XTB is a long-established, multi-regulated broker offering both CFD trading and real investing in stocks and ETFs. With more than 20 years in operation, 1.7 million registered clients worldwide, and recognition for its award-winning xStation platform, it caters to both new and experienced traders seeking low-cost access to global markets.

Company Background

Founded in 2002 and headquartered in Warsaw, Poland, XTB has expanded into more than 13 countries across Europe, the Middle East, and beyond. It has built a strong reputation in continental Europe as one of the largest brokers. Since 2016, XTB has been listed on the Warsaw Stock Exchange (ticker: XTB), which adds transparency through mandatory financial reporting and public disclosures.

Regulation and Security

XTB is regulated by leading authorities, including the UK’s Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), and Poland’s KNF. Client protections vary by entity:

-

UK clients: FSCS protection up to £85,000

-

CySEC (EU): Investor Compensation Fund protection up to €20,000

-

MENA entity (DFSA): Local protections apply

-

International (Belize): Fewer safeguards, no investor compensation scheme

All client funds are kept in segregated accounts, and negative balance protection applies for retail clients under EU/UK/MENA regulation. XTB uses two-factor authentication, SSL encryption, and full identity verification to maintain security.

Instruments and Market Access

XTB provides access to over 10,000 instruments, including:

-

CFDs on forex, indices, commodities, stocks, ETFs, and cryptocurrencies

-

More than 6,100 real stocks and ETFs available for direct investing

Popular ETFs from Vanguard, iShares, Invesco, and SPDR are included, along with major global stocks like Apple, Tesla, and Amazon. This broad range makes XTB suitable for both short-term traders and long-term investors.

