U.S. Banks Suffer Biggest Deposit Drop SInce 'Tax Day' As Money-Market Fund Assets Surge To Record High

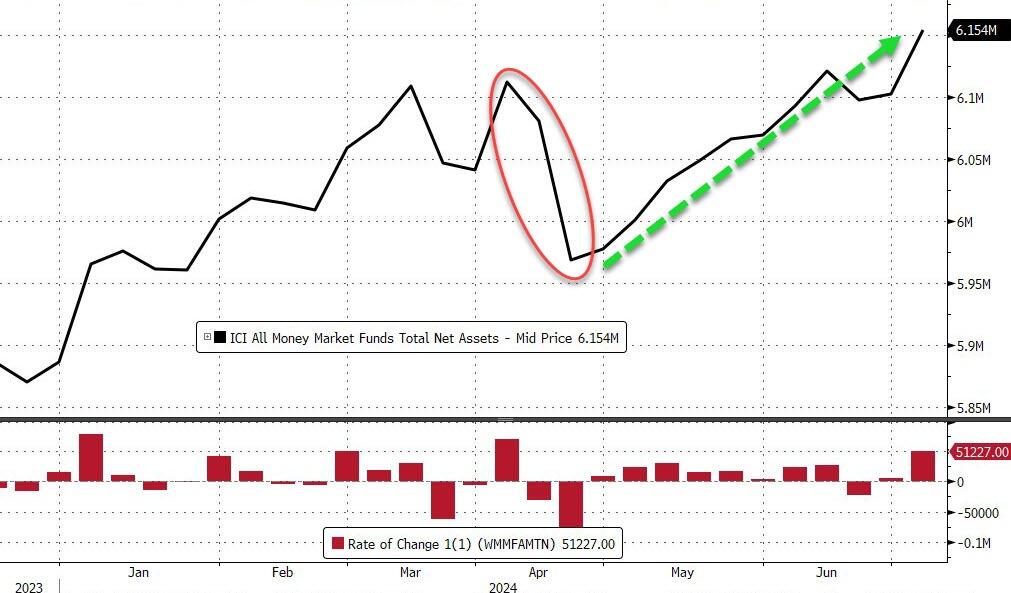

For the 10th week in the last 12 (basically since taxes), money-market funds saw inflows, and last week was bigly with $51BN added pushing the total AUM to a new record high $6.15TN...

Source: Bloomberg

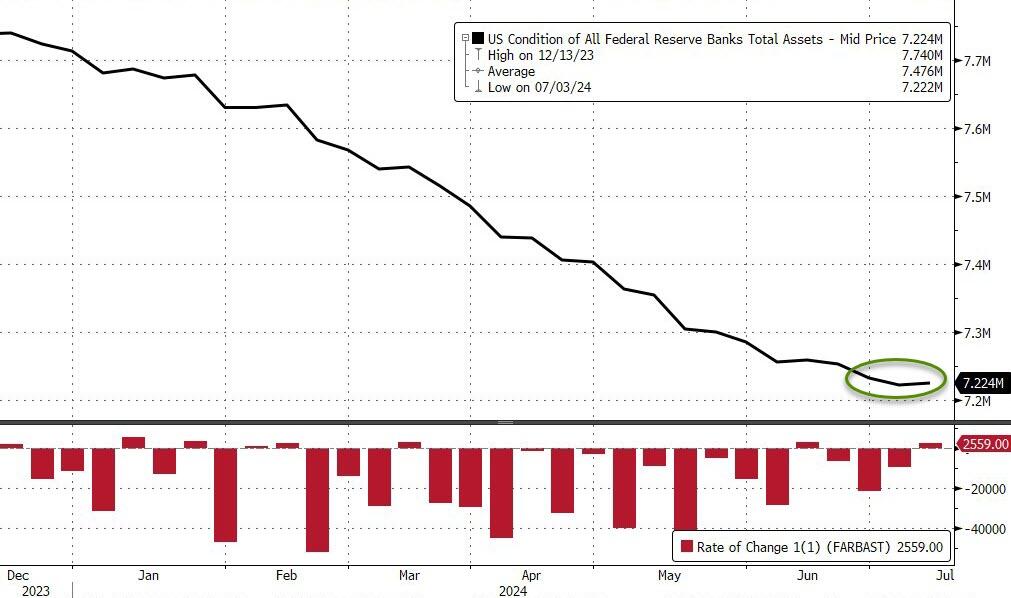

The Fed balance sheet rose by $2.5BN last week...

