Futures Dip Ahead Of "Very Good" CPI

After the S&P closed up the first 7 trading days of July, US equity futures are down small following yesterday’s last hour meltup rally and into today’s CPI. As of 7:45am ET, S&P futures down 0.1% after the underlying index gained more than 1% to fresh all-time highs, with Nasdaq futures lagging the same as Mag7 names are mixed pre-market with AMZN/NVDA higher even as Goldman publishes another note warning that at some point the hyperscalers will have to "show investors the money" for all their AI capex investments. Bond yields are flat to down 1bps pushing the USD lower for a second day. In commodities, all 3 complexes are seeing strength. CPI and Fedspeak will dominate today’s headlines but also keep an eye on jobless claims as another Powell input.

In premarket trading, Pfizer rose more than 3% after moving forward with a new wieght-loss pill. Costco climbed after hiking its membership fee for the first time since 2017; the news helped move other staples such as WMT higher. Here are other notable premarket movers:

- Albemarle drops 1.7% after Wells Fargo downgrades the stock to equal-weight in a second-quarter preview for the chemicals sector.

- Airline stocks drop in premarket after Delta Air Lines issued a forecast for third-quarter adjusted earnings per share that missed consensus expectations.

- Alcoa shares rise 2.7% after the aluminum producer’s preliminary adjusted Ebitda for the second quarter came in ahead of estimates.

- Costco shares rise 3.0% after the warehouse-club chain announced plans to boost annual membership fees for the first time since 2017, which Jefferies said would be a positive catalyst for the stock. Additionally, the company’s US comparable sales, excluding fuel and currencies, surpassed consensus estimates.

- PepsiCo shares fall 2.3% after the snack and soft-drink giant reported weaker-than-expected revenue for the second quarter and tempered its full-year outlook. The company reiterated its annual profit forecast.

