Why Bitcoin Is Heading Higher From Here

There is a lot of news about Bitcoin (BTC-USD) again, and this time sentiment is improving. Bitcoin made a move off its recent lows just as Elon Musk began discussing the idea of Tesla (TSLA) accepting the cryptocurrency again. In addition, it appears that the leading EV maker holds quite a bit of Bitcoin on its books. Now there are whispers that Amazon (AMZN) is starting to explore the digital asset segment.

Image Source: Unsplash

Multiple public companies invest in Bitcoin, but this trend is likely in its early stages. Prominent corporate leaders like Exxon Mobil (XOM) and others could start investing billions into Bitcoin going forward. The newsflow is shifting back towards a much more optimistic note, which will continue to fuel positive sentiment.

Additionally, the digital asset is coming off a prolonged correction and a consolidation phase. Bitcoin's fundamental and technical factors align once again. Positive sentiment leads to higher prices. Bitcoin is on the verge of breaking through a crucial technical level, and new highs are likely before the year ends.

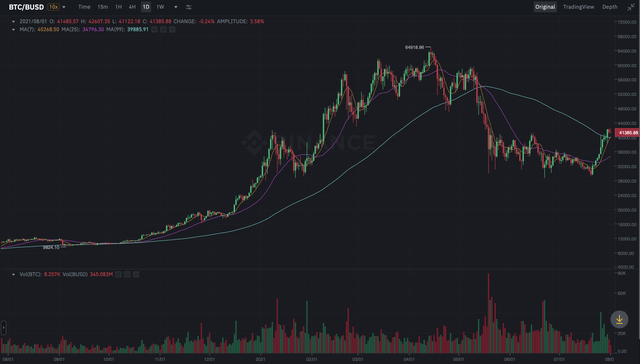

Bitcoin 1-year chart

Source: binance.com

Bitcoin "corrected" by about 55% from its all-time high in mid-April. Now BTC is on the brink of breaking above critical resistance at $42K, a level that once surpassed should allow for BTC to move notably higher.

Why I think the worst is behind Bitcoin

The all-important $30-28K support level got tested three times, and it held up each time. Moreover, let's look at the volume. On the first trip, the volume was massive and primarily sell-side. In the second attempt to take BTC lower, volume was high but lower than in the first down wave. We also see more buy volume after this dip. Finally, in the third wave, sell volume is lower than in the prior two breakdowns and is met with intense buy interest once $28-30K hold up for the third time.

This price action is a strong indication of a likely bottom in Bitcoin. It appears that prices went too high too quickly, needed to cool off, but Bitcoin did not enter a prolonged bear market, instead just a prolonged multi-month correction. Yes, I am calling a 55% move lower a correction, as a Bitcoin bear market could take a year or longer to work through and would likely cause prices to decline by 75% or more.

What Drives The Price Of Bitcoin?

There were a lot of bullish articles on Bitcoin when prices were hitting all-time highs. However, now that Bitcoin is 50% cheaper, there are a lot of bearish publications.

Source: seekingalpha.com

No, articles don't drive the price of Bitcoin, but popularity and sentiment do. This phenomenon is not new, as we have observed popularity and sentiment peak along with Bitcoin's price in prior waves. However, I don't think that we saw the peak just yet in this cycle. Instead, we likely witnessed a temporary disruption to the bull market. Multiple transitory news events coincided with extremely overbought market conditions. This dynamic led to a transitory drop-off in sentiment, which disrupted demand and caused prices to crash in May.

However, this is the cycle of increased popularity amongst institutions, not just the retail investor like in prior bull markets. The increased popularity amongst corporations is only beginning and should continue to improve sentiment, drive demand, and propel the price of Bitcoin notably higher from here.

Bitcoin is Back

The price of Bitcoin is growing in part because institutional interest is increasing. Tesla is often looked upon as a revolutionary company, leading the way as far as large-cap corporate interest goes in Bitcoin. However, it is certainly not alone, as another forward-looking mega-cap corporation (Amazon) seems to be examining a future in Bitcoin as well.

