Take-out food deliverer Doordash (NYSE: DASH) jumped more than 18% on February 17th after the announcement of its latest fourth quarter results one day ago. Financials showed that the company's Q4 revenue rose 34% over the same period of time last year, the loss continued to narrow, and the total number of orders were beyond expectations. Could DoorDash's recovery send its stock price to take off as it collapsed from the pike of US$ 257 apiece in November last year to the ever bottom of US$ 91.96?

Still lose money

While the ongoing Covid-19 pandemic is still scourging every corner around the world, it is a blessing for Doordash's development. It grew aggressively and doubled its size in the interim of 2020, accounting for a huge market share of 57% in North America.

The Covid-19 disabled customers' physical presence in restaurants, making all sorts of take-out food mobile applications (app) the most optimal solution to that separation. The soar of orders placed from these apps generated more revenue, in the case of Doordash, an extra 50% of revenue was added throughout 2020~2021. Cheerlessly, the company was still in the red by the end of 2021.

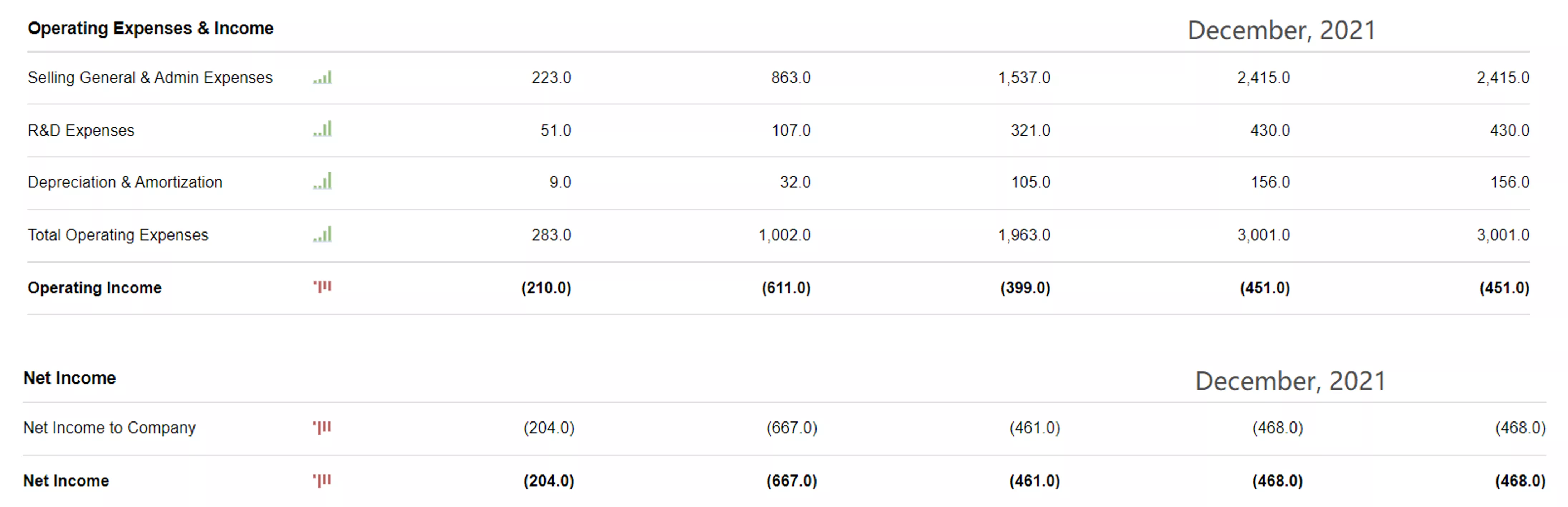

In 2021, Doordash reported an operating loss of US$ 451 million and a net loss of US$ 468 million alone. Despite the favorable market conditions, the company was hobbled by irrational executive salary and increasing operational costs.

(Source: Seeking Alpha)

The company revealed that general and administrative (G&A) expenses in 2021 were much higher than that of 2020, but what made things worse was that Doordash's founder and CEO got an annual pay of US$ 414 million in 2020 alone, mainly in the form of restricted stocks, which put more strain on the company's operating costs. Such a situation is not normal for a startup like Doordash.

In addition to the high payroll expenses, Doordash's marketing expenses of $1.2 billion for the previous nine months ended Sept 30th, 2021 was also the reason to earnings cut down.

Some analysts warned that no company in the food delivery industry would be profitable if they ran like Doordash. In this overheated battleground, dozens of rivals are coveting Doordash's market share and struggling to court more customers by giving meals discount to the largest extent they could. Take Grubhub (NASDAQ: GRUB) for instance, food delivery service for a whole week will be free of charge when customers place order in preferential time, as a benefit to attract more customers.

Given customers zero cost on switching different apps, it is difficult for every take-out food operator to retain their users, which leads to a stiff competition in need of more marketing and advertising expenses to support their growth. The situation will intend to bring fluctuation in market shares but not incremental revenue to be realized.

Fight yet to finish

Doordash's footprint in the United States is far from reaching out to every corner. In Manhattan, for example, Doordash maintains only 15% of the market share, contributing less to its revenue. While Grubhb is rather favorable in localization due to its delivery networking comprising of more available restaurants. Likewise, the gross merchandise volume of Uber Eats is the highest in both Florida and New York.

Despite Doordash dominating in some marketplaces, it is less competitive across the U.S. Like Amazon with a market share of 40% in the e-commerce, it will be a big threat to Doordash if Amazon upgrades into intra-day delivery service in the future.

Overvalued market capitalization

At present, Doordash's market cap is 9 times over its historical sales and 8.4 over expected sales, both of which are significantly higher than the industry median of 1.4 times. Analysts suggested that Doordash needs to improve in business to support its US$ 40 billion market cap, which means either an 80% drop in stock price or 5 times increase in sales.

It will be tough for Doordash to preserve a market share of over 50% in years to come. The order of deliveries may soon enter a downward track then back to the pre-pandemic level in 2019 as the impact of the pandemic fades and the economy reopens. In the meantime, Doordash is flanked by many competitive rivals, making it harder to achieve the 5 times sales goal, which indicated its stock now is overvalued by about 80%.

By and large, Doordash needs to grow stronger to ensure its promising market cap. And the challenge will never disappear until it figures out a way to keep growing even after the pandemic is well under control with diminishing demand of take-out meals.

Reference:

https://seekingalpha.com/symbol/DASH/income-statement

https://s22.q4cdn.com/280253921/files/doc_financials/2021/q4/DASH-Q4-2021-Financials_FINAL.pdf