin (BTC). Risk of a crash, currency split, or major correction could severely inhibit MGT’s growth.

Investment Thesis

The company is positioned to be the largest Bitcoin miner in the United States and eventually grow its market share to be recognized internationally. With MGT’s mining operations beginning in September of 2016, the company has grown their activities rapidly in central Washington State and will expand themselves into Sweden to take advantage of more reliable energy. Having multiple international locations gives them tremendous upside compared to competitors since cryptocurrency is international. We estimate that the company controls 17% of the U.S. Bitcoin mining market share

Conservatively, we also estimate the company has capacity to mine up to 20% of the 4.3M Bitcoin left to be mined.Our MGTI revenue projections are derived by leaving the price of Bitcoin constant at $6K per BTC. At the time of this report Bitcoin was trading at range of $9-10,000, tumbling over 60% from its December highs.

Our thesis is that MGT can drive growth and deliver value for shareholders through successful pursuit of its strategic objectives, which include:

· Pursue growth by continuing to invest in more advanced mining technology and maintaining their status as the largest domestic Bitcoin miner while also expanding internationally

· Diversifying their mining operations into new currencies such as Etherum and entering into new blockchain operations when mining is no longer sustainable.

· Lower cost of goods (costs to mine) to increase margins

We believe that crypto-currencies will be seen as a valid store of value and that we are in the beginning stages of a large open-ended growth opportunity for MGTI. Assuming the current price of Bitcoin, electrical costs, and current amount of rigs, the company may be able to generate $4.0 million in monthly revenue and over 70 Ph/s in total hash power if they are able to fund operations. According to management, all the rigs from previous purchase orders should be in operation by the end of February 2018.

Industry Conditions, Characteristics, and Trends

The crypto-currency, mining, and blockchain industry is characterized by its vertical growth, aggressive volatility, and high risk. The industry has multiple subcategories: (i) mining operations, (ii) wallet services, and (iii) various blockchain services. Being such a new space to conduct business, it’s likely that many other services will emerge as the industry matures. We find cryptocurrency growth opportunity is similar to how the internet began; it spawned new businesses and became a part of every day life. Seeing more major companies entering the blockchain space supports this thesis. Crypto-currency correlates to user’s distrust in central planning but do not correlate to the overall economy. Taxes, central banks, regulations, and many things that affect normal economic conditions, does not affect crypto-currencies. The price of Bitcoin is determined solely by the users.

One important point about MGT is that the company’s revenue has been generated solely from Bitcoin mining operations. This would lead investors to believe that the price of the company’s stock would have some correlation with the price of Bitcoin. This is not necessarily the case:

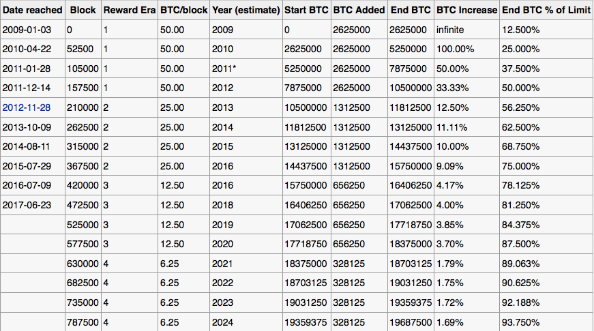

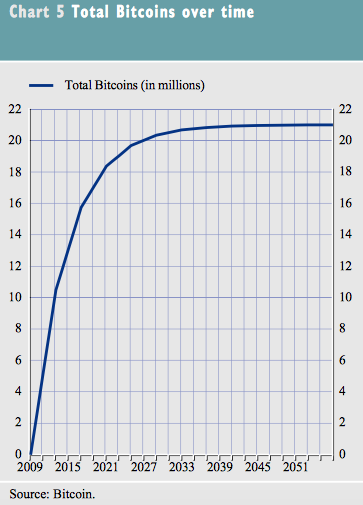

One major characteristic of Bitcoin mining is that the maximum amount of Bitcoins in existence cannot exceed 21 million. As more Bitcoin are created by miners, the more difficult mining becomes. As the algorithms become more complex, more computing power is needed to remain profitable. There are roughly 4 million Bitcoin left to be created. MGT has made it their main priority to continue to invest in new mining rigs so that they can stay ahead of this. The diagram below shows just how demanding mining has become.

Competition

MGT’s competitors mostly operate privately and are not publicly traded. Because the industry is young, averages and multiples are not the most reliable way to gauge success. DigitalX Limited and BTL Group Ltd. all have multiples comparable to MGTI but are involved in blockchain in different ways. 803 Mine and Bitfury were all leaders in the North American mining space - they then transitioned into other blockchain services.