Source: Bloomberg

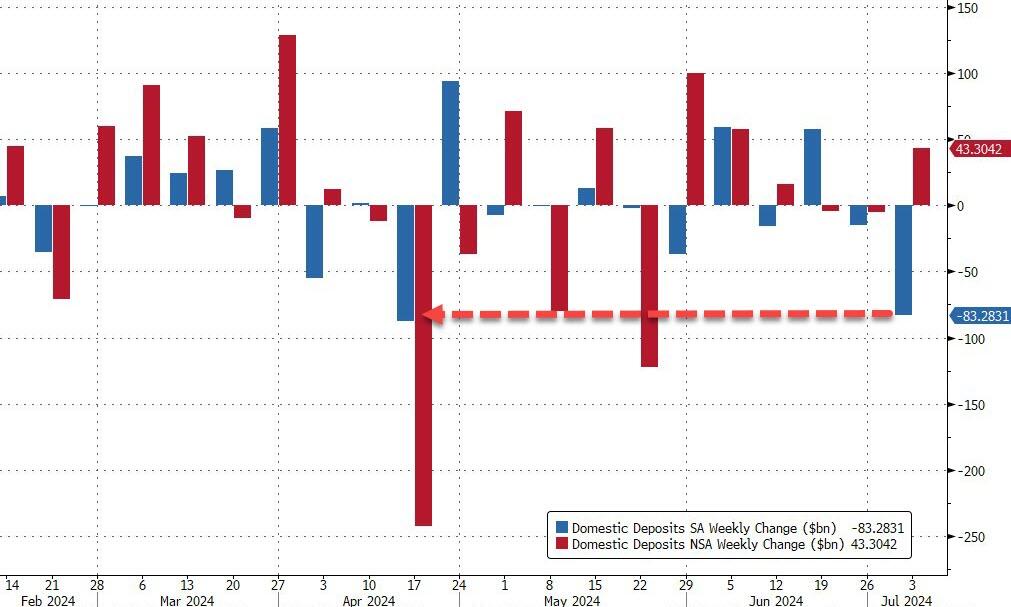

But as the Fed balance sheet rose, banks saw large deposit outflows last week, -$67BN on an SA basis...

Source: Bloomberg

BUT on an NSA basis, deposits rose by $42BN....?

Source: Bloomberg

Excluding foreign deposits, domestic banks saw $83BN in deposit outflows on a seasonally adjusted basis - the biggest since April's Tax Day decline. The drop was dominated by large banks losing $72BN (small banks saw an $11BN decline). On an NSA basis, domestic banks saw $43BN inflows (large banks +$30BN, small banks +13BN)...

Source: Bloomberg

Did the genii at The Fed just make the 'adjustment' clean up?

Source: Bloomberg

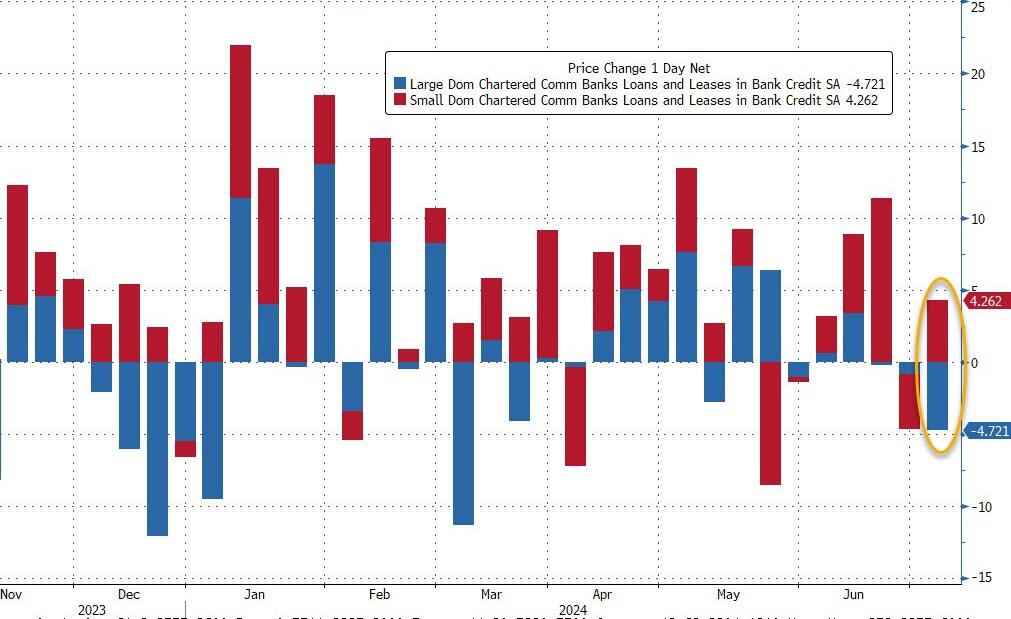

On the other side of the ledger, there was an overall shrinkage in loan volumes with large banks seeing volumes drop $4.7BN while small bank loans rose $4.3BN...

Source: Bloomberg

Bank reserves at The Fed rose last week but the chasm between US equity market cap and those reserves remains near record highs...

Source: Bloomberg

And that liquidity gap is evident on a global scale...

Source: Bloomberg

Are stocks pricing in a massive central bank balance sheet expansion?

More By This Author:

JPM Reports Record Quarterly Income After Surge In One-Time Items, Unexpectedly Boosts Loan Loss Reserves

Nasdaq Pukes To Worst Day Versus Small Caps In 22 Years, Gold Soars Near Record High After Soft CPI

Futures Dip Ahead Of "Very Good" CPI

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more