Why Did The Crypto Market Crash?

Image Source: Unsplash

The crypto market experienced one of its worst days of 2025 on Friday after President Donald Trump announced a 100% tariff on all Chinese imports. The announcement came via Truth Social and immediately triggered a global risk-off wave across financial markets.

*TRUMP: US WILL IMPOSE 100% TARIFF ON CHINA STARTING NOV 1

— Geiger Capital (@Geiger_Capital) October 10, 2025

Welcome back to the trade war. pic.twitter.com/clooxnR8zc

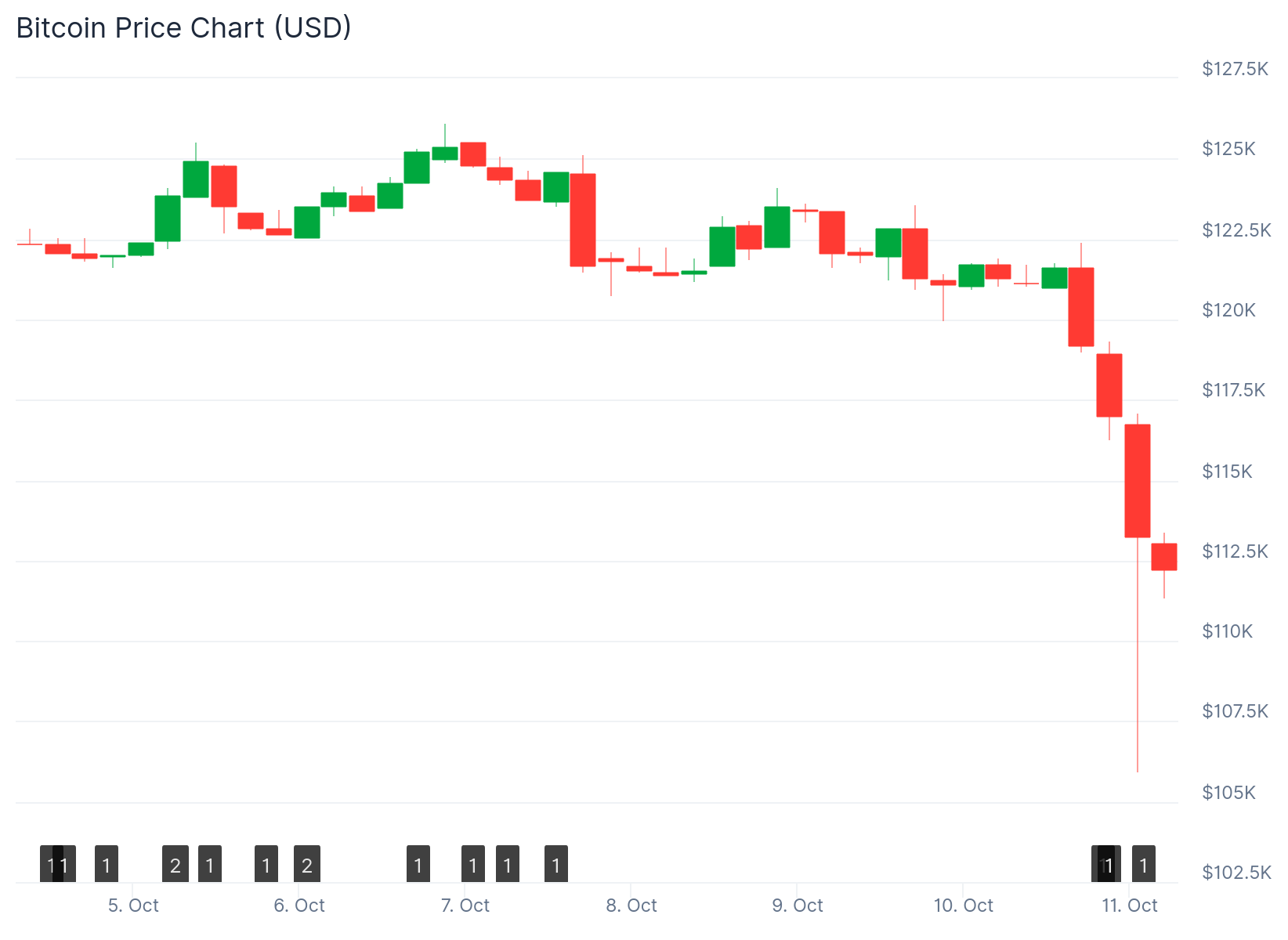

Bitcoin fell to $102,000 on Binance at its lowest point, marking a roughly 10% decline over 24 hours. Ethereum dropped over 16% during the worst of the sell-off. The total crypto market capitalization fell to $3.87 trillion, wiping out over $400 billion in value within hours.

(Click on image to enlarge)

Bitcoin (BTC) Price

The tariffs are set to begin November 1. Trump also announced new U.S. export controls on critical software in response to China’s recent rare earth mineral restrictions. This sudden escalation in trade tensions caught markets off guard.

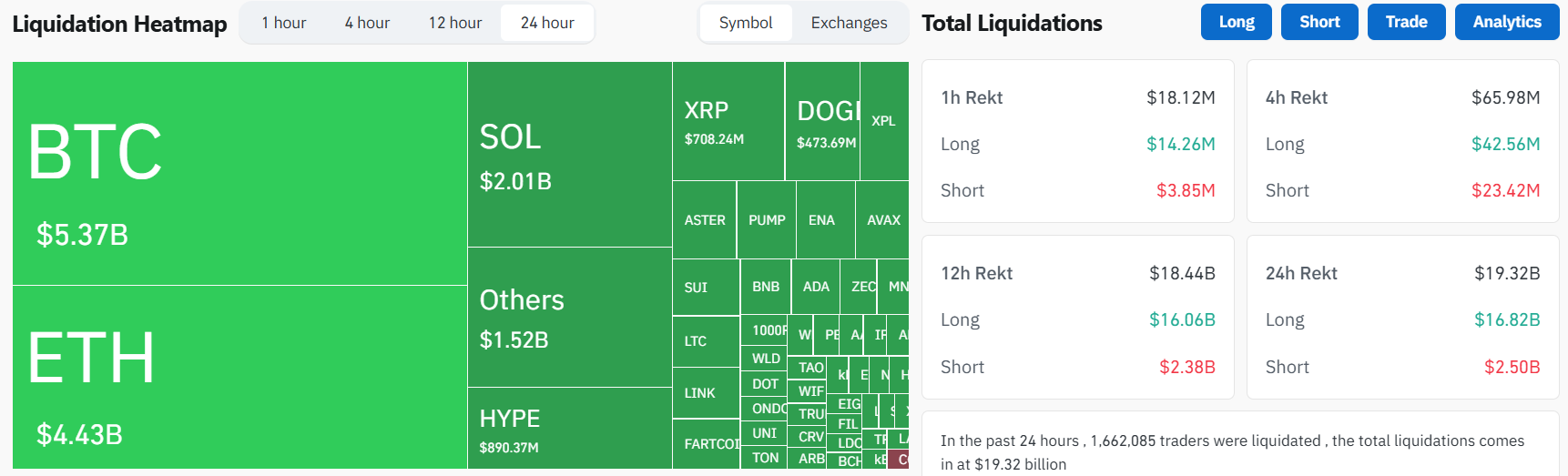

The sell-off triggered massive liquidations in the derivatives market. According to CoinGlass, over $19.1 billion in leveraged positions were liquidated within 24 hours. Roughly $16.7 billion of those liquidations came from long positions.

(Click on image to enlarge)

Source: Coinglass

More than 1.6 million traders were liquidated across exchanges. The largest single liquidation occurred on Hyperliquid, where an ETH-USDT position worth $203 million was closed. CoinGlass noted the actual total is likely higher because Binance, the world’s largest crypto exchange, does not report liquidations as quickly as other platforms.

Stablecoin Stress and Market Recovery

Ethena’s USDe stablecoin briefly lost its dollar peg during the chaos. The stablecoin traded as low as $0.9996, highlighting stress in the derivatives market. The Ethena team said minting and redemptions remained fully operational despite the volatility.

Ethena, the “synthetic dollar protocol” that is a fast growing darling of the yield hungry crypto crowd is having a spot of bother with a depeg.

— Novacula Occami (@OccamiCrypto) October 10, 2025

Because its yield is from ETH staking, “hedged” by shorting ETH perps (not a scalable model) it was always going to be tested by any… pic.twitter.com/YnPbP2EIsI

They pointed out that USDe became even more overcollateralized as unrealized gains from short positions were realized. The brief depeg added to trader anxiety during an already volatile period.

Altcoins saw heavy losses during the crash. Solana, XRP, Dogecoin, and Shiba Inu experienced drops between 15% and 40%. Many smaller altcoins saw losses of up to 80-90% at their worst points.

The S&P 500 posted its worst single-day loss since April. The crypto crash unfolded alongside broader market stress as investors pulled back from high-risk assets. Bitcoin ETF-driven highs in recent weeks likely magnified the sell-off as investors moved to safer positions.

Government Shutdown Adds Uncertainty

The ongoing U.S. government shutdown has delayed key economic data releases. This left markets without official indicators during the trade war escalation. The timing added to trader uncertainty about market conditions.

By midday Hong Kong time, Bitcoin had partially recovered to $113,294. Ethereum rebounded to $3,844. The CoinDesk 20 Index remained down 12.1% despite the partial recovery.

The largest liquidation event in crypto history.

— CoinGlass (@coinglass_com) October 10, 2025

In the past 24 hours, 1,618,240 traders were liquidated, with a total liquidation amount of $19.13 billion.

The actual total is likely much higher — #Binance only reports one liquidation order per second.… pic.twitter.com/tvMCILVgU0

In terms of dollar volume, Friday’s liquidation event was the worst in crypto history. It saw over 10 times as much value liquidated as the FTX collapse in 2022 or the COVID market meltdown. At a percentage level, the crash was less severe given how much the crypto market has grown since 2022.

Bitcoin holding above $110,000 is seen as a key level to watch. Analysts say the long-term setup remains positive with global liquidity expanding and Bitcoin ETF inflows still rising. Weekend liquidity remains thin as traders watch for fresh headlines on U.S.-China trade relations.

More By This Author:

Ethereum Price: ETH Plunges 20% To $3,500 As Tariff Concerns Shake Markets

XRP Price: Token Plunges 42% While Whales Unload $50 Million Per Day

Exxon Mobil Corp. Stock: Enters LNG Marine Bunkering Market With Two New Vessels To Cut Emissions