Why Not Wednesday – 18,000 On The Dow? No Worries

"Don't worry about a thing,

'Cause every little thing gonna be all right.

Singin': "Don't worry about a thing,

'Cause every little thing gonna be all right!" – Bob Marley

We're not worried because we cashed out yesterday.

That's right, the Dow hit 18,000 and we took the money and ran, closing out over half of our uncovered Long-Term Portfolio positions, pretty much everything that was up 40% or more, getting our CASH!!! off the table just in time to take a 2-week trading vacation ahead of the June 23rd Brexit vote. It's so much easier to take your money off the table while things are still going up – you get much better prices from all the suckers who are still buying (they are called "bagholders" by market professionals).

The last time we did such a big cash out was last August and our timing was perfect then as we cashed out and went short and, by September, as the markets collapsed, our paired Long and Short-Term Portfolios hit $1M for the first time (up 66%) and we went shopping with our CASH!!! in late September (see "Back to Cash, Back to Basics – Buying Stocks for a Discount") caught the rally into January, cashed out again, went shopping in February and now we're out again at $1.5M – up another 50%, or 80% of our starting basis, in just over 6 months so of course we should be cashing in our gains, right?

Maybe our timing is wrong this time but that's why that indicator at the top of the page says "EXTREME GREED" that's where the market is and excuse us if we don't have the stomach to ride it up to 100. When you have profits, you NEED to learn to lock them in and protect them – otherwise, what's the point of making them?