Management and Shareholders

Robert Ladd CEO directs all mining operations and has recently expanded into Sweden to take advantage of affordable electrical power. There are 5 directors and hold 23.3% of total common equity. 5% Beneficial Shareholders include Anton Strgacic and Joseph DiRenzo Sr., they in total hold 17% of common equity. The company recently announced that the relationship with John McAfee has ended and that Stephen Shaeffer, director of the cryptocurrency department will now become President of the company. Strangely enough, they referred to the company as MGT Cryptocurrency Strategies, not MGT Capital Investments.

There is uncertainty among investors about the new management and leaving of McAfee. McAfee has built multiple tech companies and now is involved with a competing a block chain operation in China. We have been unsuccessful in reaching management for comments.

Financial Results

MGTI’s revenue has been generated exclusively from Bitcoin mining operations. 2017’s third quarter saw $515,000 in revenue which is a 871% increase compared to last year’s third quarter and exceeds total revenue from 2016 entirely. Comparing q3 2016 vs q4 2017, operating income rose 581%, $22,000 and $150,000 respectively. This revenue increases can be explained by investments made in new mining technology. Management has stated that they expect monthly revenue to eventually reach $4.0 million when all of the rigs are deployed. Monthly EBITDA is expected to be $2.0 million.

Continuing to compare 2017’s third quarter performance, the company reported a 1077% increase in cost of revenue exceeding the 871% revenue growth rate. Declining margins have been a trend for the company. Cost of revenue increased over 4079% from 2015-2016. Accompanied with the shrinking margins, cash and cash equivalents decreased 3% from 2015-2016. Since of the beginning of 2017, cash has decreased 87% on MGT’s balance sheet. Debt on the company is a concern; total current liabilities have increased 848% since the beginning of this year and is expected to rise further with new purchase orders for mining rigs.

A big concern with MGTI is that the company will run out of cash and have to suspend operations. MGTI ended 2016 with a quick ratio of 0.22 showing a severe lack of cash when their mining operations started - since the company does not hold inventory, its not calculated in their ratio. 2017 was an improvement and Q1 ended with an improved quick ratio of 0.67, 0.40, 0.67 for Q2 and Q3 respectively. Q4 for 2017 is not expected to be very different. To fund future operations we expect the company to sell stock in order to raise more capital.

Between Q1 and Q3 of 2017, the company burned through $291,000 of cash, 87% of which was spent between Q2 and Q3. Because the company started out with only $43,000 in cash for Q4, we expect that unless they are successful in raising more capital, they will almost indefinitely have at least a zero balance by Q3 of 2018. The company has announced that all operations with new mining rigs will be in effect by the end of February.

Management has not been transparent with how they will continue to fund their operations. There will be a company meeting in March where a vote will take place on whether to dilute their stock by raising up to $50 million. It's safe to say that this would be the only way for the company to prevent their liabilities account from drastically increasing this first quarter.

MGTI recently announced that the new leadership will allow them to transition into a “pure-play” cryptocurrency company. This leads us to speculate that there are future plans for new blockchain operations. How will they fund these operations? We speculate that the mining is the main way they will raise capital but we also have considered the possibility of an ICO to be initiated by the company.

Valuation

MGTI is an open ended growth opportunity, a development stage company with no current profitability that requires a 15 year outlook projecting industry market share, projecting MGTI gross market share of total revenues using a venture capital risk factor in our DCF model to project present value.

There are 4.3 million BTC to be produced until the network limit is reached. We conservatively estimated that the United States holds 20% of mining/BTC market share, and that MGTI holds 17% of that. This gives MGTI a foothold of 3.4% in BTC production market share potential. We believe in a best case scenario, fair value of BTC is $30,000 (based on 10% share for all cryptocurrencies of global currency value achieved in 10 years, discounted back by 15% and assuming a 40% share of crypto currency for BTC ) . Since this is essentially a quasi- venture capital foray with limited liquidity we will use a high discount rate of 17% to calculate MGTI’s fair value. We derive = $112,574,000 market value.

A near term valuation approach using a PE multiplier may be more plausible. Management has indicated that they can increase mining production by 3x. They recently provided guidance of 100 bit coins per month, so if we assume 300 coins per month with a 10% net margin assumption holding bitcoin at average price of $10,000 for the next twelve monthswe get anet profit in the neighborhoodof $4 million. If we apply a 50% premium to the S&P500 PE for high growth potential we derive a target fair value of $120 million.MGTI has 48 million shares outstanding, or $2.50 per share.

Summary:

Due to lack of visibility, dire need for capital for operations by q4 2018 and a desire to raise capital to expand long term operations and of course, the lack of barriers to entry combined with a high level of competition, we find it difficult to become very excited about MGTI at current levels and would wait for a more attractive, and significantly lower entry point to own this stock.

I had no idea there were real, publicly traded companies whose focus was to mine #bitcoins!

yes and likely more to come.

Personally I think this crypto craze has gotten out of hand.