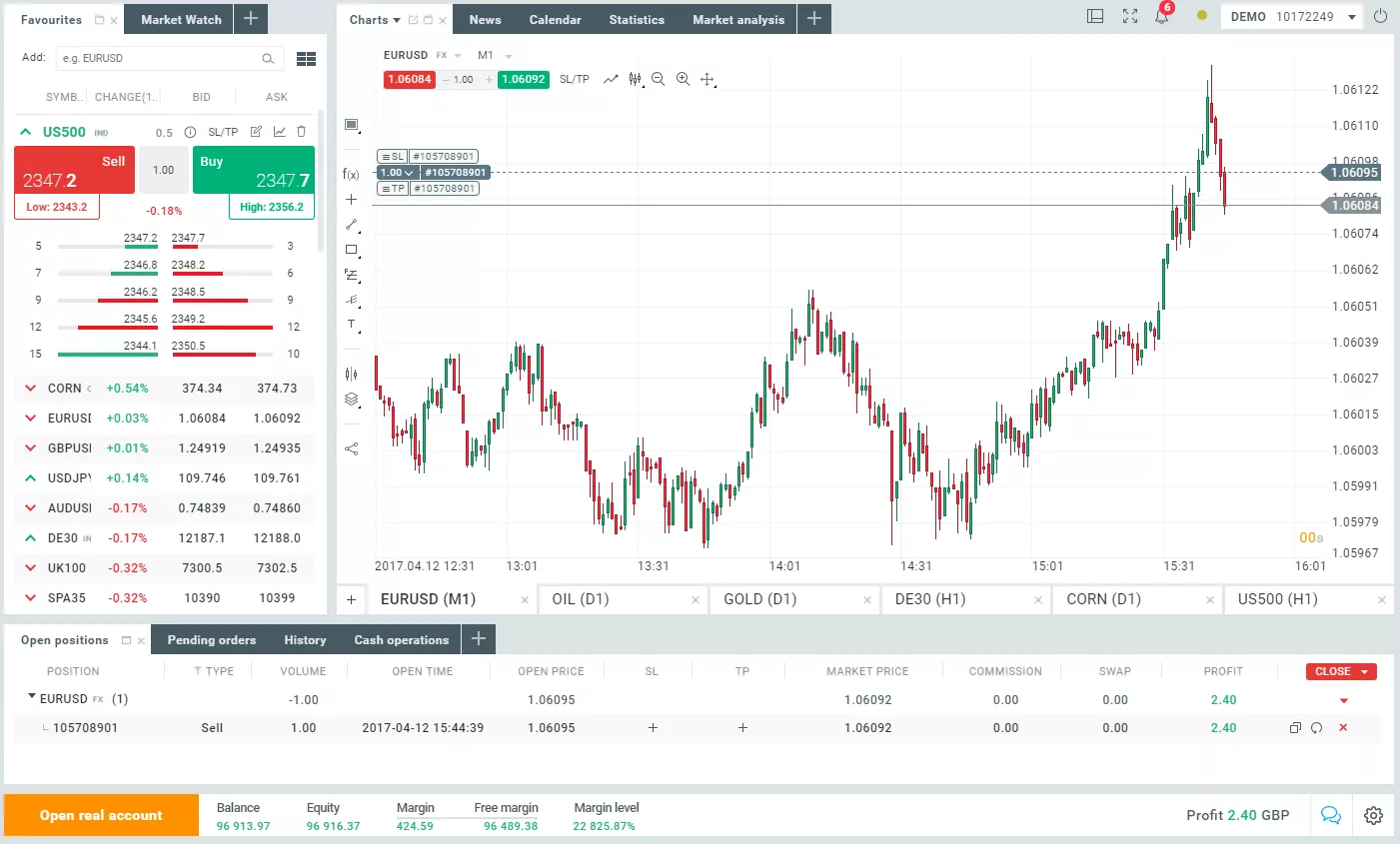

Platforms: xStation 5 and Mobile App

XTB’s proprietary xStation 5 platform is available on web, desktop, and mobile. It has won awards for its design, speed, and features. Key functions include:

-

Advanced charting with 30+ technical indicators and drawing tools

-

Market sentiment analysis and heatmaps

-

Integrated news feeds and economic calendar

-

Built-in performance statistics to track trading results

-

Equity screener for stock selection

-

One-click trading and an integrated calculator

The xStation mobile app (iOS and Android) offers full trading functionality on the go, with live charts, real-time news, and secure execution.

Account Types and Opening Process

XTB offers a Standard Account with:

-

No minimum deposit

-

0% commission on stocks and ETFs up to a monthly cap

-

Negative balance protection (retail EU/UK/MENA only)

Opening an account is straightforward: register online, verify identity, fund via bank transfer, card, or e-wallet, and begin trading. Deposits via cards and e-wallets are usually instant, while bank transfers may take longer.

A free demo account with virtual funds is also available to test strategies.

For UK investors, XTB also offers a Stocks & Shares ISA, providing a tax-efficient way to invest in ETFs and shares without account or dealing fees.

Fees and Trading Costs

XTB has a transparent fee structure:

-

Spreads: Forex from 0.5 pips (EUR/USD), indices from 0.9 points (DE40), gold from 0.25 (XAU/USD)

-

Commission: 0% on real stocks and ETFs up to €100,000 monthly turnover; 0.2% (minimum 10) after that

-

Currency Conversion Fee: 0.5% when trading outside the account’s base currency (EUR, USD, GBP, HUF, PLN in EU/UK; USD under International entity). Multiple base currency accounts are supported

-

Inactivity Fee: €10 per month after 12 months without trading or 90 days without a deposit

-

Withdrawals: Free above €100 (EU) or £/$/€50 (UK/International). Below these, fees apply (e.g., £12 UK, €16 EU, $20 US). Card withdrawals under XTB International may carry a 1.5% fee

Withdrawal speed: same day in the UK if requested before 1 pm GMT, next day in Cyprus, and typically one business day internationally.

Leverage and Restrictions

Retail clients face ESMA-regulated leverage caps:

-

1:30 on forex

-

1:20 on indices and gold

-

1:10 on commodities

-

1:5 on stocks

-

1:2 on cryptocurrencies

Professional clients can apply for higher leverage. In the UK, crypto CFDs are banned for retail clients, and globally, crypto is limited to VIP clients only.

