With Charge Offs Soaring, Capital One To Buy Discover, Creating Credit Card Giant

Image Source: Nick Youngson CC BY-SA 3.0 Alpha Stock Images

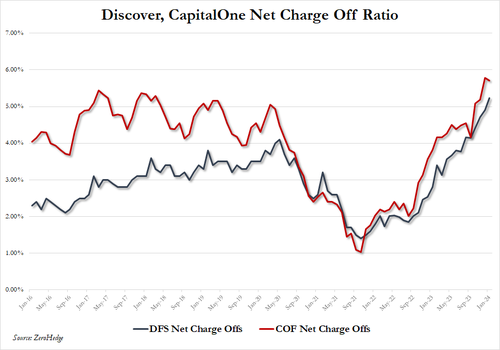

With both delinquency and charge-off ratios at the two largest credit card companies (targeting everyday consumers, unlike the top 10% focused American Express) in the US surging in the past two years to the highest level since the covid crash, and prompting speculation among traders that the US consumer is set for a painful hit (just a few days ago Goldman trader Rich Privorotsky said that "I think we are going to keep ignoring any consumer concerns for now but some of these numbers from Discovery were pretty glaring" referring to the 242bps surge in NCOs from 2.81% to 5.23%)...

... it's hardly surprising that the easiest way to cover up the growing delinquency/NCF rot below the surface is simply to throw billions in "synergies" at the problem while also combining two (very ugly) balance sheets in hopes of confusing shorts, and sure enough earlier today the WSJ reported that Capital One (COF) plans to buy Discover Financial Services (DFS) in a deal that would combine two of the largest - and ugliest - credit-card companies in the U.S.

The WSJ reported that the all-stock deal (may as well take advantage of the ridiculous short squeeze in the stock in recent months) could be announced Tuesday, and would the deal would value Discover - which has a market value of about $28 billion - at a premium.

Buying Discover would give Capital One, a credit-card lender with a market value of a little over $52 billion, a network that would increase its power in the payments ecosystem.

Card networks are critical to enabling transactions and setting fees that merchants pay when consumers shop with credit cards. Though much smaller than Visa and Mastercard, Discover is one of the few competitors to those companies in the U.S. and it is one of a small number of card issuers that also has a payments network.

Capital One, the ninth-largest bank in the country and a major credit-card issuer, uses Visa and Mastercard for most of its cards. The bank plans to switch at least some of its cards to the Discover network - which guarantees that it will lose even more customers - while continuing to use Visa and Mastercard on others. Those larger networks have more merchant acceptance abroad than Discover does.

Capital One also plans to maintain the Discover brand on the cards and network... assuming regulators sign off and the deal is consummated, which is a big "if" with the Biden FTC which has tried to kill any major merger in recent years.

Discover, based in Riverwoods, Ill., is an online institution so the takeover wouldn’t come with physical bank branches, except for one location in Delaware.

As the WSJ notes, the deal follows a tumultuous period for Discover that has included increased regulatory scrutiny and a change in leadership. The company disclosed last year that an internal review found it had misclassified certain credit-card accounts beginning in 2007, incorrectly placing them in the highest merchant-and-acquirer pricing tier. The company established a liability of $365 million to account for estimated compensation owed to merchants and acquirers. Separately, Discover received a consent order from the FDIC. In October, Discover said it would address the FDIC order to improve its consumer-compliance operations.

In December, Discover said financial-industry executive Michael Rhodes would become its CEO and president. He took over from John Owen, who had been serving in the interim after Roger Hochschild stepped down in August.

Discover has been approached by large banks and technology companies about an acquisition of all or a part of its business over the past decade or more. Tech companies have been interested in acquiring its network so that they can play a more central role in payments, but prior senior executives at Discover weren’t interested in separating the company’s credit-card lending side from the network.

For Capital One, the deal would also further expand the number of cardholders it will count as customers for its credit-card lending business.

Additionally, Discover also has consumer deposits, most of which are in savings accounts, allowing Capital One to continue to grow its already large presence in that area.

An acquisition of Discover will rank among the biggest deals so far in 2024. After a lull in M&A activity in 2023 as economic and other uncertainty and increased interest rates took a bite out of the appetite for deals, volumes have gotten off to a relatively strong start and are up 90% in the U.S. compared with a year earlier, according to Dealogic. Other big transactions include software maker Synopsys’ roughly $35 billion acquisition of rival Ansys and Diamondback Energy’s $25 billion deal for Endeavor Energy.

More By This Author:

Key Events This Week: Nvidia Earnings And FOMC Minutes

Hotel Rooms Or Homes?

Bitcoin & Black Gold Bid As Stagflation Fears Wreck 52-Year-Old Equity Win-Streak

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more

Doesn't seem like the time to pay a premium for a credit card company.