China's leading online discount retailer Vipshop (NYSE: VIPS) released its financial results for the fourth quarter and full year ended December 31st, 2021, on February 23rd. Financials showed that the retailer's total revenue for Q4 2021 was RMB 34.1 billion (US$ 5.4 billion), a drop of 5% as compared to the same period 2020; it achieved full year revenue of RMB 117.1 billion (US$ 18.4 billion), an increase of 14.9% year-on-year.

Nearly two years into the Covid-19 pandemic, the online retail business is surging on the rise of customers' preference for online shopping. In the meantime, the new challenge faced by e-commerce operators is in imminent as the craze for this shopping style is cooling down. How to respond and navigate through the fickle environments, as well as figure out a way to remain growth top issues for many Chinese mainstream e-commerce platforms, with Vipshop no exception.

Negative Q4 growth

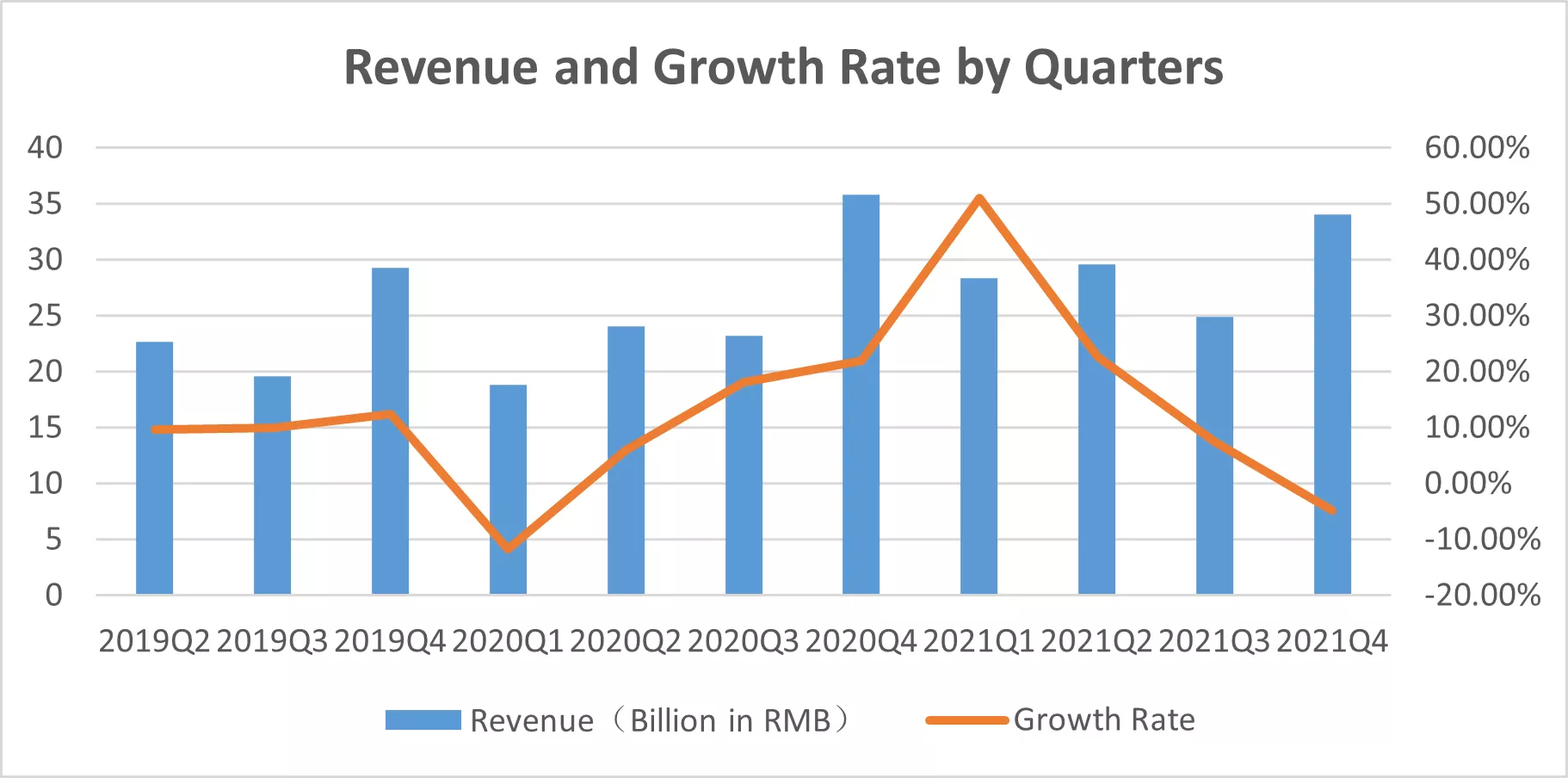

Vipshop's revenue performance has been on a roller-coaster ride. It suffered negative revenue amid the most heavily virus-hit Q1 2020 but grew sharply by 51.1% in Q1 2021 quarter-on-quarter as the pent-up consumption quickly soared at a time when the pandemic was well under control. Its latest earnings report revealed that the company's revenue for Q4 2021 was RMB 34.1 billion (US$ 5.4 billion), decreasing by 5% year-on-year, the fourth declined growth rate quarter in a row with even negative growth rate in Q4 2021.

The boom in e-commerce sector largely benefited from the worldwide pandemic-incurred lockdown, which shifted people's shopping activities to internet. However, the fallback of growth in the post-pandemic time lays bare a company's real performance trajectory. It would be a tough undertaking for Vipshop when facing the decline of online shopping demand, which generates its growth to collapse. Days look bad for e-commerce these days.