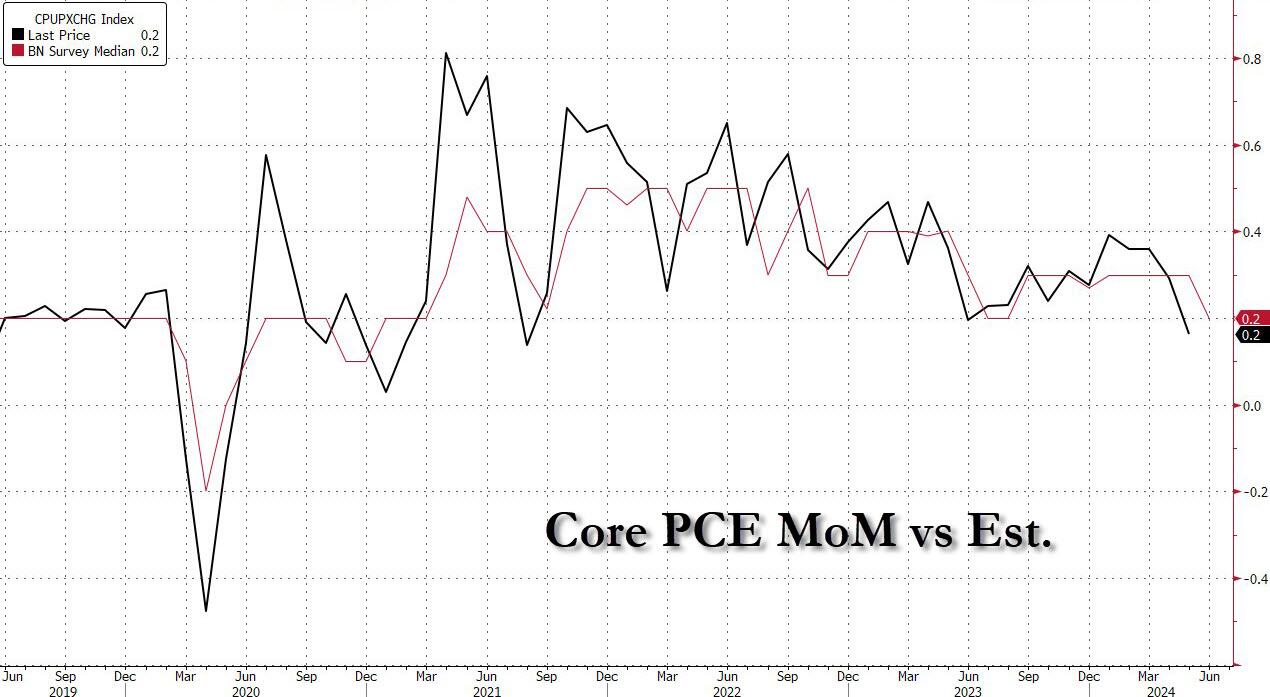

The core CPI reading Thursday is expected to rise 0.2% in June for a second month. That would mark the smallest back-to-back gains since August — a pace seen as palatable for Fed officials. Our full preview can be found here.

Swaps are pricing in two Fed cuts in 2024, with a strong chance of the first coming in September. Traders are also eyeing reports from JPMorgan Chase & Co., Wells Fargo & Co. and Citigroup Inc. tomorrow to cap off the week.

“June’s CPI report looks to be another ‘very good’ report that should boost the FOMC’s confidence about the inflation trajectory,” said Anna Wong at Bloomberg Economics. “That should set the stage for the Fed to start cutting rates in September.”

Meanwhile, Goldman strategists doubled down on their warning about the AI bubble, saying that investors are growing increasingly concerned that US technology megacaps are spending too much on artificial intelligence. Valuations could be due for a painful de-rating unless revenue and earnings rise to justify the capex spending, they said.

Investors broadly expect the frenzy to remain a key feature of a rally in the second half, although some are betting on sectors such infrastructure providers and utilities to lead gains for the remainder of 2024, the Goldman strategists said. One measure, though, signals that the rally may be losing momentum: market breadth has contracted in recent months, with the share of S&P 500 members trading above their 200-day moving average hovering around its lowest in 2024.

Europe’s Stoxx 600 advanced 0.3%, with consumer products, construction and utilities leading gains. DNB Bank ASA surged the most since Nov. 2020 after the Norwegian lender reported earnings that beat analysts’ estimates. Swiss chocolate maker Barry Callebaut AG dropped more than 10% after disappointing results affected by high cocoa-bean prices. Here are the biggest European movers:

- DNB jumps as much as 6.4%, the most since November 2020, after the Norwegian lender reported an “impressive” 2Q print, Citi writes, with strong beats to net interest income (NII) and fees

- Bayer shares rise as much as 2.9% after securing US FDA fast track designation for AB-1005, which is being developed for moderate Parkinson’s disease

- Ambu rises as much as 6.8%, the most since May 15, after the Danish medical device firm predicted full-year revenue gains and said preliminary 3Q results indicated a jump on revenue

- Husqvarna gains as much as 6.9% as Nordea upgrades its rating on the Swedish outdoor and garden equipment maker to buy based on expectations for improved earnings momentum

- Vivendi gains as much as 3.4%, to the highest price in over two years, as JPMorgan places the French conglomerate on positive catalyst watch and highlights it as a top pick

- UK water stocks are trading higher this morning after regulator Ofwat outlined draft determinations regarding the industry’s investment plans

- Barry Callebaut slumps as much as 11% after the Swiss chocolate producer reported 9-month sales that Vontobel says show “significant exogenous, unprecedented market headwinds”

- Galp declines as much as 4.9% and is the weakest performer on the Stoxx 600 energy index on Thursday as Morgan Stanley downgrades to underweight due to a “rich” valuation

- Suedzucker falls as much as 5.1%, to the lowest level since April, after the German sugar producer reported operating profit for the first quarter that missed estimates

- Evotec shares fall as much as 6.6% after the German pharmaceutical company was downgraded to hold by Deutsche Bank, which expects soft second-quarter results and sees guidance at risk

