What If? Thoughts On The No Excess Demand Scenario

It’s become commonplace to assert that the passage of the American Rescue Plan ignited inflation, dooming the prospects for the Biden and Harris candidacies. Consider this piece:

The least contentious point of criticism is the macroeconomic effect of the ARP, specifically on the issue that has wreaked havoc on the Biden administration, doomed progressive policies in this congress, and will likely hand control of Congress to the Republican party: inflation. The ARP is by no means the impetus for the inflationary pressures that plague the United States, but the role of $1.9 trillion in deficit spending in exacerbating an existing inflationary gap is undeniable. Passed as the American economy began to open up and regain full capacity, the ARP entered into an economy struggling with above-average demand due to pandemic saving patterns and below-average supply due to supply chain constraints, already a recipe for inflation.

Sounds good, but I wonder exactly how much inflation was pushed up by excess aggregate demand, presumably coming from the ARP (but also the preceding CARES act, and other measures passed during the Trump Administration). I turned to this SF Fed Economic Letter entitled “How Much Has the Cooling Economy Reduced Inflation?” by Regis Barnichon and Adam Shapiro. Using their estimates of the modified Phillips curve (esp. the one relying on the vacancy-effective searchers, or V-S, ratio) of an approximately 0.75 ppts of 2022 inflation attributable to excess demand, and 0.4 ppts in September 2024 inflation.

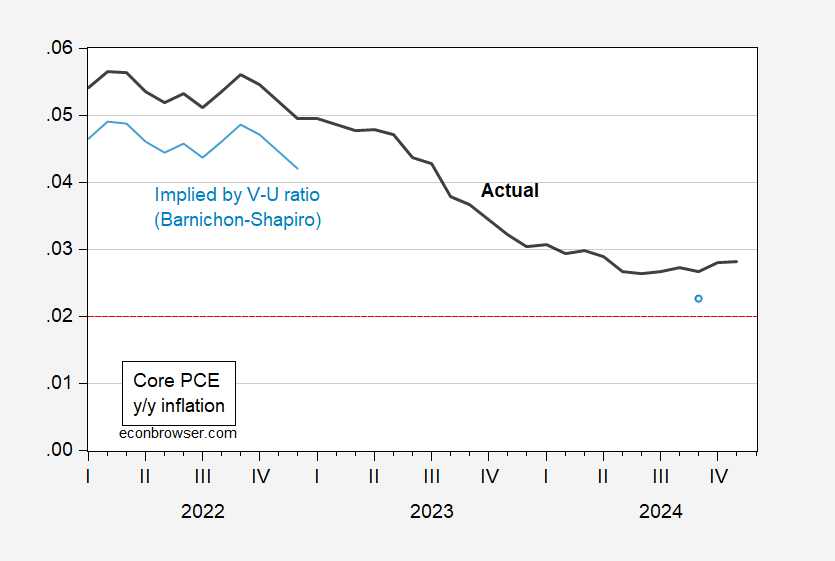

Figure 1: Year-on-Year core PCE inflation (bold black), and implied inflation w/o excess demand (light blue). 2022 alternate inflation calculated subtracting 0.75 ppts from actual inflation. Horizontal dashed line at 2%. Source: BEA via FRED, Barnichon and Shapiro (2024), Figure 3, and author’s calculations.

The relevant question her is whether 0.75 ppts lower inflation in 2022, and a smaller deviation in 2023, would have tipped the balance. At the same time, the high aggregate demand which sustained strong wage growth and low unemployment (such that median household incomes were higher in 2024 than just before the pandemic) was due to the ARP and lagged effects from the previous fiscal packages. After all, a lot of the resilience of the economy throughout 2024 (remember how many people thought a recession in 2024 was a sure thing) is attributable to the consumer, and that in turn was due to savings built up from the Trump-Biden transfers.

More By This Author:

Revisiting The Relationship Between Debt And Long-Term Interest RatesIntra-industry Trade Estimated

When Econ 101 Isn’t Enough: Oren Cass On Trade