Losses hurt. This is true emotionally, financially and mathematically. And some homeowners are learning a painful math lesson even as real estate recovers.

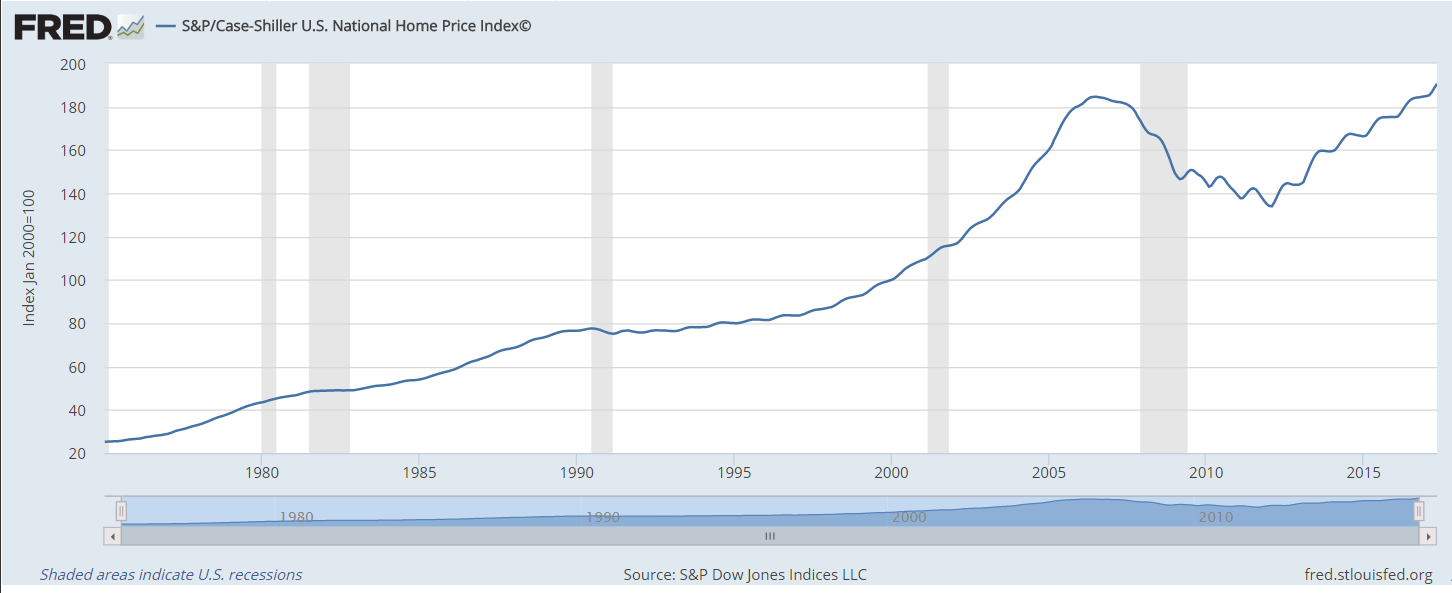

However, there is good news for many homeowners. Home prices, measured with the S&P/Case Shiller U.S. National Home Price Index, are at new all-time highs.

(Source: Federal Reserve)

After peaking in 2006, the bear market in home prices lasted six years. From top to bottom, the index lost 28%. After a 39% recovery, prices set new all-time highs this year, 11 years after their previous peak.

You probably noticed the difference in size between the loss and recovery in percentage terms. The math explains why losses hurt so much — it always takes a larger percentage gain to recover from a loss. A 20% loss, for example, requires a 25% gain to get back to breakeven.

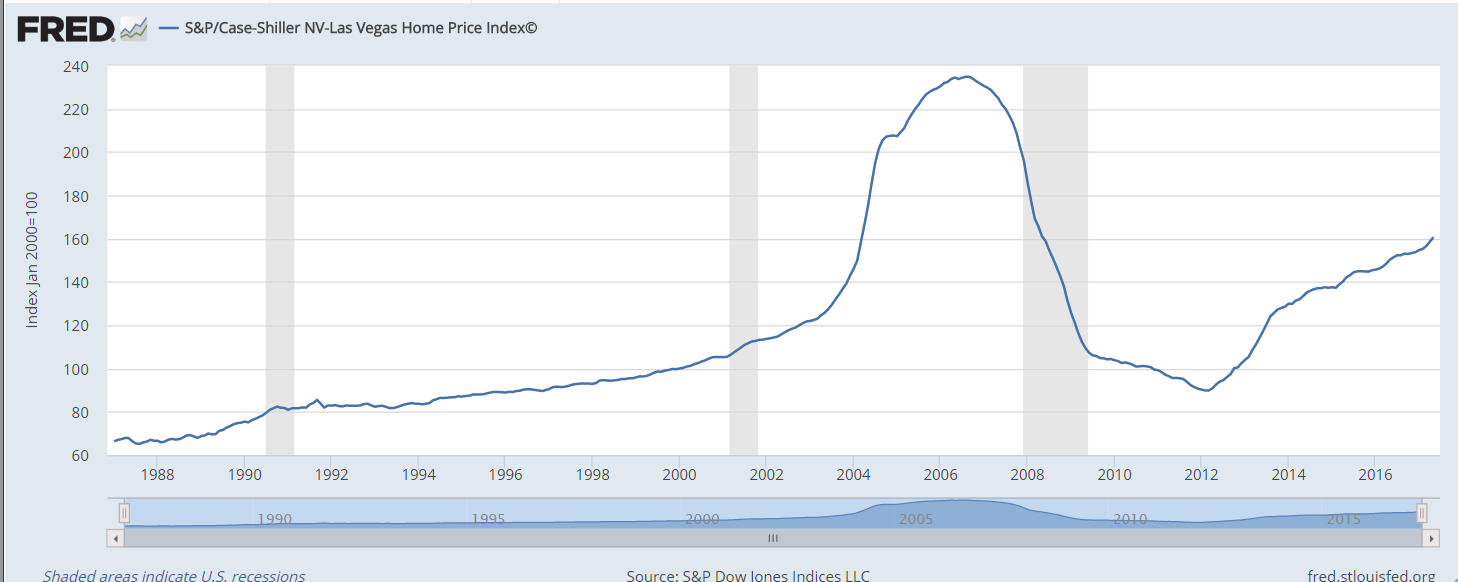

This mathematical reality explains why home prices in Las Vegas are still 32% below their all-time high, even after a 79% gain.

(Source: Federal Reserve)

The S&P/Case-Shiller NV-Las Vegas Home Price Index fell 62% from its 2006 peak. At the low, homeowners who bought the top needed a 162% gain to get back to breakeven. They are moving closer to breakeven, but many are still years away from the home prices of 2006.

This math is true for all markets. Losses also hurt stock market investors. When the next bear market comes — and there will be another bear market one day — investors need to take steps to protect their portfolio.

On average, the stock market declines about 32% in a bear market, according to CNBC. Prices then need to gain about 47% to get back to their old highs. For many investors, being forced to wait for a 47% gain could mean delaying retirement.

Losses like that are why index funds may prove to be dangerous when prices fall again. Selective trading is really the only way to avoid losses in a bear market.

Regards,

Michael Carr, CMT

Editor, Peak Velocity Trader