- DocMorris drops as much as 19%, most since October, after the Swiss pharmacy’s sales came below expectations and its ramp up dynamics of electronic prescriptions could be stronger, ZKB says

Earlier, Asian stocks rose, as Taiwan Semiconductor traded at record levels after the sole supplier of the most-advanced chips for Nvidia and Apple said second-quarter sales grew the fastest since 2022. Sony, Tencent Holdings and Korean chipmaker SK Hynix which traded at its highest levels since 2000, were among top contributors to the climb in the regional stock index. The iPhone maker said it aims to ship 10% more new devices after a bumpy 2023. The S&P 500 has advanced in each of the past seven sessions, its longest winning streak since November. MSCI Inc.’s global stocks index is at a record high.

In FX, the Bloomberg Dollar Spot Index fell for a second day to a one-month low. The British pound rose to its strongest level against the dollar since March after data showed the UK economy expanded in May at twice the pace expected. Gross domestic product rose 0.4% month-on-month after the flat reading in April. That compares with the 0.2% pace economists had expected, reflecting the fastest expansion in construction in almost a year. Cable is up 0.2% and set to log its ninth gain in eleven sessions.

In rates, treasuries were steady with price action muted ahead of June CPI data at 8:30am New York time. European bonds lag, led by gilts after UK GDP rose 0.4% in May, double the median estimate. Yields are mixed across the curve but within 1bp of Wednesday’s closing levels. 10-year is around 4.28% with bunds and gilts lagging by 2bp and 3bp in the sector. Along with CPI, US session includes 30-year bond auction at 1pm, following good results earlier this week for 3- and 10-year offerings.

In commodities, oil climbed for a second day with WTI trading near $82.20 a barrel as a decline in US crude inventories countered the IEA’s call that demand growth is slowing. Gold edged higher for a third day, adding $12 to around $2,383/oz.

Looking at the calendar, US economic data slate includes the CPI report and initial jobless claims (8:30am) and monthly budget statement (2pm). Fed members scheduled to speak include Bostic (11:15am) and Musalem (1pm)

Market Snapshot

- S&P 500 futures little changed at 5,684.75

- STOXX Europe 600 up 0.5% to 519.14

- MXAP up 1.1% to 187.17

- MXAPJ up 1.3% to 585.57

- Nikkei up 0.9% to 42,224.02

- Topix up 0.7% to 2,929.17

- Hang Seng Index up 2.1% to 17,832.33

- Shanghai Composite up 1.1% to 2,970.39

- Sensex little changed at 79,916.84

- Australia S&P/ASX 200 up 0.9% to 7,889.64

- Kospi up 0.8% to 2,891.35

- German 10Y yield +1.5bps at 2.55%

- Euro up 0.1% to $1.0841

- Brent Futures up 0.4% to $85.46/bbl

- Gold spot up 0.4% to $2,380.86

- US Dollar Index down 0.12% to 104.92

Top Overnight News

- Democratic donors have warned that funding for the November election effort is “drying up” because of President Joe Biden’s refusal to step aside, threatening to undermine the party’s effort to defeat Donald Trump. FT

- The United States will start deploying long-range fire capabilities in Germany in 2026 in an effort to demonstrate its commitment to NATO and European defense, the United States and Germany said in a joint statement. RTRS

- China cracks down further on short selling, with higher margin requirements for the activity (while the country’s largest stock lending provider will suspend its business of lending securities to brokerages). BBG

- NATO dramatically ratcheted up its criticism of China’s support for Russia, calling Beijing a “decisive enabler” of Putin’s war, language that could open the door to sanctions against the Xi government. NYT

- Global oil demand growth slowed to its weakest in more than a year last quarter, with consumption rising by just 710,000 barrels a day as China slipped into a marginal contraction, the IEA said. Demand remains on track to grow by less than 1 million b/d this year and next. BBG

