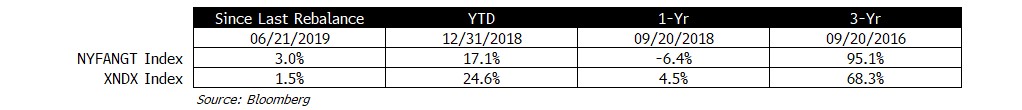

- Current rebalance date is September 20th, 2019. The last rebalance date was June 21st, 2019.

- The best performers within the index since the last rebalance date were Twitter (TWTR), Nvidia (NVDA), and Apple (AAPL).

- The worst performers within the index since the last rebalance date were Netflix (NFLX), Baidu (BIDU), and Amazon (AMZN).

- NYSE FANG+ Index return since the last rebalance is 3.05%.

- NYSE FANG+ Index return year to date is 17.14%.

- NYSE FANG+ Index return since inception is 163.95%.

FANG+ Spotlight

- NYSE FANG+ Index constituent performance since the index last rebalanced after the close June 16th, 2019

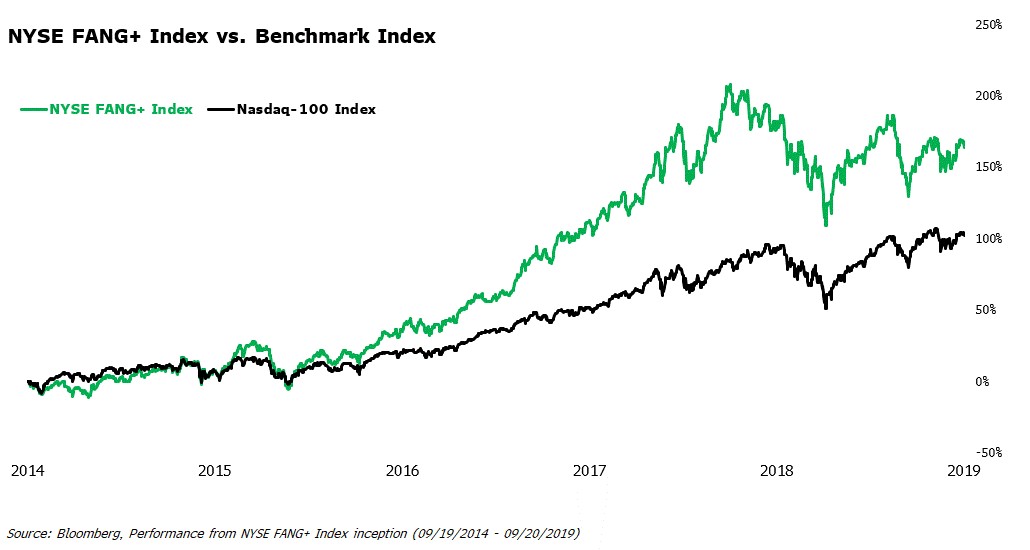

- The NYSE FANG+ Index vs. Nasdaq-100 Index historical total return performance

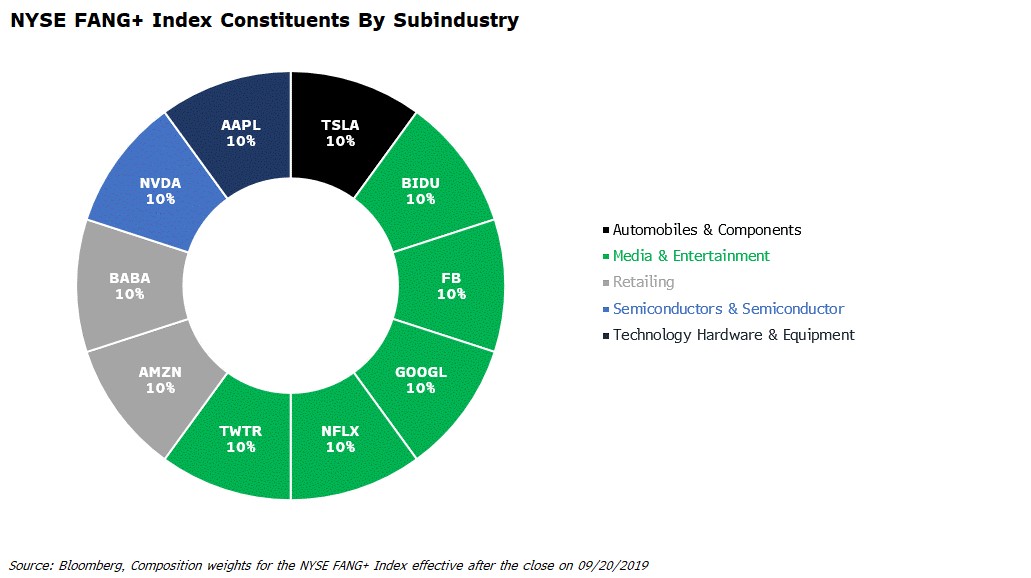

NYSE FANG+ Index Weightings

- The holdings and weights for the NYSE FANG+ Index as of the close on September 20th, 2019

- The NYSE® FANG+ Index™ rebalances become effective after the close of the third Friday of March, June, September, and December. The rebalance announcement will be made after the close of the second Friday of the month (one week prior).

- Every quarter after the close of trading on the third Friday of March, June, September and December, the index portfolio is adjusted by equally weighting the constituents based upon the prices and index market capitalization as of the close of trading.

What is the NYSE FANG+ Index?

The NYSE FANG+™ Index includes 10 highly liquid stocks that represent industry leaders across today’s tech and internet/media companies. The index’s underlying composition is equally weighted across all stocks, providing a unique performance benchmark that allows for a value-driven approach to investing. While the performance of indices weighted by market capitalization can be dominated by a few of the largest stocks, an equal-weighting allows for a more diversified portfolio.

Disclaimer

Source: Bloomberg L.P. Past performance does not guarantee future results. The NYSE FANG+™ Index, an equal-dollar weighted index, was created by ICE Data Indices, LLC in 2017 and was launched on 9/26/2017.

Index data prior to that date is hypothetical and reflects the application of the index methodology in hindsight. The hypothetical data cannot completely account for the impact of financial risk in actual trading. Past historical or hypothetical data is not a guarantee of future Index performance.