Director, Profile Investment Services, Ltd.

Contributor's Links:

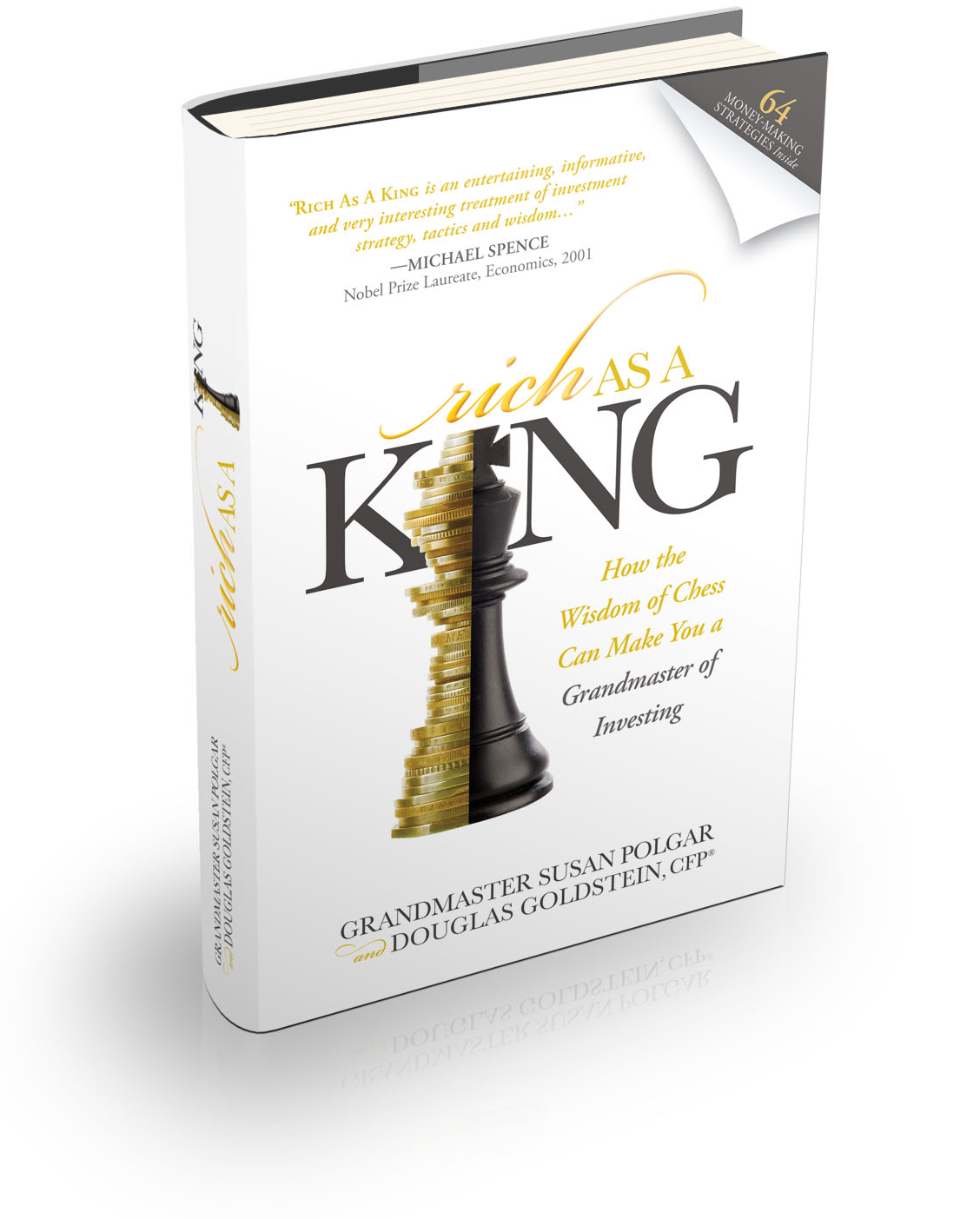

Profile Perspectives Rich As A King

Doug began his career on Wall Street in 1992 at Dean Witter. After developing a successful practice in New York, Doug moved with his wife and family to Israel. Doug is accredited by the Israel Securities Authority (ISA) as a licensed Israeli advisor and is also a licensed U.S. advisor. He holds ...more

Doug began his career on Wall Street in 1992 at Dean Witter. After developing a successful practice in New York, Doug moved with his wife and family to Israel. Doug is accredited by the Israel Securities Authority (ISA) as a licensed Israeli advisor and is also a licensed U.S. advisor. He holds the designations of Certified Financial Planner™, Registered Investment Advisor, and Trust and Estate Practitioner. He is a member of both the Financial Planning Association and of the Society of Trust and Estate Practitioners. Doug is frequently invited to give lectures as well as teach college courses on investing. He is often invited to comment on financial affairs on radio and TV and in local and international newspapers. He also serves as a trainer and consultant to banks in Israel. Doug’s advice appears weekly in The Jerusalem Post, and he hosts a weekly radio show, Goldstein on Gelt, about business and investing. He is the author of the book Building Wealth in Israel: A Guide to International Investments and Financial Planning, and newly published Building Wealth: Investing in Stocks.less