Source: Company's financial reports

Ceiling in customers acquisition?

More bad news unfurls. Vipshop's gross merchandise value (GMV) for Q4 2021 was RMB 57.0 billion (US$ 9.02 billion), a reduction of 4% year-on-year. Total orders for the same quarter were 216.9 million, 5% of drop year-on-year. The negative growth both in GMV and total orders dragged the retailer into depression.

Source: Company's financial reports

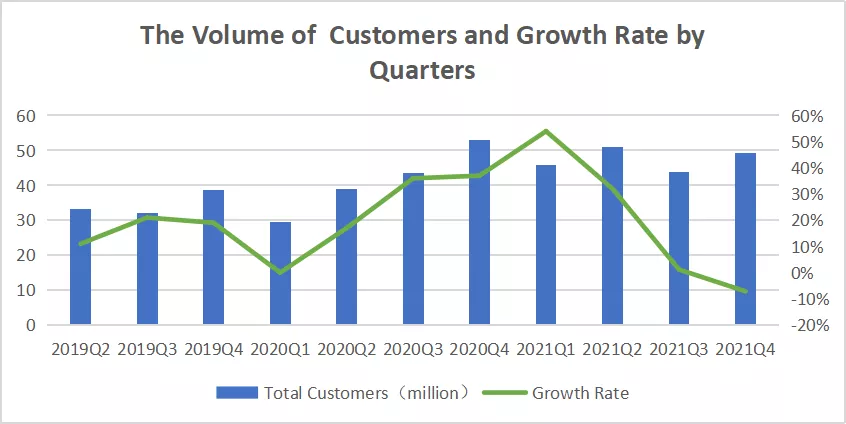

On the customer side, the pandemic incurred the company the worst record number of active customers in Q1 2020, but in the next couple consecutive quarters, the number of active customers rose quickly to a spike of 53 million as the pandemic was well under control and customers consumption sentiment was released. Cheerlessly, the growth didn't last long but turned to a negative trend that had Vipshop 49.2 million active customers for Q4 2021, a loss of 7% compared with 53 million in Q4 2020. For a company like Vipshop, failure to attract new customeris a nightmare to the future.

Customers are all about everything for a market entity. Exploration of customers' potential consumption can also be a solution to make a business successful. Vipshop reported an increase of 50% of premium membership, called Super VIP, for its Q4 results. However, whether the increasing of super VIP could come out with a higher user stickiness and order growth remain unknown.

Source: Company's financial reports

Vipshop's Super VIP is co-launched by Tencent Video, QQ Music (video and music streaming services offered by Tencent), Meituan (take-out food delivery coupon), and many other lifestyle service providers, and customers with a premium membership are accessible to those all privileges. Obviously, bundled consumption has been a common commercial norm in China and many users come only for this combo that costs less money. Unfortunately, customers' loyalty and quality to Vipshop seems ineffectively improved through this way.

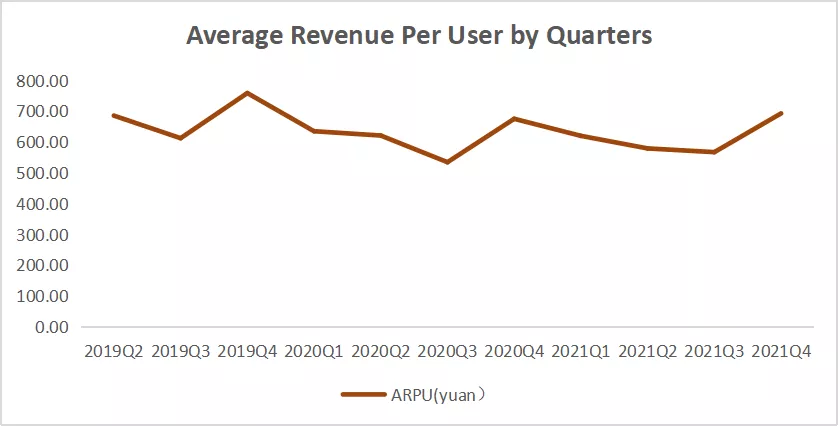

Average Revenue Per User (ARPU) is frequently used as a more precise metric to analyze of the customer quality. In the case of Vipshop, its ARPU growth is on a flat channel in the past quarters and is even lower than the pre-pandemic level when its GMV reached a peak in Q4 2020. The fourth quarter in China usually marks the high season of e-commerce, especially the annual "Double 11" shopping festival that falls on November 11th, and it largely drove up Vipshop's ARPU in Q4 2021. Far from satisfaction, the performance of Q4 2021 was still left behind that of Q4 2019.

Source: Company's financial reports

A bad kick-off in 2022

Vipshop keeps profitable for 36 consecutive quarters even when the pandemic was in its gravest severity in 2020. But its Non-GAAP net income attributable to shareholders for Q4 2021 was RMB1.8 billion (US$282.6 million), a significant drop of 30.77% as compared with RMB2.6 billion in the prior year period. Despite still maintaining profitability, it has been recorded two consecutive negative growth year-on-year. according to its Q1 2022 guidance, dispiritedness may unfold into 2022 as the company expects a net income of between RMB 27 billion and RMB 28.4 billion in Q1 2022, down about 5% to 0% year-on-year.

Source: Company's financial reports

Negative growth in revenue, net income, GMV, and total orders wrapped up Vipshop with a bad ending of the year. More badly, it is hobbled to gain more customers. For Vipshop and even China's other e-commerce player, it will be a common challenge when talking about customer acquisition, customer loyalty and efficient profitability.

Reference:

Vipshop Reports Unaudited Fourth Quarter and Full Year 2021 Financial Results | Vipshop Holdings Ltd