In other news, German funds that manage around $2.1 trillion in assets can now invest up to 20% of their holdings in Bitcoin. This trend of institutional investing in Bitcoin and other digital assets is only starting, and most institutional investors expect to invest in digital assets in the future. Therefore, we should continue to see substantial inflows into Bitcoin and the digital asset segment in general as we advance.

Technical Setup

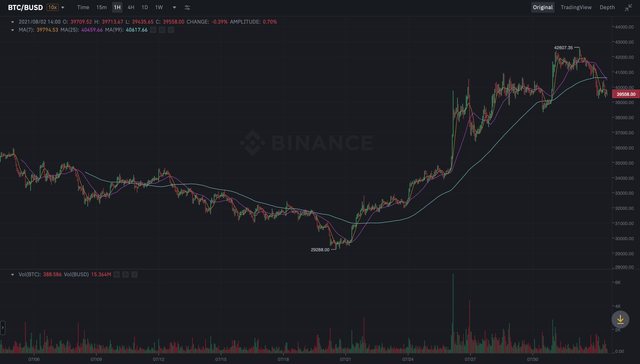

Source: binance.com

Bitcoin appreciated by around 45% (peak to trough) from its recent bottom. While this is a remarkable gain in such a short time frame, Bitcoin will likely go substantially higher. We will probably see some consolidation, possibly even a "mild" pullback after the recent run-up, but Bitcoin should penetrate the crucial $40-42K resistance level in future sessions. The breakout above this technical level should open the door to higher resistance and ultimately to new all-time highs after that.

Companies that Accept Bitcoin: Microsoft (MSFT), PayPal (PYPL), Whole Foods (owned by Amazon), Starbucks (SBUX), Home Depot (HD), Overstock (OSTK), and many others.

The Bottom Line

More and more companies will likely start accepting Bitcoin and other digital assets as a form of payment in the future. This dynamic of widespread acceptance, institutional interest from an investments standpoint, and institutional interest from a balance sheet perspective should continue to increase popularity, improve sentiment, and lead to substantially higher Bitcoin prices in the future. Bitcoin is in a favorable position from a technical perspective and a fundamental standpoint. The digital asset's price is likely going to break out above $40-$42K resistance and should go on to make new all-time highs before this year's end.

Which Assets to Consider

I prefer to invest in the underlying digital assets, Bitcoin, Ethereum (ETH-USD), Cardano (ADA-USD), etc. But if you want to get exposure to Bitcoin through equities, consider these stocks:

Note: The stocks I am about to discuss are elevated risk investments due to their involvement in the digital asset industry. However, where risk is elevated, reward potential is typically high as well.

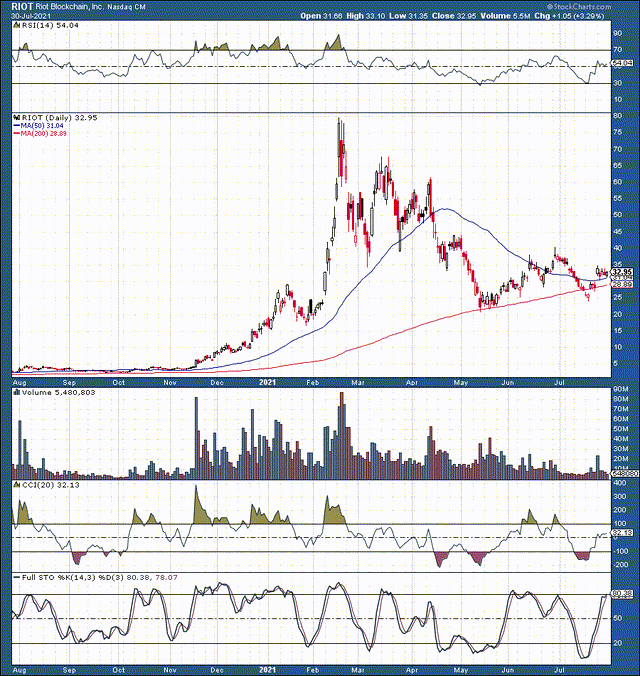

Riot Blockchain (RIOT)

Source: stockcharts.com

Riot is a North American Bitcoin miner. The stock enjoyed a stellar runup over the past year. However, shares have deflated by around 60% from Riot's ATHs. Riot currently trades at about 17 times 2022's consensus EPS estimates and is expected to generate substantial revenue growth in future years.

