Yellow Flag From Initial Jobless Claims Turns A Little More Orangey

Initial jobless claims rose 22,000 to 264,000 last week, while the 4 week average rose 6,000 to 245,250.

![]()

Continuing claims, with a one week lag, rose 12,000 to 1.813 million:

Note that both measures of initial claims are at their highest levels since late 2021. Continuing claims are also at those levels, although slightly down from three weeks ago.

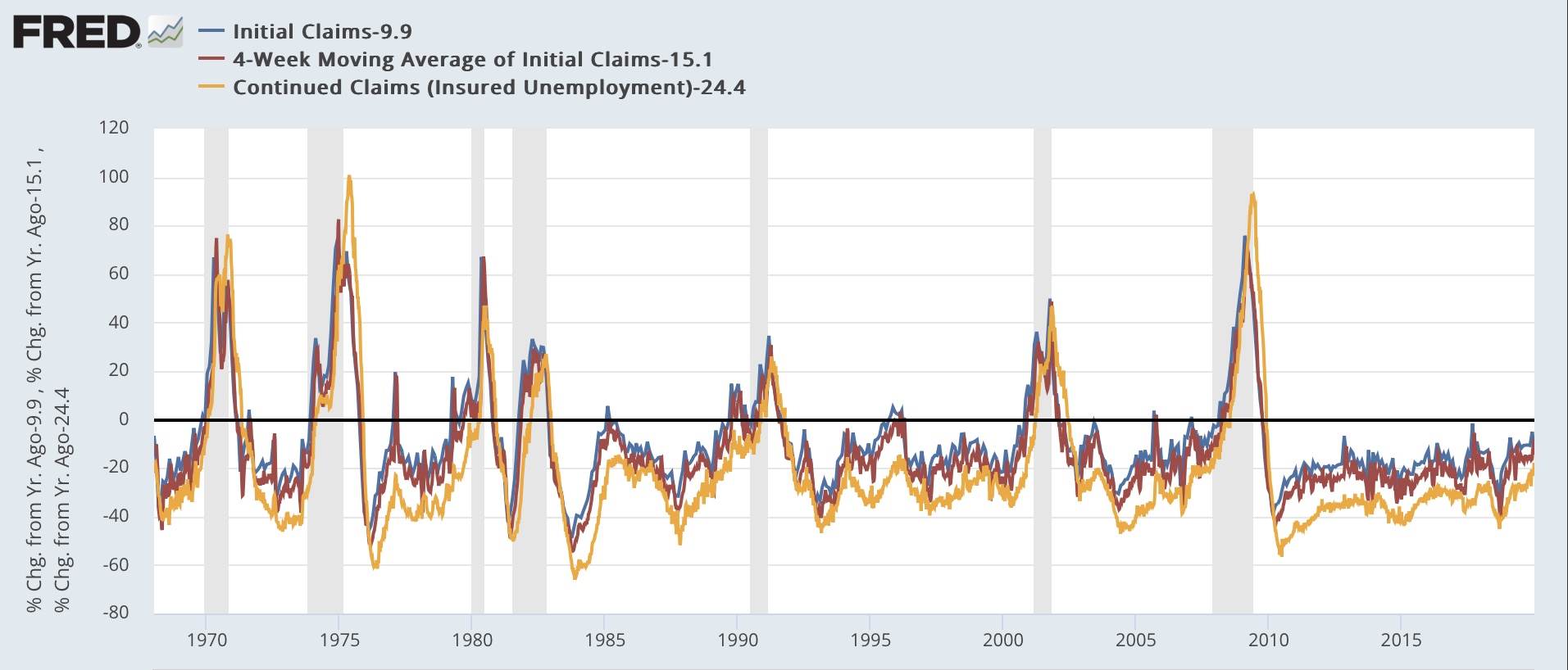

On a YoY basis, initial claims are up 25.7%, the 4 week average up 15.1%, and continuing claims up 24.4%:

If these YoY comparisons persist for another month, that would be sufficient to hoist the “red flag” recession warning. So this is a good time to reiterate that weekly data can be noisy, and this week’s spike could be the start of a trend - or it could just be an outlier. Many times in the past there have been brief crossings of the 12.5% YoY threshold that reversed quickly and did not signal a recession.

Here’s what the historical record of YoY readings in the three metrics have looked like (all normed to 0 as of this week’s reading, 1 week’s claims averaged by month):

In 4 of the 7 recessions before the pandemic, claims did not hit this level YoY until after the recession actually started. In 2 they hit this level 6 months or less before the recession, and in 1 (1990) 9 months before. But there were also 7 false positives: August 1971, February 1977, March 1979, February 1985, October 1995-June 1996, March 2005, and February 2007. Note that only one of these lasted longer than a month.

So this week the yellow flag caution turned a little more orangey.

More By This Author:

Inflation Ex-Shelter Increasing At 1.0% Annualized Rate Since Last JuneCredit Conditions Worsen, And Likely To Worsen Further Due To Debt Ceiling Debacle II

Scenes From The April Employment Report: The Fed Just Can’t Kill The Employment Beast

Disclaimer: This blog contains opinions and observations. It is not professional advice in any way, shape or form and should not be construed that way. In other words, buyer beware.