Will Household Wealth Be A Tailwind To Consumption In 2024Q3?

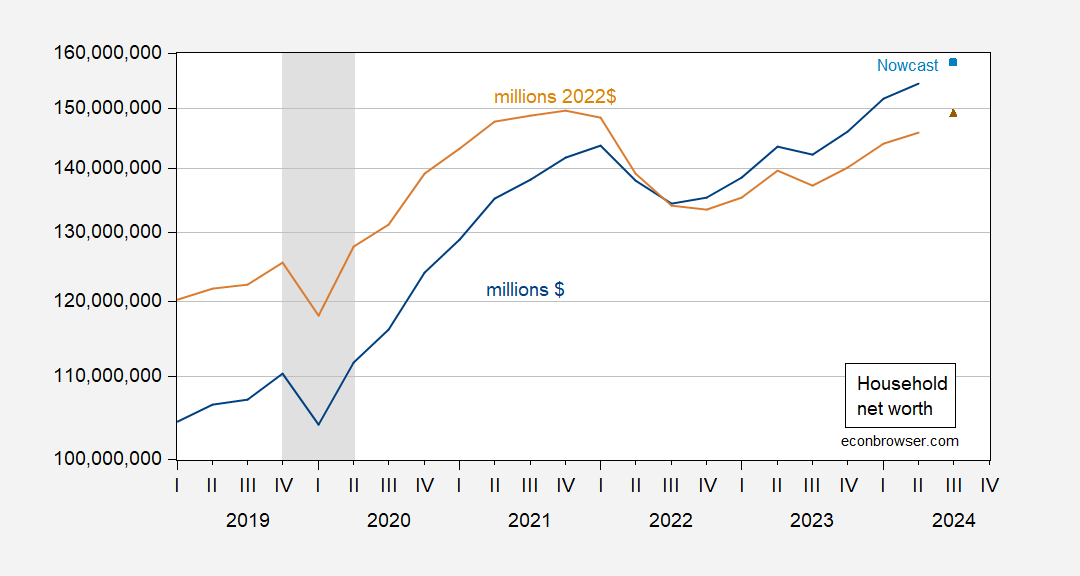

Here’s a picture of household net worth, in both nominal and real terms, with my nowcasts for Q3.

(Click on image to enlarge)

Figure 1: Household net worth (blue), nowcast for 2024Q3 (blue square), in billions $; real household net worth (tan), nowcast for 2024Q3 (brown triangle), in millions 2022$, on log scale. NBER defined peak-to-trough recession dates shaded gray. Real net worth deflated using Chained CPI, September value uses Cleveland Fed nowcast as of 10/6/2024. Source:Federal Reserve Flow of Funds via FRED, BLS, Cleveland Fed, NBER, and author’s calculations.

Nominal (real) net worth is nowcasted to rise 2.5%(2.3%) q/q in Q3.

I generated the nowcast for household net worth by a log-log regression, 2021Q3-2024Q2:

worth = 14.184 + 0.382sp500 + 0.243home

Adj-R2 = 0.91, SER = 0.013, DW = 2.22, NObs = 12. Bold face denotes significance at 10% msl, HAC robust standard errors.

Will this support consumption? Pre-2019 data says yes (in log first differences); not so clear in post-pandemic data.

Addendum:

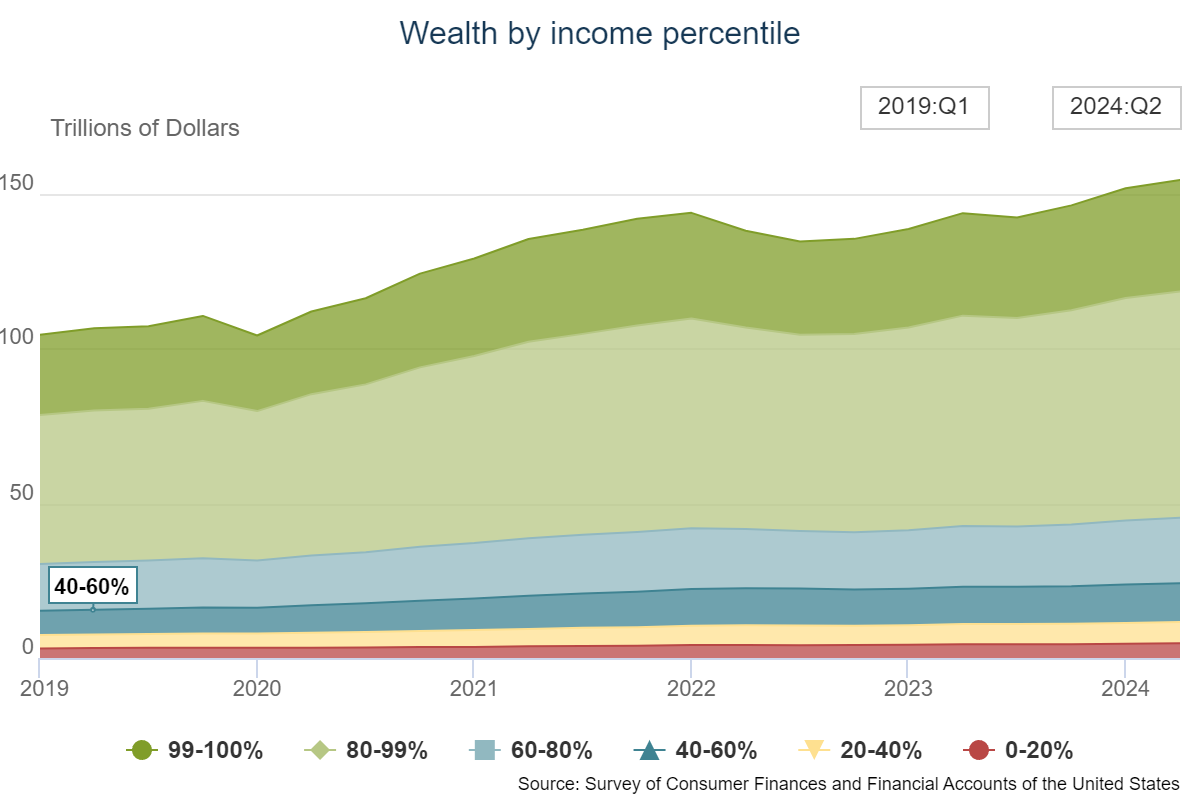

The composition of the net worth is of interest.

(Click on image to enlarge)

Source: Federal Reserve Board.

While the bulk of the gain has been in the high income deciles, the high income deciles also account for a disproportionate share of consumption.

More By This Author:

Employment Overall, And At Smaller FirmsIn Real Time, Does A Downturn In Household Survey Employment Better Presage A Recession Than One In The Establishment Survey?

Did Government Employment Account For Most Of September’s Employment Gains?