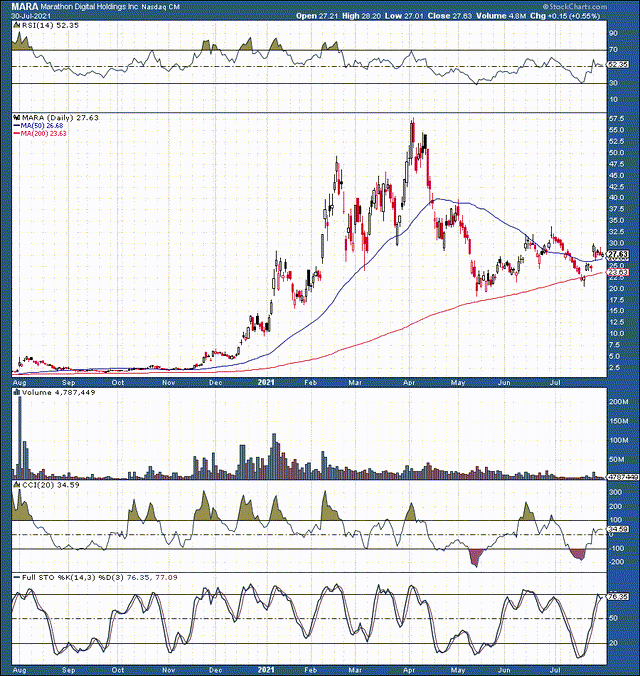

Marathon Digital (MARA)

Source: stockcharts.com

Marathon is another digital asset miner with operations in the U.S. This stock also went through a huge boom and bust period and is now trading at about 10 times 2022's consensus estimate EPS figures. Like Riot and many other Bitcoin mining companies, MARA wasn't very profitable with Bitcoin under $10,000. However, now that Bitcoin is around $40,000, Marathon's business is much more viable and should continue to become more profitable as Bitcoin's price rises.

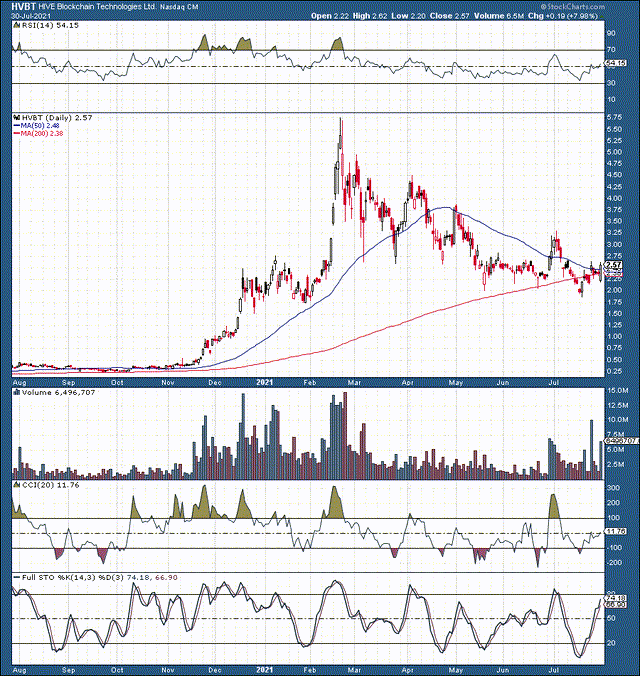

HIVE Blockchain (HVBT)

Source: stockcharts.com

HIVE is a smaller cryptocurrency miner headquartered in Canada. We see a similar technical image as with the prior stocks mentioned. Now it may be time to head higher once again. With these companies, we are banking on the price of Bitcoin going higher, as the stock price appreciates along with positive price action in the world's number one cryptocurrency. While HIVE is a smaller company and is yet to become profitable, its revenues will nearly triple on a YoY basis this year.