- The NBA has finalized an 11-year TV rights deal worth $76B with NBC, Amazon, and ESPN, although it’s not clear if TNT will retain a few games for itself. The Athletic

- Apple has avoided the threat of fines from European Union regulators by agreeing to open up its mobile wallet technology to other providers free of charge for a decade. BBG

- PEP reported solid EPS upside in FQ2 at 2.28 (vs. the Street 2.15), but organic revenue growth of 1.9% fell short by ~100bp (the Street was modeling +2.9%). RTRS

- Since the start of 2023, 97% of NVDA's return has been driven by greater earnings (vs. just 3% from valuation expansion). However, year to date, NVDA's NTM P/E ratio has increased from 25x to 42x (+70%), accounting for 56% of the 165% YTD price return: Goldman

- Fed's Cook (voter) said the baseline outlook is for a continued fall in inflation without a significant increase in unemployment and US data is consistent with a soft landing. Cook added they are very attentive to what is happening with the unemployment rate and would be responsive if the situation changes quickly.

- US Senate Majority Leader Schumer is privately signalling to donors he is open to a democratic presidential ticket that isn't led by President Biden, according to Axios.

A more detailed look at global markets courtesy of Newquawk

APAC stocks took impetus from Wall St where the major indices rallied as outperformance in tech spear-headed the S&P 500 and Nasdaq to fresh record highs once again following TSMC's record quarterly sales and as Apple aims to boost iPhone shipments. ASX 200 gained with all sectors in the green and notable strength in tech, real estate, and heavy industries. Nikkei 225 continued its record-setting streak and advanced above the 42,000 level for the first time. Hang Seng and Shanghai Comp. conformed to the broad constructive mood amid the rising tide across equities despite NATO's firm rhetoric on China which it called a decisive enabler of Russia’s war effort in Ukraine, while sentiment was also unfazed by reports that Germany is to cut Huawei from its mobile networks.

Top Asian News

- BoK kept its base rate unchanged at 3.50%, as expected, with the decision made unanimously. BoK said it will maintain a restrictive policy stance for a sufficient period of time and will examine the timing of a rate cut, while it dropped the phrase that 'upside risks to inflation forecasts have increased' in its policy statement and said inflation could be slower than forecast. BoK Governor Rhee said they need to assess how a rate cut would affect financial stability and that a cut could adversely affect financial stability. Furthermore, he commented "time to prepare pivot rate cuts" and that two board members said they could consider a rate cut within the next three months, although he added that market expectations for policy rate cuts are a little excessive.

- Fast Retailing (9983 JT) - 9M (JPY): Net Profit 312.84bln (+31.2% Y/Y), operating profit 410.8bln (+21.5%); Sees FY operating income at 475bln (prev. 450bln)

European bourses, Stoxx 600 (+0.4%) are entirely in the green, in a continuation of the strength seen on Wall St. in the prior session, which also helped to prop up sentiment in APAC trade. European sectors hold a strong positive bias; Consumer Products takes the spot, propped up by gains in the Luxury sector. Energy is found at the foot of the pile, though with marginal losses. US Equity Futures (ES -0.1%, NQ -0.1%, RTY U/C) are flat/lower, taking a breather from the significant gains seen in the prior session.

Top European News

- Goldman Sachs raises UK's 2024 GDP growth forecast to 1.2% (prev. 1.1%)

- UK PM Starmer said the special relationship with the US is so important and stronger than ever.

- India warned the UK not to impose a deadline on trade talks, while India's Commerce Minister said India and the UK are 'on board' on the major details, according to FT.

FX

- DXY is back onto a 104 handle with all eyes on US CPI which takes place in the context of last week's "dovish NFP" and "dovish" comments from Fed Chair Powell.

- EUR/USD has marginally built on yesterday's gains and incrementally surpassed Monday's 1.0845 peak. For today, fate for the EUR/USD pair will likely be dictated by events stateside.

