What Was The Service Sector Saying In September?

In an earlier post, we detailed the results of the September ISM Non-Manufacturing PMI. While the headline index and the sub-indices were indicative of general improvements in the services side of the economy more broadly, the commentary section offered some interesting minutia on specific areas of business. For starters, the commentary was conflicting. When discussing the broad outlook, adjectives used ranged from “bleak” and “uncertain” to “optimistic”. More specifically, the Arts, Entertainment, and Recreation sector, which remains largely closed appeared to have some of the most pessimistic commentaries while the Health Care and Social Assistance commentary, perhaps surprisingly for elective procedures to be exact, held a very confident point of view. Meanwhile, the Educational Services industry walks the tightrope noting that if students are sent home, the result would be “a drastic reduction in our revenue.” In other words, on an aggregate level, the report’s data surrounding the services sector has shown a continued recovery, but anecdotally, certain industries are still on shaky footing if not completely left out of the recovery so far.

The commentary also shed some light on a few COVID era trends. Circling back to the comments from the Health Care and Social Assistance industry, it noted that “productivity remains high, possibly higher than when we are in our office,” giving fodder to the argument that work from home could be more permanent. The same comment made mention that a return to work is not in the plans until mid-next year. Additionally, as housing market data continues to impress, the Construction industry mentioned that it does not have appropriate labor levels to meet the pace of rising orders. Meanwhile, the Wholesale Trade industry noted the strength in sales for home-improvement. Besides that, the Insurance industry made mention that bad weather and protests—which have been pillars (outside of COVID) of current events over the past several months—have had an impact on business. The commentary also made note of some supply chain issues. The Health Care and Social Assistance industry noted vendor rejections and Retail and Wholesale Trade both detailed issues with suppliers. Those issues included port and rail delays, capacity problems, hiring difficulties, and adverse weather.

(Click on image to enlarge)

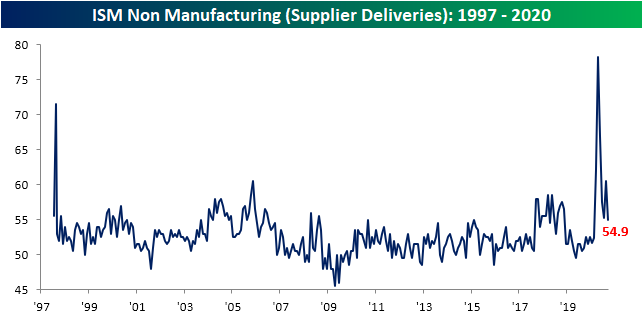

Those final comments from the Retail Trade and Wholesale Trade industries about supply chain issues are consistent with this month’s data from the report. As shown below, imports were lower with the index in contraction in September falling to 46.6. The index for Supplier Deliveries saw a drop larger than 99% of all prior monthly moves, but at 54.9 it is still historically elevated and is indicative of longer lead times.

(Click on image to enlarge)

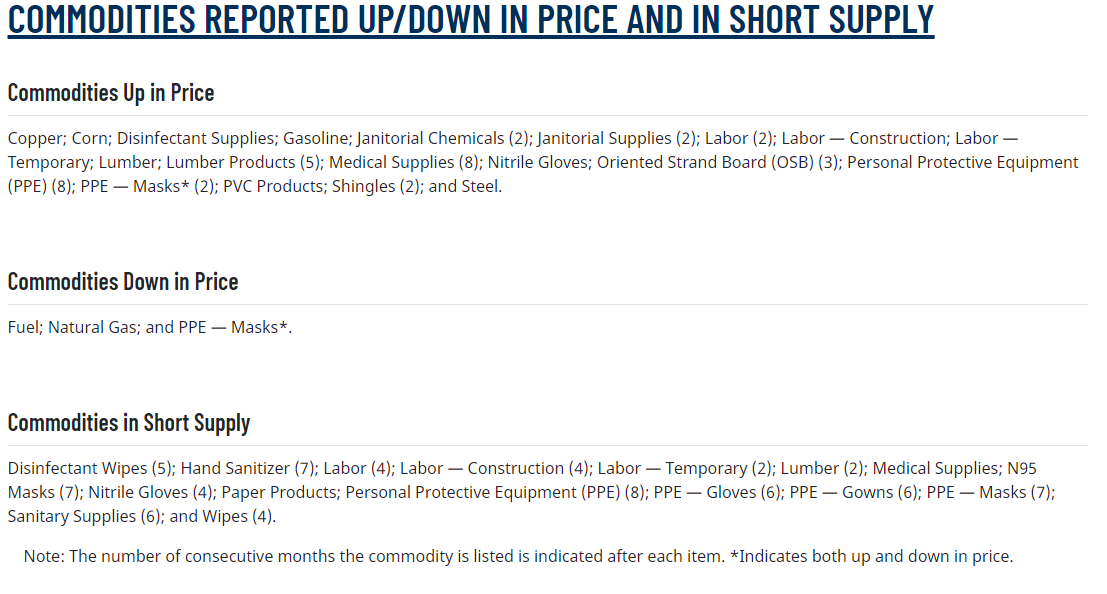

The ISM report also details the commodities that are reported as rising/falling in price and are in short supply. Preventative measures to stop the spread of COVID like cleaning supplies and personal protective equipment all remain in short supply, and consequentially, higher in price. Adding yet more reinforcement to how strong the housing sector of the economy has been, rising prices also applies to many commodities pertinent to the construction sector like lumber, copper, steel, shingles, and labor. Finally, fuel and natural gas were reported as in short supply.

(Click on image to enlarge)

Click here to view Bespoke’s premium membership options for our best research ...

more