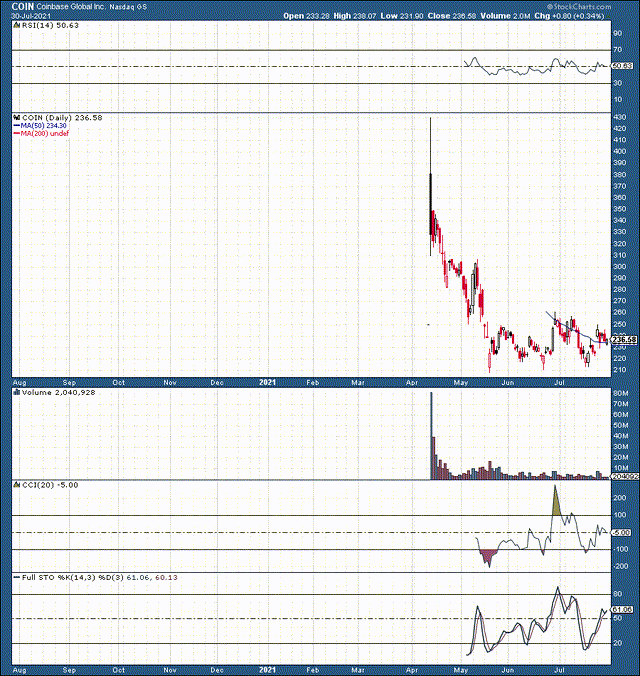

Coinbase Global (COIN)

Source: stockcharts.com

Coinbase is one of the largest global cryptocurrency exchanges. The company went public right around the recent market top. Thus, we see a sharp decline off the highs. However, the $210-200 level has held up several times, and shares are likely to head higher if BTC continues to do well. The company is trading at around 26.5 times this yea's EPS estimates. While COIN expects to have a decline in EPS next year, earnings should increase in future years.

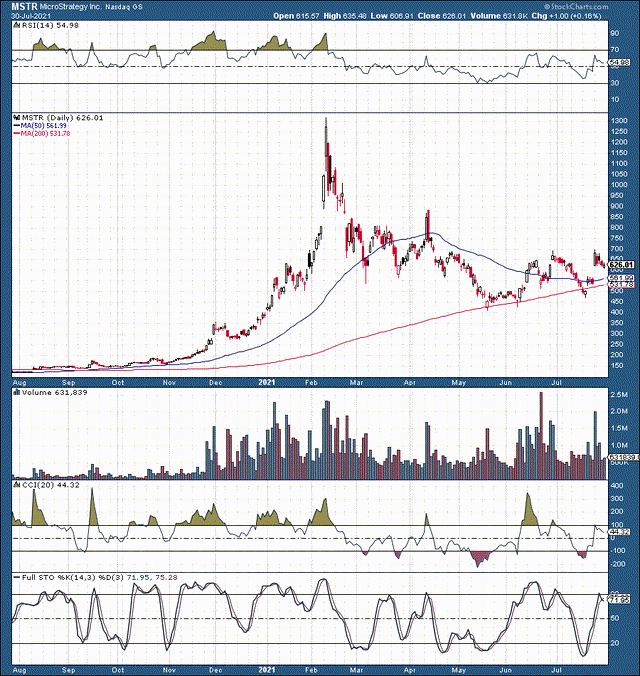

MicroStrategy (MSTR)

Source: stockcharts.com

MicroStrategy is one of the most prominent investors in Bitcoin. The company reportedly owns more than 100,000 Bitcoins, worth roughly $4 billion right now. Given that the market cap of this company is around $6 billion, its stock price will likely trade along with Bitcoin going forward.

Risks to Consider

Bitcoin remains a volatile asset and is not suited for everyone. Numerous factors like increased government regulation, hacking, functionality issues (such as speed, cost, and scale), fraudulent activity, and other detrimental elements could impact Bitcoin's popularity/sentiment and affect its price negatively.

Therefore, for investors with low to mild risk tolerance, a position size of 3-5% of total portfolio holdings may be appropriate. For investors with higher risk tolerance, a position size of 10% of portfolio holdings may be suitable.

It remains unclear exactly how Bitcoin's future will play out. The digital asset could be worth a lot more than it is now several years down the line, or it could be worth a lot less.

Disclosure: I/we have a beneficial long position in the shares of BTC-USD, ETH-USD, ADA-USD either through stock ownership, options, or other derivatives.

Disclaimer: This article ...

more