- GBP is extending its run as the best performing G10 currency YTD. Strong GDP metrics have followed up recent hawkish rhetoric from Haskel, Pill and Mann. Cable as high as 1.2876 with the next target coming via the March 8th YTD peak at 1.2893.

- JPY clawed back some ground vs. the USD after climbing as high as 161.75 overnight and backing away from the multi-decade 161.95 high seen on the 3rd July.

- Antipodeans are both near the top of the G10 leaderboard, benefiting from the constructive risk tone. NZD/USD is attempting to atone for Wednesday's RBNZ induced losses which saw the pair relinquish the 0.61 handle.

- PBoC set USD/CNY mid-point at 7.1339 vs exp. 7.2730 (prev. 7.1342).

Fixed Income

- USTs are flat in a very narrow 3+ tick range ahead of US CPI. A data point that will be scrutinised to see if it favours a September cut; within Wednesday's 110-10 to 110-20 parameters, a hawkish CPI print could bring into play the WTD 110-07 base.

- Bunds are incrementally softer with specifics light and attention entirely on US CPI. Recent very modest bout of downside came in tandem with a slight pick-up in the crude complex.

- Gilts are the incremental underperformer after strong growth data for May which caused Gilts to open lower by a handful of ticks before dipping further to a 97.81 base. Gilts remain comfortably within existing 97.64-98.38 WTD parameters. Gilts caught a slight bid following a well received 7yr auction.

- UK sells GBP 3.75bln 4.00% 2031 Gilt: b/c 3.29x (prev. 2.97x), average yield 4.074% (prev. 4.218%), tail 1.9bps (prev. 1.4bps).

- Italy sells EUR 8.5bln vs exp. EUR 7.25-8.5bln 3.45% 2027, 1.10% 2027, 3.45% 2031, 0.90% 2031, 4.45% 2043 BTP. A well received auction which sparked modest upside in BTPs, lifting them to incremental session peaks of 117.26; though not all to surprising given the reduced auction amount.

Commodities

- Crude futures hold a modest upward bias but trade off best levels after WTI Aug hit an overnight peak of USD 82.87/bbl. Elsewhere, the IEA monthly oil market report had no bearing on prices. Brent September currently sits around USD 85.30/bbl.

- Mixed price action in the precious metals complex with spot palladium underperforming after yesterday's rebound, whilst spot gold and silver hold a mild upward bias heading into the US CPI metrics. Spot gold currently sits in a USD 2,371.34-2,384.14/oz range.

- Base metals are mixed with the breadth of the market also narrow. Copper prices remain subdued following a large build (+11.3k tons) in LME inventories after jumping to the highest level since 2021 yesterday.

- Azerbaijan oil production at 65.597k tons per day in June (vs 62.118k in May), according to the energy ministry.

- IEA OMR: Sees 2024 and 2025 oil demand growth forecasts little changed from the prior month at just below 1mln BPD; Global oil demand growth slows further at China cools; China’s oil demand growth eased to 710k BPD in Q2, IEA say. IEA sees oil demand growth at 970k BPD in 2024 (prev. 960k BPD), 980k BPD in 2025 (prev. 1mln BPD). Iran’s crude oil production rises to six-year high. Global oil stockpiles fell 18.1mln bbl in June in prelim data. Subpar economic growth, efficiencies, EVs are oil headwinds

Geopolitics: Middle East

- The Gaza cease-fire agreement framework is reportedly agreed, and the parties are now “negotiating details of how it will be implemented”, according to a senior US official cited by Washington Post's Ignatius. "US officials say the framework of a three-stage deal is down to implementation details." "Officials caution that although the framework is in place, a final pact probably isn’t imminent, and the details are complex and will take time to work through." "A final possible bonus of a Gaza cease-fire is that Saudi Arabia has signaled it is prepared to 'move forward on normalization' of relations with Israel", according to a US official.

- White House's Kirby says he is cautiously optimistic things are moving in the right direction on Gaza ceasefire talks, according to CNN.

