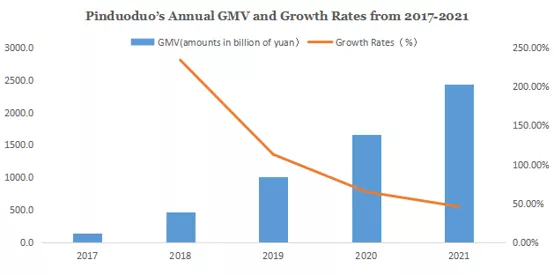

Pinduoduo (NASDAQ: PDD), China's largest agriculture and interactive commerce platform, released its fourth quarter and fiscal year 2021 financial results on March 21st. Financials showed that the gross merchandise volume (GMV) the company achieved throughout 2021 was RMB2.44 trillion (US$383 billion), an increase of 46% year-on-year; the number of active buyers for the whole year reached 869 million, and annual spending per active buyer was RMB2,810 (US$441), an increase of 33% over the 2020 level.

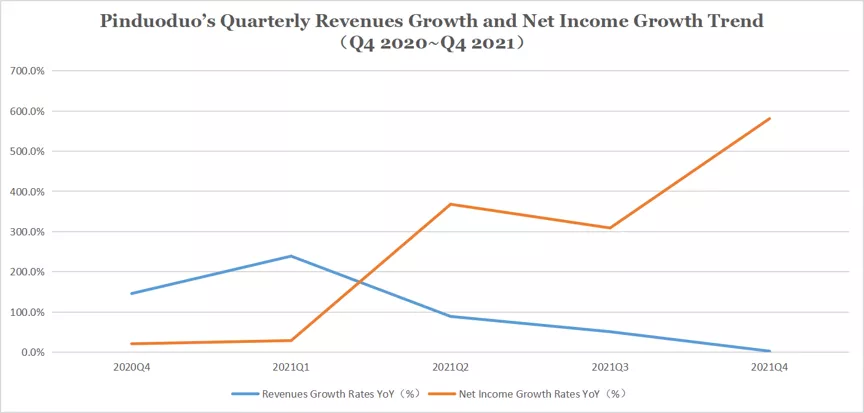

For the fourth quarter alone, the company's revenues edged up 2.6% to RMB27.2 billion (US$4.27 billion), representing the lowest revenue growth record in three years. It speaks to Pinduoduo reaching the ceiling on its user growth; However, its net income logged a best-ever fourth quarter with RMB6.62 billion (US$1.04 billion), a bigger number of RMB8.44 billion (US$1.32 billion) on a Non-GAAP measure. The bold gains in net income for Q4 2021 translate to Pinduoduo's continued profitable position since Q2 2021.

For the full year 2021, it achieved total revenues of RMB93.9 billion (US$14.74 billion), representing an increase of 58% over the 2020 level; net income attributable to ordinary shareholders was RMB7.77 billion (US$1.22 billion), compared with that of RMB7.18 billion in 2020. Non-GAAP net income attributable to ordinary shareholders was RMB13.83 billion (US$2.17 billion), compared with that of RMB2.97 billion in 2020.

Total revenues for the whole year 2021 spread over three major components. Revenues from online marketing services increased by 51% year-on-year to RMB72.56 billion (US$11.38 billion), which was still the biggest cash cow for the company; revenues from transaction services were RMB14.14 billion, representing an increase of 144% from RMB5.79 billion in the same period in 2020; revenues from merchandise sales grew by 26% from RMB5.75 billion in 2020 to RMB 7.25 billion (US$1.13 billion) in 2021.

It can be found that Pinduoduo's revenues growth trend and net income growth trend are heading widely diverging. The business environment and the corporate strategic changes were the two major factors behind the divergence. On the one hand, the reemergence of the COVID-19 spread dealt a blow to China's e-commerce sector that spawned logistic disruptions. Core users on Pinduoduo are more price sensitive than their counterparts on the likes of JD.com and Tmall. The "Double-11" shopping gala is also losing traction in recent years. In the end, the lower-than-expected revenues growth, though less exciting, made sense for Pinduoduo.

On the other hand, the company's efforts in costs control bore fruition in Q4 2021. Total costs of revenues were RMB6.52 billion (US$1.02 billion), a sharp decrease of 43%

from RMB11.53 billion in the same quarter of 2020; its gross profit margin also jumped by 19.5% from 56.6% in Q4 2020 to 76.1% in Q4 2021.

Meanwhile, its marketing expense-to-sales ratio dropped to 41.7% in Q4 2021 from 55.4% in the same period 0f 2020, translating to a decline of RMB3.26 billion in total operating expense along with a larger revenues record.

However, it was the excellent expense discipline that has slowed down Pinduoduo's user expansion, despite it indeed resulting in stronger profitability of the company. Data suggested that the average monthly active users in Q4 2021 were 733.4 million, a quarter-on-quarter decline for the first time compared to that of 742 million in Q3 2021. As for the amounts of buyers, the growth also experienced somewhat weakness which only 1.4 million new buyers were added in the quarter. Excitingly, annual spending per active buyer rose by 33% to RMB2,810 (US$441.0) from RMB2,115.2 in 2020, significantly elevating its average revenue per user (ARPU). By and large, repeat purchases and a higher user retention rate were the results of cementing user stickiness to Pinduoduo.

Pinduoduo has long been a target of investors' big rounds of fundraising, which always are used to support its group-buying-at-low-price business model in pursuit of a bigger user base. This strategy shortly helped Pinduoduo succeed in mustering sizable users that turned it strong enough to vie with old e-commerce giant Alibaba. But the small profits but quick returns model in the long run not only harasses the interests of sellers but also puts strain on yielding profits for the company.

In the face of the incessant COVID-19 disturbance and volatile market environment, Pinduoduo's immediate need is to determine a development path that sets it apart from JD.com and Alibaba, and makes profits as fast as can.

Developing agricultural products is one of the solutions given by Pinduoduo. In the earnings call for the fourth quarter fiscal results, Chen Rui, chairman and CEO of the company, said: "Our strategy in agriculture is centered on technology and we believe that there is still a lot of room for technology adoption in agriculture. As an agriculture platform, Pinduoduo will invest patiently and do our part to contribute to agricultural modernization." The 10 Billion Agriculture Initiative launched by the company last August is also a part of Pinduoduo's effort to support the digitalization of agriculture and advance sustainability in rural Chinese farms. Chen Rui added that the company is dedicated to improving the trade efficiency of agricultural products through technology and upgrading logistic networking across rural areas.

Pinduoduo seeks expectations from its efforts in the agriculture realm but also shows patience as it knows investment in agriculture waiting long to reap returns. In other aspects, the company pledged to continue its "zero commission policy" for agricultural goods and continued to allocate profits to the 10 Billion Agriculture Initiative, which by far received as much as RMB 10.76 billion investment.

Research and development expenses for the full year 2021 were RMB 8.99 billion (US$1.41 billion), an increase of 30% from that in 2020. At a time when the company is undergoing the business shift and slower user growth, its hard-working in the niche track and costs reduction might promise it another glittering year.