Yields Pop As Fiery Jobs Report Justifies Powell

Stronger-than-expected hiring and wage growth data this morning is causing bond yields to climb while equities are advancing because the data is helping alleviate concerns of a potential recession. From a broader perspective, the data is reinforcing recent comments by Federal Reserve Chairman Jerome Powell that emphasized the central bank’s commitment to maintaining hawkish policies and sought to temper investors’ expectations for Fed funds rate cuts this year.

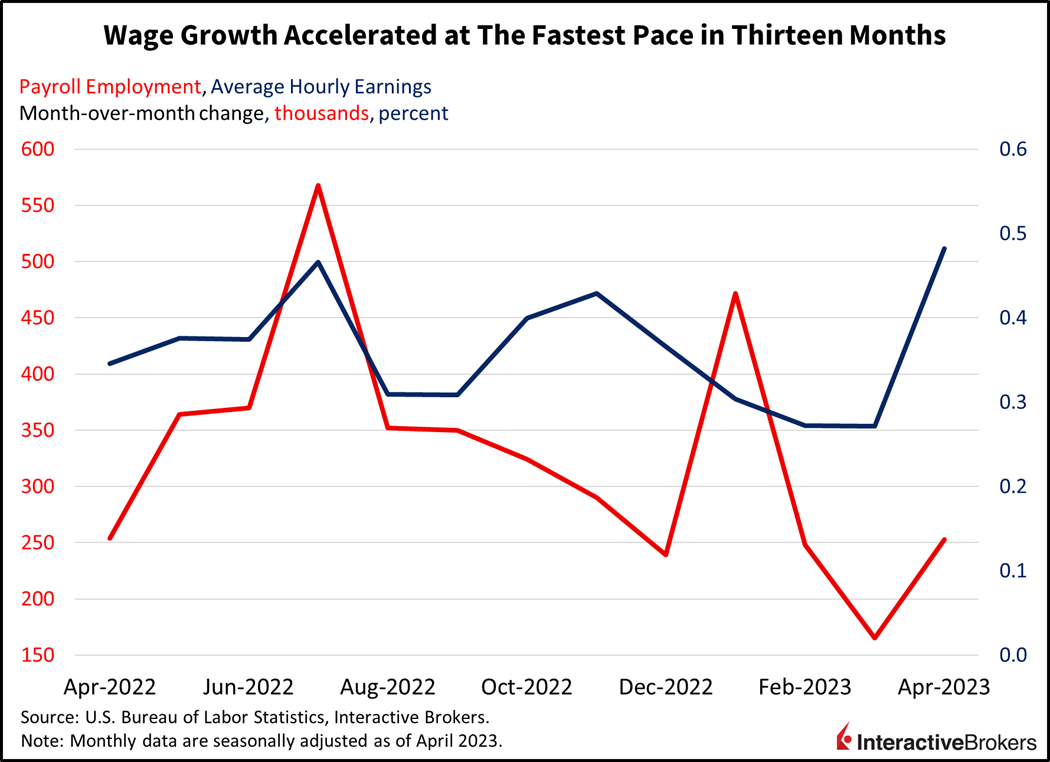

Payroll job gains blew past expectations, as corporate hiring appetites remained buoyant. The 253,000 jobs added in April handily beat expectations for 180,000 additions and also accelerated meaningfully from the 165,000 new hires in March. Wages were on fire, accelerating on both a year-over-year (y/y) and month-over-month (m/m) basis. Average hourly earnings grew 0.5% m/m and 4.4% y/y, a faster pace than March’s 0.3% and 4.3% rates and perhaps more significantly, the fastest m/m increase in wages in thirteen months. The tight labor market that Chairman Powell referenced so much during his press conference on Wednesday was loud and clear in this report, with the unemployment rate moving down for the second-consecutive month to 3.4% despite forecasts calling for an increase to 3.6%. The unemployment rate has moved further away from the Fed’s year-end forecast of 4.4%, which justifies Powell’s hawkish stance. However, following four months of individuals joining the ranks of the employed or actively seeking work, people didn’t flock to the labor market in April, leaving the labor force participation rate unchanged at 62.6%.

