Why Performing Below The Benchmark Is Irrelevant

Let’s look at the data on individual stock returns of S&P 500 members to contextualize what we are up against when it comes to picking stocks. Of course, individuals should set their own expectations. You should aim to have enough money to achieve your life goals while taking an acceptable risk. If someone has invested well enough to send their kids to college, no one would complain to them that they underperformed the benchmark by a few basis points. No one can complain anyway because it is their money. Comparing stocks to the S&P 500 is simply the best way to gauge returns, but it’s not the ‘end all be all’ for individual investors.

https://t.co/BlqnyzUQEk pic.twitter.com/DO582wijWz

— Nick Reece, CFA (@nicholastreece) November 27, 2020

In the past 25 years, there have been about 1,000 stocks in the S&P 500 because companies have been added and subtracted. This passive index is actively managed based on specific criteria. In the spectrum of passive versus active, this is relatively passive, but it’s not completely so. The chart shows about 29% of stocks had a loss on a total return basis. Even losing a small amount is terrible because there is a massive opportunity cost over 25 years. Even a CD would have been much better.

The median return is 66% which means half delivered less returns. The average return is 359%. 80% of stocks did worse than average which makes picking winners quite difficult. Of course, the odds differ if you are willing to invest in stocks outside of the index (which you should be willing to do). The good news is most of your stocks don’t need to outperform as long as you have a few really great winners like the index does. There are quite a few that have delivered over 20X returns.

The key is to avoid diversifying away from your huge winners. Let them go. That’s easier said than done. You need deep conviction to hold stock after it has doubled. Cyclical stocks double all the time, but they aren’t the big winners. You should be more inclined to sell cyclicals when people start to think they are secular winners. People are easily fooled. They are also fooled in the reverse as we are seeing now. Investors believe energy will never come back. Narratives are backward-looking.

2nd Worst Decline In 100 Years

Investors have no faith in energy. We now need to preface this by saying investors have no faith in fossil fuel stocks because green energy stocks are some of the hottest stocks in the market even though they provide a very low percentage of our fuel. Any business that is growing and losing money is loved by this market. That’s because of high speculation and low rates. There has only been one worse downturn in energy stocks in the past 94 years as you can see in the chart below. On a total-return basis, the losses are about 66% while the losses were almost 80% in the early 1930s.

Energy sector currently in the midst of its deepest and longest drawdown since the Depression pic.twitter.com/25rAHtKVyW

— Lawrence Hamtil (@lhamtil) November 27, 2020

After we have a few great weeks in the energy sector, don’t think the sector is overbought and ready to be sold, depending on your time horizon of course. That mantra is recency bias at work. The dogma is that any rally in energy should be sold. However, when the sector comes back like it always does because there is currently no replacement for it, selling after quick gains will prove to have been a huge mistake. Again, depending on your timeframe – we are referring to years, not days.

V-Shaped Recovery In Profits

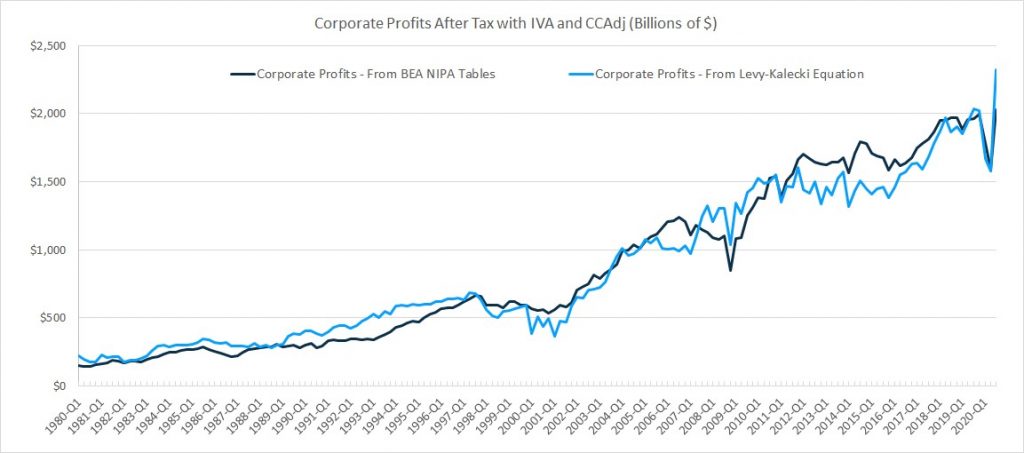

In a previous article, we mentioned the bottom few industries dragged down S&P earnings. Most industries actually had positive EPS growth. The chart below adds to this point as two measurements of corporate profits have more than recovered from their decline during the recession.

