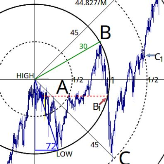

Geometric technical analysis of global financial markets

Contributor's Links:

Pattern to Profit

Pattern to Profit is an independent technical investment research firm utilizing unique geometric analysis of global financial markets. Research from Pattern to Profit is largely based on Hathaway Analysis (™), comprised of the proprietary methods and techniques of Scott Hathaway, ...more

Pattern to Profit is an independent technical investment research firm utilizing unique geometric analysis of global financial markets. Research from Pattern to Profit is largely based on Hathaway Analysis (™), comprised of the proprietary methods and techniques of Scott Hathaway, CFTe, Co-Founder of Pattern to Profit, including his unique take on geometric charting called Relative Charting (TM), which is currently unavailable anywhere else. Geometric charting is a highly effective way to reveal hidden relationships in price and time by uniting price and time, while Relative Charting utilizes specific price action to determine a chart's scale ratio. These methods can provide greater accuracy and more powerful forecasting. Scott Hathaway is joined by veteran market strategist Bruce Powers, CMT, who brings his more than 20 years of experience as a technical analyst, trader, writer and educator to Pattern to Profit to ensure the delivery of the most powerful financial markets analysis available.less