(Click on image to enlarge)

Job gains were broad-based, with almost every sector achieving an increase in employees from March. Private education and health services, professional and business services, leisure and hospitality and finance led, gaining 77,000, 43,000, 31,000, and 23,000, respectively. Government, construction, manufacturing and transportation and warehousing also contributed at more tempered levels. Wholesale trade was the laggard, losing 2,200 jobs while utilities and information barely added any, gaining 1,000 each.

Investors Flock to Risk Assets

Markets are responding in a bifurcated way this morning, with the yield curve popping on the back of an inflationary report. However, equity investors are focusing on strong job growth as a sign that an imminent recession is unlikely. Yields are being led by the short-end with the 2-year treasury up 17 basis points (bps) to 3.9% while the 10-year is up 9 bps to 3.44%. Equities are rallying, looking to achieve their first daily gain this month with the S&P 500 Index climbing 1.45% to 4121 while regional banks are recovering strongly from their recent malaise. The S&P Regional Banking ETF (KRE) is up 4.6% and propping up the small-cap Russell 2000 Index, which has gained 2%. WTI crude oil is also recovering from hitting a new year-to-date low of $63.64 per barrel yesterday, despite OPEC +’s production cuts, and is up 4% to $71.46 per barrel. The dollar is roughly unchanged.

Corporate Earnings Underscore Fed’s Views of Consumers

Recent earnings reports underscore the Fed’s concerns about demand for entertainment and travel sustaining strong non-housing services inflation as Americans continue to splurge on out-of-home activities while backing away from buying consumer goods. Examples include the following:

- Bookings Holdings, which is an online travel and entertainment reservation company with brands such as Priceline.com, Kayak and OpenTable, generated first-quarter earnings of $11.60 per share, substantially beating the consensus estimate of $10.48 per share and up from $3.90 per share for the first quarter of 2022. The company’s results underscore the Fed’s belief that strong demand still exists for non-housing services with consumers having pent up demand for entertainment and traveling after sheltering in place and observing other restrictions intended to slow the spread of Covid-19. Indeed, Bookings’ first-quarter revenues of $3.78 billion climbed substantially from the $2.7 billion in first-quarter 2022 revenues.

- Apple reported net income of $24.2 billion, down 3% from the year-ago quarter but exceeding analysts’ expectation of $22.6 billion. In an example of weak consumer spending in the U.S., Apple’s revenue fell 3% y/y to $94.8 billion. Revenue missed the $92.9 billion expected by analysts and the period was the second-consecutive quarter of declining revenues. Apple experienced weak U.S. sales, especially for its iPad and computers, but strong sales of its iPhones in emerging markets helped cushion the impact of domestic weakness.

- Carvana, which sells used cars, reported an adjusted loss per share of $1.51, beating expectations for a loss of $2 a share, a result of the company reducing its sales costs as it shifts its focus to profits rather than growth. Its revenue of $2.61 billion fell from the $3.5 billion from the year-ago quarter but met expectations. In another sign of a weakening consumer, Carvana sold 79,240 units, which exceeded the company’s forecast of between 76,000 and 79,000 units but substantially trailed the first quarter of 2022, when sales totaled 105,000 units.

Will the Coming Days Bring a Wake-Up Call?

This morning’s inflationary labor report failed to derail investors’ bullish sentiment. Despite the stronger-than-expected labor report this morning and Powell’s recent comments emphasizing that the Fed still hasn’t determined if its monetary policy is sufficiently restrictive to curtail inflation, investors believe that only an 11% chance exists for the central bank to increase the Fed funds rate next month. A busy week ahead, however, is likely to further challenge investors’ dismissal of Powell’s hawkish comments. Deposit and loan statistics this afternoon will be followed by the potential for additional regional banks to fall into FDIC receivership this weekend. This coming Wednesday’s Consumer Price Index, if stronger than expected, could be a rude wake up call for investors that are pricing securities based on the unlikely chance of rate cuts this year.

More By This Author:

Fed Likely To Look Beyond Bank Issues In Battle Against Inflation

A Use Case For 1-Day VIX?

Nowhere, Man

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider ...

more