Looking at one part of my investing performance, dividend income, last year was my best year ever when considering year-over-year growth, in spite of the fact that the value of my DG stocks declined by 3.7% thanks to the correction that popped up in the 4th quarter.

Cumulative dividends paid in 2018 were 19% higher than in 2017, which in turn was 11% more than 2016. The total income in 2016 was 8% higher than in 2015. The long-term compounded average annual dividend growth for my DG portfolio is now firmly in double-digits at 11.8%.

While the results might seem a bit surprising to some, the strategy I employ, which I call "Optimal Dividend Growth", predicts an acceleration of growth over the long run. I based my strategy on what I learned from reading the two versions of the "The Single Best Investment" [SBI], a free ebook by Lowell Miller.

A ODG strategy begins to pay off after a period of 15-20 years. You'll have success after 5-8 years but the performance really takes off later on.

The ODG strategy uses a three-part system: buying and holding high quality DG stocks that have a long record of annual dividend increases, reinvesting dividends, and adding new capital.

High quality DG stocks

My method of choosing high quality DG stocks is defined in the post "Creating The Optimal Dividend Growth Portfolio" which was first published on my personal blog "The Mathematical Investor" several years ago. Note that the numbers might be slightly different today, which in turn could influence the stocks picked. However, the important concepts remain the same.

If I was starting a ODG portfolio today some of the stocks I'd consider include Cracker Barrel Old Country Stores, Inc. (CBRL), National Health Investors, Inc. (NHI), and WEC Energy Group, Inc. (WEC). I currently hold NHI and WEC in my portfolio.

Reinvesting dividends

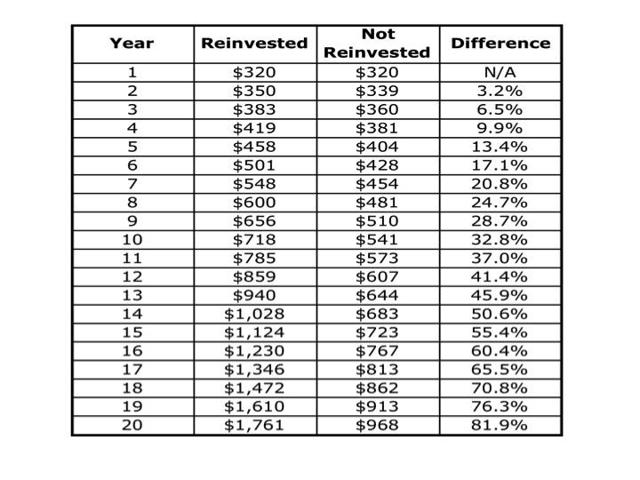

The second leg of the ODG strategy, reinvesting dividends, can make a big difference in the income growth down the road as the following example illustrates.

Compare the income generated by a $10,000 investment (no additional capital added), initially yielding 3.2%, with organic increases of 6% each year with and without dividend reinvestment (assumed to be compounded annually) over a 20 year period.

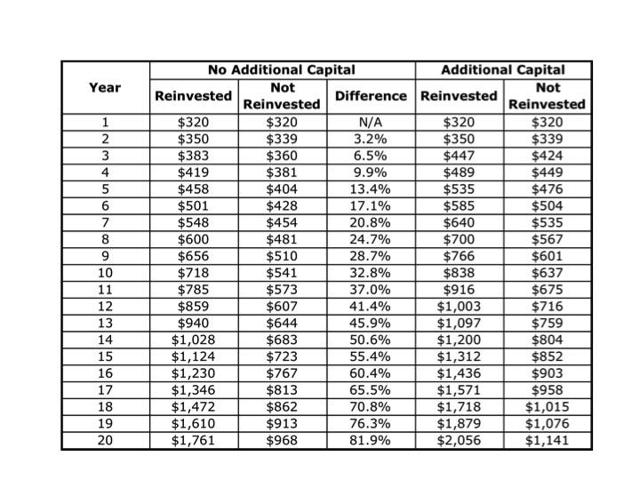

Adding new capitalIncome can also be juiced significantly by adding capital to an investment. Using the example above even a one-time addition of say $2,000 in year 3 makes a big difference (17% higher income each year) in later years. Putting it all togetherCombining the three legs of the ODG system (capital additional plus annual dividend reinvestment plus annual organic increases) will result in 27% year-over-year income growth in year 3 for the example above. Even if no new capital is added then the y-o-y growth will be 9.4% each year. ConclusionSo while my portfolio declined in value by a whopping 3.7% my dividend income grew by 19% based upon the combined effects of the three legs (picking high quality stocks, dividend reinvestment, and addition of new capital) of the Optimal Dividend Growth system that I use. |

Congrats.

Thank you.