Why Do The Same Stocks Keep Rallying Day After Day Like Clockwork?

The stock market is up this morning on “start of the month” buying for pension funds and other large financial institutions.

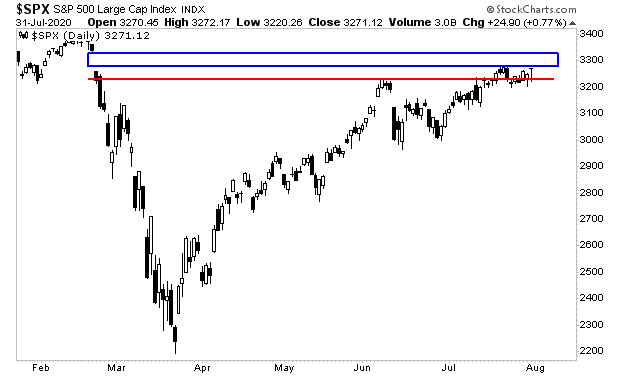

The S&P 500 did manage to close above resistance (red line in the chart below). However, it is struggling to move into “the gap” established by the first leg down of the March meltdown (blue rectangle in the chart below). (SPX)

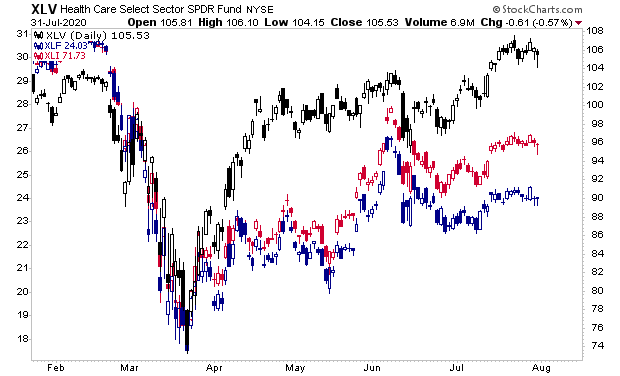

The bigger issue concerns the fact that the market is being largely driven by tech stocks. Financials, industrials and healthcare stocks, which comprise over 50% of the S&P 500 have effectively gone nowhere for several months now. (XLV)

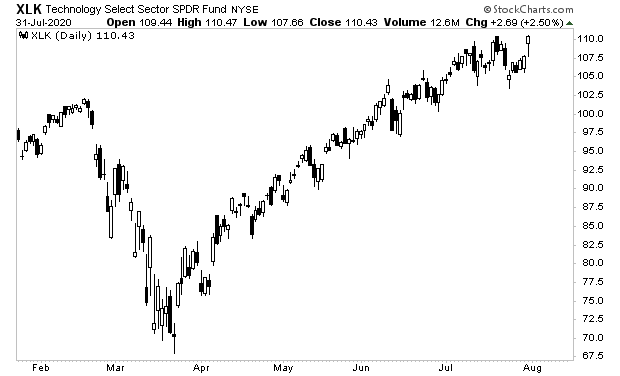

Meanwhile Tech stocks have exploded higher, soaring to new all-time highs. (XLK)

Why is this?

Because the large tech stocks (Microsoft, Apple, Amazon, Facebook) are where central banks are buying.

Together these companies account for nearly 20% of the stock market. And if central banks can get them to rally, the rest of the market will follow.

Put another way, if you were going to rig the market, these are the companies you’d be buying.

And with the same stocks moving higher day after day like clockwork, it’s pretty clear it’s central banks doing the buying.

At the end of the day, it all boils down to what I’ve been saying since 2017… that the Fed is trapped in a vicious cycle through which it INTENTIONALLY creates bubbles to deal with each successive bust.

We had the Tech Bubble in the ’90s.

The Housing Bubble in the mid-00s.

And now the Everything Bubble in 2020.

On that note, we’re putting together an Executive Summary on how to play this move.

It will identify which investments will perform best during the Fed’s next bubble, including a unique play that could more than double the performance of the S&P 500.

For more market insights and investment ideas, swing by our FREE daily e-letter at www.gainspainscapital.com.

People are playing the trend as usual. That said, it is fine to pay for growth, the issue is, will it continue at the current pace or slow down and are there better values out there. I think slower growth and better healthy balance sheets and decent and consistent profitability are worth it, especially if the companies have the sticking power to last years. For me, safety beats chasing the trends here. However, to each their own.