✅Learn more about XTB Investing and Trading Broker

Additional Features

-

4.5% interest on uninvested cash balances for UK clients, significantly better than traditional brokers.

-

No RSP (Retail Service Provider) system for UK stock trading, meaning execution differs from some established UK stockbrokers.

-

Fast online registration - accounts can often be set up in under 15 minutes.

Educational Resources and Support

XTB offers one of the most robust education suites among brokers:

-

Trading Academy with structured lessons for beginners through advanced traders

-

Webinars hosted by experts

-

Daily market news and analysis

-

Market sentiment tools and integrated research

Support is available via phone, email, and live chat in multiple languages.

Business Model Transparency

XTB’s commission-free stock and ETF investing is funded by its CFD business, which accounts for over 94% of revenue. CFDs are high-margin products that carry significant risk for inexperienced traders, but this model enables XTB to keep investing costs low. The broker is open about this, which adds to its transparency.

Pros and Cons

Pros

-

Strong regulation under FCA, CySEC, KNF, and DFSA

-

Listed on the Warsaw Stock Exchange

-

Over 10,000 instruments, including 6,100+ real stocks and ETFs

-

0% commission on stocks and ETFs up to €100,000 per month

-

4.5% interest on uninvested cash (UK)

-

Award-winning proprietary platform (xStation 5)

-

Comprehensive education and analysis tools

-

No minimum deposit and fast account setup

-

Negative balance protection for retail clients

Cons

-

Inactivity fee after 12 months without trading or 90 days without a deposit

-

Currency conversion fees if trading outside account currency

-

Limited leverage for retail clients under EU/UK rules

-

No crypto CFDs for UK retail clients

-

UK stock trades do not use the RSP system

Suitability for Different Traders

-

Beginners benefit from free education, the demo account, no minimum deposit, and tax-efficient ISA investing.

-

Experienced traders gain access to tight spreads, advanced charting, performance analytics, and a wide range of CFDs and real instruments.

Banned Countries and Client Acceptance

XTB does not accept clients from the following countries:

India, Pakistan, Syria, Iraq, Iran, United States, Australia, Albania, American Samoa, Aruba, Bhutan, Barbados, Belarus, Belize, Belgium, Cayman Islands, Hong Kong, Israel, Jamaica, Japan, Kosovo, Mali, Mongolia, Montserrat, Myanmar, New Zealand, Nicaragua, Norfolk Island, Northern Mariana Islands, Russia, Somalia, South Korea, South Sudan, Sudan, Taiwan, Turkey, Venezuela, Bosnia and Herzegovina, Ethiopia, Uganda, Cuba, Yemen, Afghanistan, Laos, North Korea, Gibraltar, Guyana, Vanuatu, Mozambique, Republic of the Congo, Libya, Macao, Panama, Singapore, Bangladesh, Kenya, Palestine, and Zimbabwe.

Client acceptance depends on residency and the relevant XTB entity:

-

XTB Ltd (UK) – FCA regulated, accepts only UK residents

-

XTB Cyprus (EU) – CySEC regulated, accepts EU residents

-

XTB International – accepts non-EU/UK residents (availability varies by country)

-

XTB MENA Limited – accepts residents of the MENA region

-

XTB FR (France branch) – accepts Canadian residents only

Cost Comparison with UK Brokers

Compared with traditional UK brokers such as Hargreaves Lansdown, AJ Bell, Interactive Investor, and Vanguard, XTB’s ISA can save investors thousands of pounds over time.

For example, an investor contributing £500 per month into ETFs could save more than £2,000 in fees over 10 years versus some mainstream UK platforms. With no account fees, no dealing charges, and interest paid on cash, XTB is one of the cheapest ISA options currently available.

✅Learn more about XTB Investing and Trading Broker