Geopolitics: Other

- China's mission to the EU said the declaration of the NATO summit in Washington is full of 'Cold War mentality and belligerent rhetoric,' and the China-related content is full of provocations, 'lies, incitement, and smears'

- Taiwan is to strengthen its civil defence to prepare against China's threat with the government working to prepare public services and infrastructure to function in wartime as China’s aggressive stance fuels concerns about the risk of open conflict, according to FT.

- Russian Deputy Foreign Minister says US and Germany's decision to deploy long-range missiles in Germany is aimed at harming Russia's security; says Russia will respond "in a military manner", according to RIA

US Event Calendar

- 08:30: June CPI MoM, est. 0.1%, prior 0%

- June CPI YoY, est. 3.1%, prior 3.3%

- June CPI Ex Food and Energy MoM, est. 0.2%, prior 0.2%

- June CPI Ex Food and Energy YoY, est. 3.4%, prior 3.4%

- June Real Avg Hourly Earning YoY, prior 0.8%, revised 0.7%

- 08:30: July Initial Jobless Claims, est. 235,000, prior 238,000

- June Continuing Claims, est. 1.86m, prior 1.86m

- 14:00: June Monthly Budget Statement, est. -$76.1b, prior -$347.1b

DB's Jim Reid concludes the overnight wrap

After telling you earlier this week that I hoped my current trip to Cape Town would be less eventful than my last 20 years ago, it is fair to say it's not been without incident. Yesterday due to a historically bad run of weather, the mayor of Cape Town told everyone to work from home and today schools are closed with people urged to stay off the roads and remain indoors. So thanks to the many who braved the storm to meet us yesterday. Being forced to stay inside and watch England play in the current Euros would have been worse than any storm but miracles have happened and they reached the final last night. I'm not expecting Spain to be quaking in their boots this morning.

There are few storms in the US at the moment, with markets continuing to power forward over the last 24 hours, with the S&P 500 (+1.02%) advancing to its 37th record this year with the Mag-7 (+1.26%) now surpassing +50% YTD. These moves are becoming increasingly relentless now, as the S&P rose for a 7th consecutive day for the first time since November, and it’s also the first time since late-2021 that it’s managed 10 out of 11 gains in a row. So not the sort of rally you see every day, and if we can make it to 11 out of 12 gains today, that would be the first time that’s happened since April 2019. Over those 10 days the rally is +3.4% so steady and relentless rather than spectacular, at least prior to yesterday. This continued strength has been echoed across different asset classes though, but it’s now going to face several important tests, as the US CPI release is coming out today and earnings season is about to kick off in earnest, with several US banks reporting tomorrow.

That CPI release is in particular focus, because there’s been mounting anticipation that the Fed might still deliver two rate cuts this year, with September and December seen as the most likely dates. It’s true that their dot plot in June only signalled one cut this year, but since then we’ve had some weaker jobs reports, and the unemployment rate has ticked up to 4.1%, which is the highest since November 2021. So if there is positive news on inflation and we get another soft print, then that momentum for a rate cut is likely to build further.

Back in Q1, the inflation numbers were much stronger than expected, which meant that market pricing for rapid rate cuts this year proved wide of the mark. But since then, the April inflation numbers eased a bit, and the latest print from May was even better from the Fed’s perspective. Indeed, the monthly core CPI reading was down to just +0.16%, the weakest since August 2021. So with more numbers like those, the Fed could feel a lot more confident that inflation was heading durably back to their 2% target.

In terms of today, our US economists are expecting that both headline and core will be a bit firmer than last month, with headline at a monthly +0.09%, and core at +0.25%. In turn, that would push the year-on-year measure down to 3.1% for headline CPI, although the core CPI measure would tick up a tenth to 3.5%. When it comes to the Fed, it’ll also be worth keeping an eye on tomorrow’s PPI report as well, since several components in that feed into the PCE measure of inflation that they officially target. So over the next couple of days we’ll get a better idea of where that’s likely to land and if the Fed have the space to cut rates. Our US economists point out that the median forecast for core PCE in the June SEP was at +2.8% on a Q4/Q4 basis, so to achieve that we need to see monthly core PCE at an average pace of 20bps a month for the rest of the year. So for them, that’s the primary test for whether the Fed can cut earlier than their baseline, which sees a first cut in December. For more details on their CPI forecast and how to sign up for their subsequent webinar, click here.