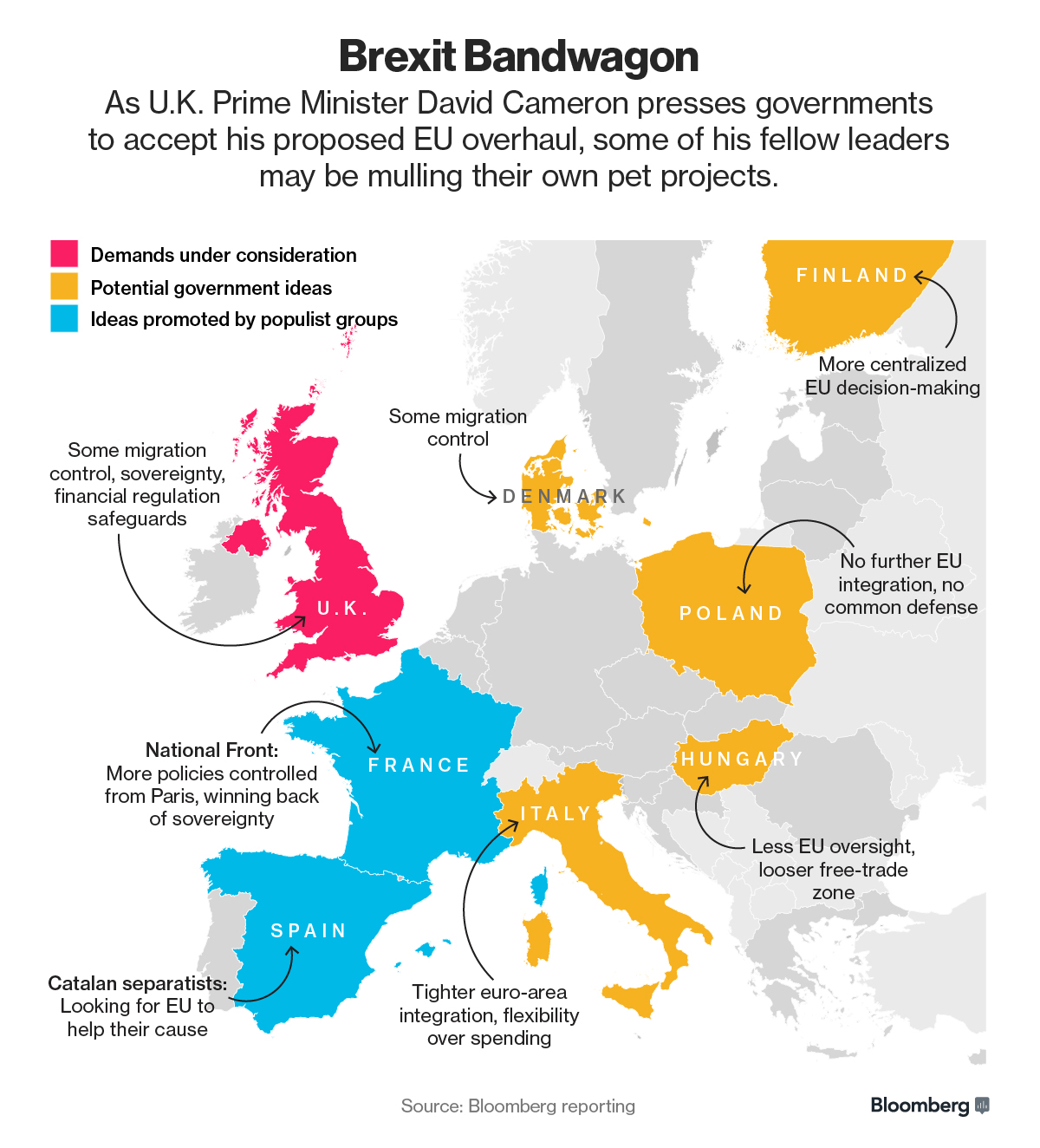

As you can see from the chart on the right, the June 23rd Brexit vote is not the only issue facing the EU as 7 other nations are already demanding changes in the charter and Italy is right on Greece's tail if the ECB doesn't do something about their unpayable debt balances.

Something is going to hit the fan this summer. After the Brexit vote, even if the UK remains, then we will turn our attention to Brazil with 6 weeks to the Olympics (Aug 5th) that country and their disastrous economy (World's 5th largest) will be in the news constantly – as will fears of the Zika virus, which is bad enough that 150 experts petitioned the World Health Organization to postpone or move the Olympics to avoid a possible global pandemic as people from all over the World converge on Rio, get bitten by infected mosquitoes and then go home in the summer to have their local mosquitoes in turn feed on them.

In our Short-Term Portfolio, we have a July spread on Intrexon (XON), who are working on genetically modified mosquitoes that only produce male offspring to introduce into the population to cut down on breeding. They also own most of AquAdavantage, who make super fast-growing salmon (ready in 18 months vs 3 years for normal salmon), which got FDA approval in November and now by Health Canada, so that's going to be a huge business too.

We're already up $2,600 (65%) on our spread (we jumped on the story back in January) but, as a new trade on the company and for our Options Opportunity Portfolio I like (with the stock at $28.62):

- Sell 5 Jan $20 puts for $3 ($1,500)

- Buy 10 Oct $25 calls for $7 ($7,000)

- Sell 10 Oct $30 calls for $4.60 ($4,600)

That will net us into the $5,000 spread for $900 in cash and our upside potential at $30 is $4,100 for a 455% gain on cash in 6 months. If XON is below $25, we risk losing our $900 and below $20 (down 30%) , we risk being assigned 500 shares at $20 ($10,000) – that's our worst case and, if it were just Zika, I wouldn't risk it but the salmon story is solid and should lead to very nice long-term revenue growth.

In riskier trading ideas, Oil (/CL Futures) ran up to $51.15 this morning with an inventory report coming at 10:30 this morning and, to be clear, we have TONS of longs on oil and Natural gas in our Portfolios but, between today and the 22nd, I expect to see $50 tested again, in the very least so we love the short play here and, if it pops on inventories, we'll be more likely to double down than stop out. $52.25 is the 10% line from the $47.50 bottom and that's our June move, so far so we expect that $1 pullback (weak retrace) or maybe a stronger $2 pullback to at least the $49.50 line so our plan is to short 1x here ($51.15) and go to 2x at $52.25 to average $51.70, then half out at $51.70 and we'll see how far it falls:

more