Why You Should Avoid Being Bearish Right Now

Stocks continue to defy the bears.

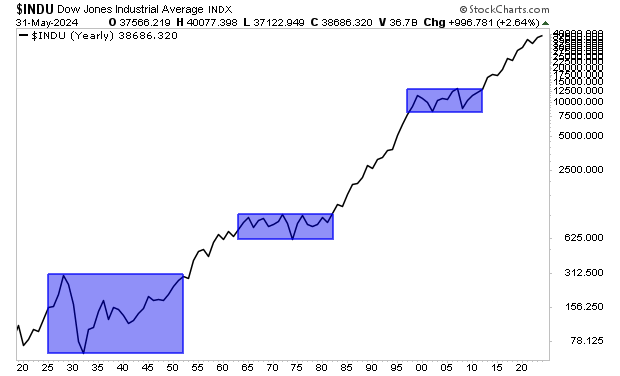

Being bearish is inherently problematic because historically stocks tend to go up… and quite a lot. Over the last 100 years, the Dow Jones Industrial Average has finished the year up 68% of the time. And as you can see in the chart below… they’ve gone up a LOT.

(Click on image to enlarge)

Investing is all about probabilities, and if there is a greater than two thirds odds that stocks will go up in any given year, betting on a collapse is generally going to be a losing bet.

Understand, I’m not suggesting you should be mindlessly optimistic about the markets. There are always risks. But from a big picture perspective, stocks tend to go up, and go up quite a lot.

This should be the foundation for your view of the markets.

So why not simply buy stocks any time you have any additional capital?

Because when stocks DON’T go up, they either:

1) Go nowhere for years, if not decades.

2) Can lose a LOT of money VERY quickly.

Regarding #1, take a look at the below chart of the Dow Jones Industrial Average since 1919. You’ll note that there were three periods in which stocks went nowhere for a considerable length of time.

They were:

1) 1923-1953 (30 years)

2) 1963-1982 (19 years)

3) 1993-2015 (22 years)

(Click on image to enlarge)

Anyone who loaded up on stocks automatically throughout these time periods didn’t make a cent for decades.

There are a lot of analysts who ignore these facts and tell their clients to simply buy stocks for the long-term at any time, but what are the odds that a real person, putting real money to work in the markets could sit through ~20 years of NO gains and not despair?

More By This Author:

The Fed Has Made A Crucial Mistake… What Does That Mean For Stocks?Immigration, Wages, And The Phillips Curve

Why Stocks Are Falling… And What Comes Next