Ahead of that, Fed Chair Powell was continuing his semiannual congressional testimony yesterday, appearing at the House Financial Services Committee. But there weren’t really any fresh headlines from that, and T reasury yields were largely steady on the day, with the 2yr yield (-0.6bps) and the 10yr yield (-1.2bps) both slightly lower. It was a similar story for Fed pricing, with the amount of cuts priced by the December meeting (+0.4bps) also little changed at 51bps.

On the equity side, the S&P 500 (+1.02%) posted its biggest gain in over a month, with the advance once again led by the tech mega caps. The Mag-7 (+1.26%) extended its YTD gain to +50.9%, led by Nvidia (+2.69%) and Apple (+1.88%) on the day. That said, the session saw broad gains with all top level sector groups within the S&P 500 up by at least 0.4% on the day.

Meanwhile in Europe, markets staged a recovery yesterday, with the S TOXX 600 (+0.91%), the DAX (+0.94%) and the CAC 40 (+0.86%) all advancing. It was the same story for sovereign bonds, with spreads tightening as yields on 10yr bunds (-4.7bps), OATs (-5.9bps) and BTPs (-8.8bps) all came down as well. However, UK gilts (-3.3bps) saw a smaller decline in yields, which followed comments from BoE chief economist Pill that were perceived a bit more hawkishly. He said that “It’s still an open question of whether the time for that cut is now or not,” which seemingly cast doubt on the prospect of a cut when they announce their next decision on August 1. Indeed, investors moved to dial back the chance in response, with the probability of a cut down from 64% the previous day to 56% by the close. The next important data print will be the CPI release next week, but Pill also pointed out that “we have to be realistic about how much any one or two releases can add to our assessment.”

Asian equity markets are all higher this morning as the globa l risk move gathers momentum . Across the region, Chinese stocks are outperforming with the Hang Seng (+1.45%) leading gains while the CSI (+0.99%) and the Shanghai Composite (+0.77%) are also higher. Elsewhere, the Nikkei (+0.94%) is being powered by technology stocks and crossing 42,000 for the first time. The KOSPI (+0.75%) is also higher as the Bank of Korea kept interest rates steady at 3.5% for the 12th consecutive meeting, as widely expected. In overnight trading, US stock futures are pausing for a breather at the moment and are broadly flat alongside Treasury yields.

Early morning data showed that Japanese core machinery orders unexpectedly fell sharply again in May (-3.2% m/m v/s +0.8% expected) dampening expectations for a recovery in Japanese investment in Q2/Q3. It followed a -2.9% decline in April.

In the geopolitical space, today will see the final day of this year’s NATO summit in Washington. The summit has been somewhat overshadowed by lingering questions over President Biden’s candidacy for the November US election. These re-intensified yesterday, initially triggered by an interview from former House Speaker Nancy Pelosi, who avoided unequivocally supporting Biden, saying “it’s up to the president to decide” if he should stay on in the race. Later on Peter Welch of Vermont became the first Democratic senator to call on Biden to withdraw from the race, while Axios reported that Democrat Senate Majority Leader Chuck Schumer was privately open to replacing Biden as the presidential nominee.

To the rest of the day ahead now, and data releases include the US CPI reading for June, the weekly initial jobless claims, and UK GDP for May. From central banks, we’ll hear from the Fed’s Bostic and Musalem.

More By This Author:

Cocoa Grinding Estimates Suggest Demand Destruction NearingStock Fragility Is The Highest On Record

Bitcoin Extends Gains As US ETF Inflows Battle German Govt Selling Overhang

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more