For more than three decades, The Motley Fool has stood out as a trusted source of financial guidance for investors worldwide. With a mission to make the world "smarter, happier, and richer," this Virginia-based company blends time-tested investing principles with modern tools, expert research, and a community-oriented philosophy. But is it worth your time and money? In this review, we take a deep dive into the offerings, features, performance, and ethos behind The Motley Fool.

A Legacy of Empowering Investors

Founded in 1993 by brothers Tom and David Gardner, The Motley Fool began as a backyard newsletter and evolved into a globally respected financial advisory firm. The name itself, borrowed from Shakespeare’s “As You Like It,” reflects a spirit of truth-telling, wit, and challenging conventional wisdom — qualities that still define the company today.

Core Philosophy: Simple, Long-Term Investing

The Motley Fool’s six investing tenets are deceptively simple:

-

Buy 25+ companies over time

-

Hold stocks for 5+ years

-

Add new savings regularly

-

Hold through market volatility

-

Let winners run

-

Focus on long-term returns

These principles are embedded across all Fool services, encouraging disciplined, goal-oriented investing.

Key Premium Services Reviewed

The Motley Fool offers tiered premium services designed to meet different investing needs and portfolio sizes. Here's a breakdown of their main offerings:

Stock Advisor

-

Target Portfolio: $25,000+

-

Price: $99/year (intro offer), regular $199/year

-

What You Get:

