Key Points

--Because of lower corporate tax rates and other factors, dividend payouts are up.

--Dividend payouts are great; dividend payouts with regular increases in those payouts are even better.

--Moving more of a portfolio into dividend-paying stocks can reduce volatility and increase the chances of a plan succeeding.

For the first time in at least 15 years, no S&P 500 company cut its dividend in the first quarter.

A lot of this has to do with lower corporate tax rates, which now top out at 21% instead of 35%. Companies appear to be passing along a lot of the earnings bump to investors. We were already on a roll as far as that goes, though: 2018 looks like it will be the seventh straight year of record dividend payments.

Overall, the companies in the index have increased their dividends by 5.5% year over year. What does this tell us?

Growth Is Health

We have talked about the importance of building a portfolio of companies with growing dividends. Dividends obviously matter to investors--especially retirees--because of the income they provide. But dividends that consistently grow over time can be a sign of a company that is confident in its cash flows. You can find companies that have paid increasing dividends every year for 40 years or more, through good economic times and bad.

Total Returns = Dividends + Capital Appreciation

Let's take a step back and look at the big picture.

A paper a few years ago (pdf) from Guinness Atkinson Asset Management broke down, by decade, what percentage of the S&P's total return came from dividends. The average dividend portion of total returns by decade, going back to 1940, is more than 50%. As the paper states, in stretches of low growth like the 1940s and 1970s, dividends accounted for more than 75% of total returns.

There's a great line in the paper--maybe it's an old saying, but it's one that we've never heard before: "Profits are a matter of opinion, dividends are a matter of fact." This refers to how earnings can be manipulated via accounting, but cash in your pocket (or reinvested, or however you handle your dividends) is real.

In any case, the table above demonstrates how dividend payers can be ballast during market turbulence. They can also help increase your chances of a successful retirement--which is to say a retirement where you never run out of money.

The Dividend Difference

Putting the WealthTrace planning software to work, we took a look at a hypothetical case of a couple in their early 60s who hope to retire soon. They have around $900,000 in invested assets, and estimate their spending will be about $70,000 annually. They would prefer not to take Social Security until they are 67.

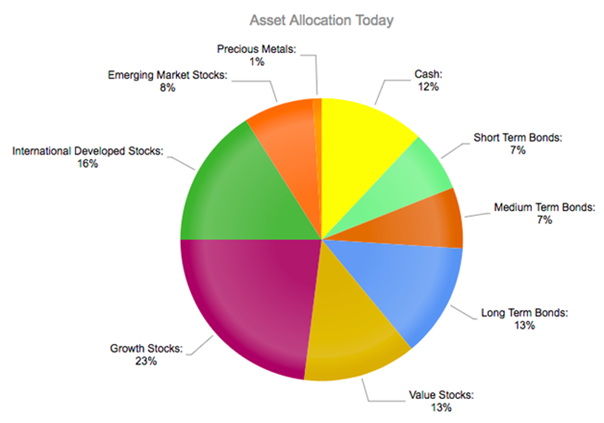

At present, their investment portfolio is pretty well diversified. But they know they'll have to change that as retirement approaches.

That bond allocation kept the volatility down over the years, and that's the way the couple liked it. But current bond yields aren't going to be enough to generate the income they'll need in retirement.

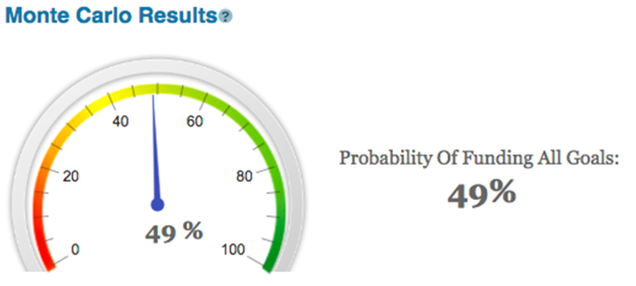

If we run the plan through our Monte Carlo simulation, which looks at 1,000 possible outcomes based on historical returns and asset class correlations, things don't look so great for them:

So what can they do? Weighting the portfolio toward dividend payers is one option--and the one that we usually prefer.

Have a look at this list. There are more than 100 companies who have paid increasing dividends, year in and year out, for 25 years or more. A few have done so for more than 60 years!

Now, granted, the past does not predict the future. Also, a lot of these companies, while boosting dividends consistently, only yield 1% or 2% at the moment, given the performance of the stock market.

But you could put together a portfolio of these stocks that can get you an average of 4% a year--and growing. And these are mostly household names, too. Coca-Cola. AT&T. Chevron. Clorox.

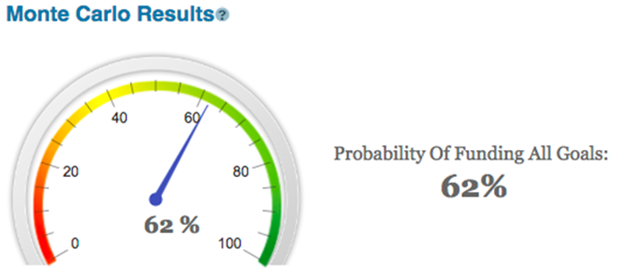

And what happens if we do that?

That's more like it. Dividend-paying stocks are far less volatile than most stocks, providing a reliable stream of income over time--and one greater than what a lot of bonds pay.

This Monte Carlo number is still too low--we want a probability that's more like 80% or higher. But the income is headed in the right direction. We might need to make a few other minor adjustments to make the plan work that don't have to do with income, such as reducing spending in some years, or pushing out their retirement a bit.

With dividends on the rise, it could be a great time to revisit your own portfolio's asset allocation, and to get your slice of this often-tax-advantaged source of income.