Widespread Losses Weighed On Global Markets Last Week

US investment-grade bonds were the exception. Otherwise, the major asset classes felt the sting of risk-off sentiment in the wake of what is widely perceived as a subtle-but-otherwise-conspicuous hawkish tilt in the Federal Reserve’s outlook on inflation risk.

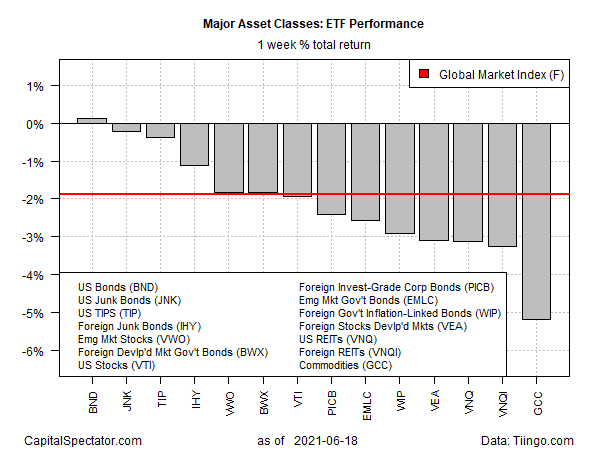

US bonds posted the only gain for the major asset classes for the trading week ended Friday, June 18, based on a set of ETFs. Vanguard Total US Bond (BND) edged up 0.1%, marking the fund’s fifth straight weekly advance.

Last week’s news from the Federal Reserve’s policy meeting suggests that the central bank may start raising interest rates sooner than expected. Despite this risk, real or not, bonds benefitted from the change in expectations, which is to say that bond prices rose and yields fell. Some observers might wonder if lower yields contradict the hawkish aura flowing from the latest Fed pronouncements, including St. Louis Fed President Jim Bullard, who says the Fed may begin lifting rates as early as late-2022. Shouldn’t yields be rising if the Fed may start hiking earlier than expected?

Not necessarily, at least not yet. As Viraj Patel, global macro strategist at Vanda Research, explains via Bloomberg, “There are two legs to this unwind.”

First is a peak in the inflation narrative as we work our way through those base effects and one-time reopening effects in term of price implications. The second thing is that central banks, especially those in the U.S. and China, are telling us that actually these unconventional easy monetary policy conditions that we’ve been used to for the past 12 months aren’t likely to exist forever.

As a result, “Traders are adjusting positions as they scale back on reflation trades in the wake of the Federal Reserve’s hawkish pivot last week, which fueled a scramble to unwind curve steepeners,” Bloomberg reports. “The likes of Morgan Stanley and TD Securities were stopped out of recommended trades, while Goldman Sachs analysts unwound outright 30-year short positions.”

Embedded in this analysis is the potential for softer economic growth (or worse), particularly if the Fed makes a policy error by hiking too early, too much or both.

Beyond investment-grade bonds, losses dominated. Last week’s biggest setback: commodities. WisdomTree Continuous Commodity Index Fund (GCC), which equal weights a broad mix of raw materials, tumbled 5.2% — the ETF’s first weekly decline in a month.

An ETF-based version of the Global Market Index (GMI.F) lost 1.9% — the first decline on a weekly basis in the past five weeks. This unmanaged benchmark holds all the major asset classes (except cash) in market-value weights via ETF proxies.

For the one-year trend, all but one of the major asset classes are posting gains, although the range of results varies widely. Leading the gainers: US stocks via Vanguard Total US Stock Market Index Fund ETF (VTI), which is up 39.4% on a total-return basis over the past 252 trading days.

The only loss: Vanguard Total US Bond (BND), which is off a fractional 0.1% for the past 12 months.

GMI.F’s one-year return is a 21.9% gain after factoring in distributions.

Monitoring funds through a drawdown lens continues to reflect a wide range of results. US junk bonds (JNK) are currently posting the smallest peak-to-trough decline – just -0.2%. At the opposite end of the spectrum for the major asset classes: a steep 38.1% drawdown for commodities (GCC).

GMI.F’s current drawdown is currently -2.0%.

Disclosures: None.