-

2 new stock recommendations per month

-

Top 10 stocks to buy now

-

Access to Fool IQ partial data tools

-

GamePlan financial hub

-

Three portfolio styles: Cautious, Moderate, Aggressive

-

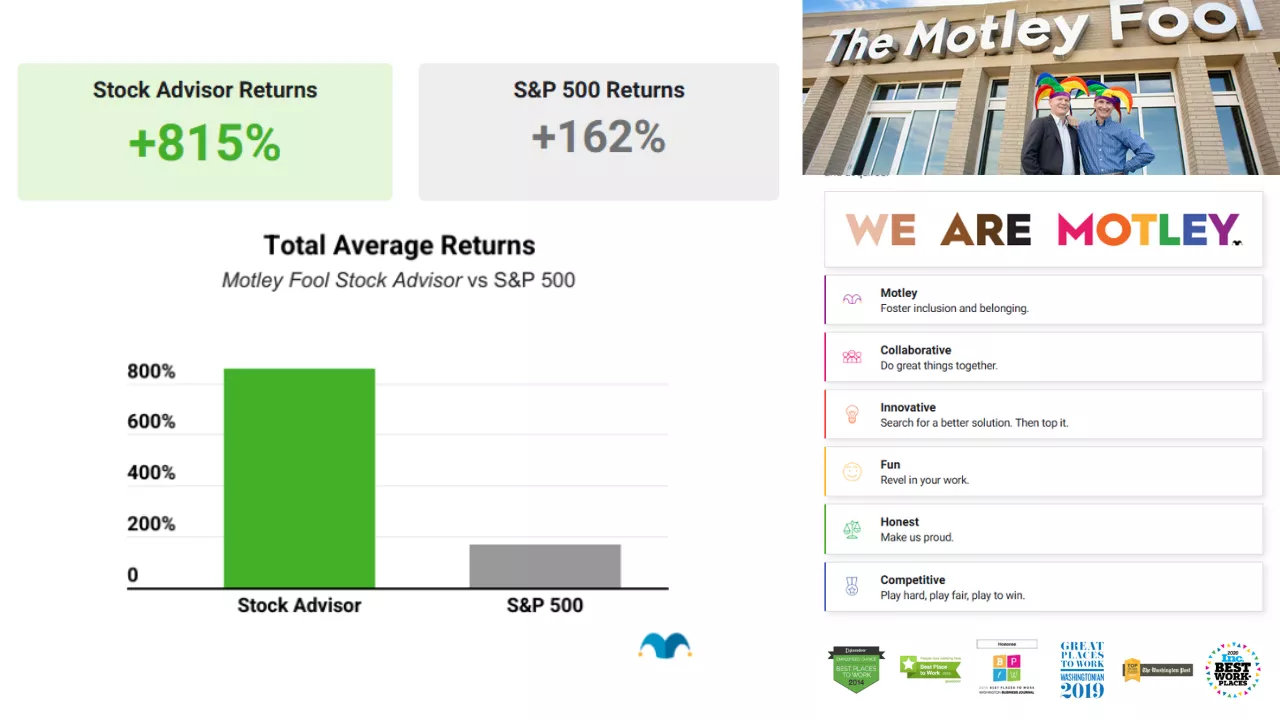

Performance: Since launching in 2002, Stock Advisor has delivered an average return of +845%, far outpacing the S&P 500’s +165% over the same period (as of March 27, 2025).

Motley Fool Epic

-

Target Portfolio: $50,000+

-

Price: $299/year (intro offer), regular $499/year

-

What You Get:

-

5 stock picks per month

-

Everything in Stock Advisor

-

Full Fool IQ access

-

Quant 5Y projections

-

Podcast, expanded articles

-

Strategies for Cautious, Moderate, Aggressive investors

-

Focus: Growth, dividend, and under-the-radar stock picks with deeper analytics.

Epic Plus

-

Target Portfolio: $100,000+

-

Price: $1399/year (intro offer), regular $1999/year

-

What You Get:

-

8+ monthly stock recommendations

-

All features in Epic

-

Access to Tom Gardner’s AI Playbook

-

Options trading strategies

-

Specialized scorecards (Trends, Value, International)

-

Best for: Investors seeking global diversification, AI insights, and actionable options trading guidance.

Fool Portfolios

-

Target Portfolio: $250,000+

-

Price: $3499/year (intro offer), regular $3999/year

-

What You Get:

-

10+ monthly stock picks

-

Tom Gardner’s real-money portfolios

-

Crypto and microcap research

-

Access to proprietary tools: Fool IQ+, Moneyball, Quant projections

-

Ideal for: Experienced investors looking for premium research and access to real-money portfolios.

Motley Fool One

-

Target Portfolio: $500,000+

-

Price: $13,999/year

-

What You Get:

-

30+ monthly stock recommendations

-

Access to all Motley Fool services

-

Daily stock picks via the Moneyball Portfolio

-

Exclusive member events

-

Early access to new tools

-

Value Proposition: An all-in-one membership for serious investors who want the most comprehensive view of Motley Fool’s research and tools.

One-Off Reports

Motley Fool also offers one-time stock reports for $100, giving non-members access to selected recommendations and analyses.

Features That Set The Motley Fool Apart

Proven Performance

Few advisory services can claim the consistent long-term outperformance Motley Fool has delivered, particularly through its flagship Stock Advisor service.

Educational Value

Whether it’s podcasts, livestreams (like Fool24), or in-depth written guides, members gain not just stock picks, but the why behind them.

Tools & Data

From Fool IQ to Quant 5Y to the GamePlan hub, Motley Fool offers deep research tools, stock rankings, and model portfolios to help investors stay on track.

Integrity and Transparency

Motley Fool Money, their personal finance arm, follows strict editorial independence. Recommendations are unbiased and often based on firsthand experience with financial products.

Ideal Users

Motley Fool is best suited for long-term, buy-and-hold investors who:

-

Want curated, high-quality stock recommendations

-

Prefer education-backed investing over speculation

-

Are building or managing portfolios ranging from $25,000 to $500,000+

-

Value financial planning tools alongside stock picks

Areas for Consideration

-

Price: Higher-tier services like Epic Plus, Fool Portfolios, and Fool One carry premium price tags, justifiable only for investors with sizable portfolios.

-

Focus: The strategy is unapologetically long-term and may not suit traders or those looking for quick wins.

-

U.S.-centric: While international stock research is growing, most of the guidance is U.S. market-focused.

Roundup

The Motley Fool has earned its reputation through decades of trustworthy guidance, impressive returns, and a commitment to empowering individual investors. With options to suit both beginner and advanced investors, it offers a structured, research-driven path toward financial independence.

If you believe in long-term wealth building and want expert-backed insights to support your investing journey, The Motley Fool deserves a place on your shortlist.

Learn more on my website at: