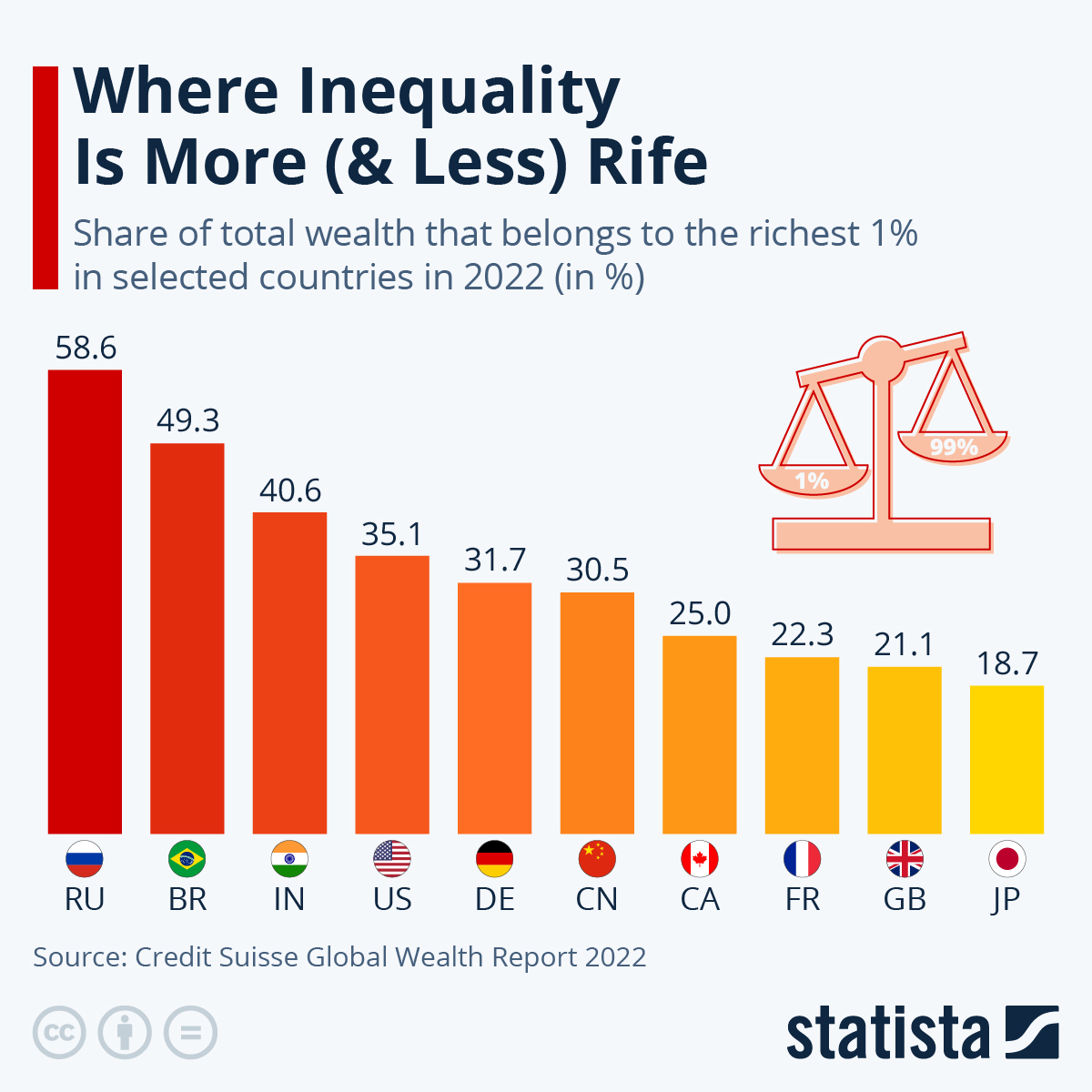

Where Inequality Is More & Less Rife

Image Source: Pixabay

The Global Wealth Report 2024 was on Friday today by the Swiss bank UBS, highlighting where wealth inequalities have grown the furthest.

As Staista's Anna Fleck shows in the chart below, South Africa comes top of the list, scoring 82 out of 100 on the inequality index, where 0 indicates total equality and 100 indicates absolute inequality. This is a jump of 17.7 percent since 2008.

You will find more infographics at Statista

Other countries with particularly high scores were Brazil (81), the United Arab Emirates (77), Saudi Arabia (77) and Sweden (77).

Even Japan, which at 54 scored the lowest figure of the markets analyzed, is still far from equal.

The gap on inequality has closed slightly in North America since 2008, with the United States recording a decrease of 2.4 percent in that time frame.

Inequality has widened in Latin America and much of Eastern Europe and Asia though.

This is shown on the chart, with Brazil seeing a wealth increase in inequality of 16.8 percent and Mexico a rise of 6.5 percent, as India saw an increase of 16.2 percent, Singapore of 22.9 percent, Indonesia of 15.1 percent, China of 7.4 percent and Japan of 9.4 percent. South Korea and Hong Kong buck the regional trend, with decreases of 8.1 percent and 5.9 percent, respectively.

According to UBS, while inequality is increasing in fast-growing markets, the opposite is true in a number of mature economies, where middle wealth segments are outpacing the pace of growth of higher wealth brackets.

While the Gini index is a useful tool for comparing inequality across different markets, it is important to take the measure of absolute wealth into consideration too.

More By This Author:

What Snapped? US Ground Beef Retail Prices Jump Most Since Covid Meatpacking Crisis

U.S. Banks Suffer Biggest Deposit Drop SInce 'Tax Day' As Money-Market Fund Assets Surge To Record High

JPM Reports Record Quarterly Income After Surge In One-Time Items, Unexpectedly Boosts Loan Loss Reserves

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more