Source: Twitter @sonusvarghese

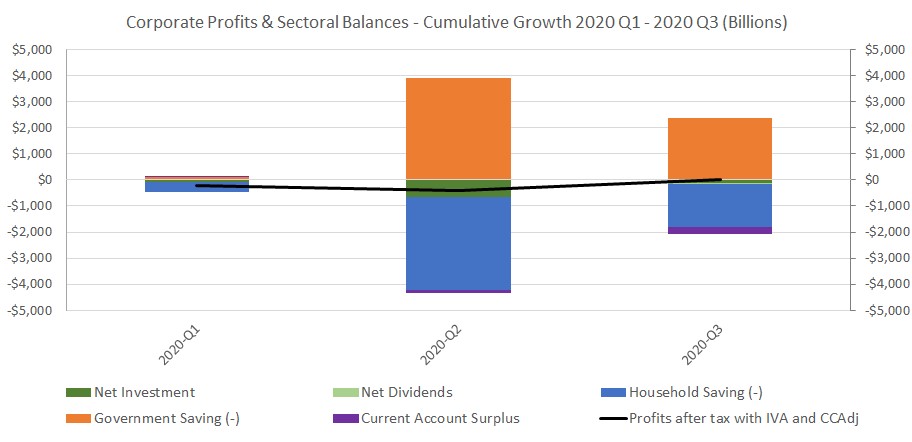

Profits have recovered due to government deficits ($28 billion year to date). The fiscal punchbowl might be taken away, but the vaccines are set to reopen the economy. The government did a good job at stemming the economic pain. The worry is about the over 13 million people set to lose their pandemic benefits at the end of the year. If these benefits don’t continue as lockdown restrictions are maintained, a lot of the good work will be undone.

Source: Twitter @sonusvarghese

A Decent Start To The Holiday Shopping Season

Air travel before Thanksgiving didn’t spike. As you can see from the chart below, there were 1.071 million travelers on Thanksgiving eve which was down 41% from last year.

“[TSA] screened more than 1.07 million people at US airports on Thanksgiving eve. For context this number was still down 41% on the same Wednesday last year.” DB pic.twitter.com/rpxgQvdLU3

— Sam Ro 📈 (@SamRo) November 27, 2020

You can argue a low amount of air travel is good for the economy because it limits the spread of the virus. We will have a moment of truth after the vaccines goes out, but until then we don’t expect a full recovery. Some are predicting there won’t be a recovery after the vaccines go out because businesses will want to save money by using video chat software. Video chat software has always existed. In-person meetings will always be relevant.

The malls were empty as people shopped online because of the virus. Foot traffic to stores fell 95% on Thanksgiving Day. According to Adobe, online Thanksgiving Day spending was up 21.5% to $5.1 billion which was a new record. It’s worth noting that since people didn’t celebrate with their extended families, they had more time to shop online. Retailers that offer curbside pickup had a 31% higher conversion rate to their sites. It’s a safer way to get items than going in the store. The NRF, which expected 3.6% to 5.2% holiday spending growth, has 20% to 30% online growth in their numbers. Black Friday sales at stores fell 52.1% and online sales were up 21.6% which was $9 billion in spending.

SPACs Keep Going

SPACs are symbolic of extreme speculation in the stock market. Investors are buying stocks without research and winning big. Those are the new rules of the game in 2020, but that doesn’t mean these rules will stay for the long-term. As you can see from the chart below, there are 248 SPACs outstanding.

The SPAC universe consists of 248 blank check companies, of which 51 have announced a deal and 197 are still seeking arrangements

— The Arbitrage King 👑 (@JulianKlymochko) November 28, 2020

In addition, there are 59 SPACs that have filed an S-1, waiting to IPO pic.twitter.com/fKSRBpj4HP

51 have announced a deal and 197 are seeking arrangements. The longer this bubble goes on for, the worse the deals will be as firms are desperate to make a deal to get their cut when the reverse merger happens. 59 SPACs have filed an S-1 and are waiting to IPO.

Conclusion

80% of firms that have been in the S&P 500 at one point in the past 25 years have underperformed the index. This was the worst decline in energy stocks since the early 1930s. Corporate profits have more than recovered their recessionary losses because of fiscal deficits. TSA throughput was down 41% on Thanksgiving Eve. Online sales growth was solid on Thanksgiving and Black Friday. It was very weak in stores, of course, because of the virus. The SPAC bubble is still alive and well.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be ...

more