Who You Calling Chicken?

This Tyrannosaurus Rex, that looks very much like a fire rooster, is the bird’s predecessor.

So the Rallysaurus, which some would argue began the market’s road to extinction today, may just be a rooster in dinosaur’s clothing.

After a weekend of tumultuous polices that were met with opposition, the confidence in the market’s ability to maintain strength came into question.

The Dow broke down back below 20,000. Significant? Psychologically perhaps. Technically? Not so much.

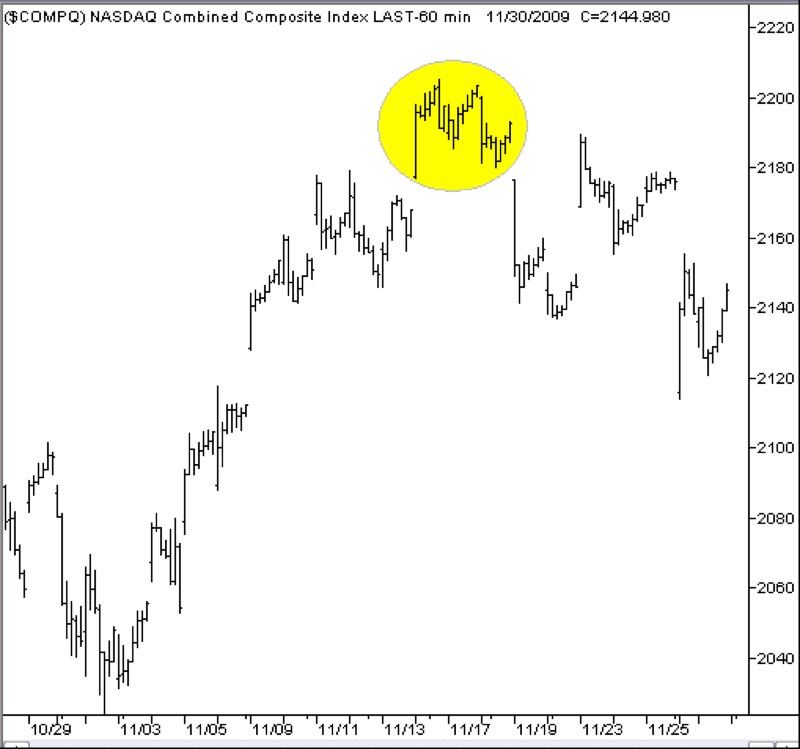

However, what could turn out as a much bigger technical issue is the potential island top left in the S&P 500.

An island top fits one of the 5 criteria for establishing a top in any financial instrument.

An island top means after a gap higher (SPY had a runaway gap last week), the instrument then gaps lower leaving a price island that stands alone.

Will our Rallysaurus, in its race to the top, reveal itself a more evolved fire rooster or did it just get smoked?

Looking at the Modern Family, the Russell 2000 fell beneath the 50 daily moving average entering its second unconfirmed warning phase.

Should IWM fail to move higher tomorrow, the next point to gauge how the other indices might ultimately perform is if IWM can or cannot hold the January 6-month calendar range low 133.59.

Granny Retail (XRT) is another piece of the puzzle. A possible reversal pattern with decent volume could take Granny from near coma to up and shopping.

Transportation (IYT) may have put in a double top. However, it holds in a bullish phase. Biotechnology (IBB), already discounted as the weak link, can still play a role.

Higher levels in IBB will bring around buyers. A collapse under 264 should create even more problems.

Semiconductors (SMH), our sister, offers the best evidence for an extinct dinosaur now prancing around in rooster’s clothing. SMH held up extremely well.

Lastly, Regional Banks (KRE ) could see 52.00 (lower) over the course of a few weeks provided it cannot clear back over 57.00.

Good thing the fire rooster has its DNA origins in the Tyrannosaurus.

After all, it will require the genetic memories of its two-legged, huge headed, long legged, small armed and predatorial forefather to keep this rooster crowing.

S&P 500 (SPY) Between 228.51 and 228.34 sits the gap. Watching to see if it gets filled or not

Russell 2000 (IWM) 138 key resistance and 135.50 key support on a closing basis

Dow (DIA) Held the 10 DMA so now, 199 support and 200 the place to recapture

Nasdaq (QQQ) No more runaway gap but no island top either

KRE (Regional Banks) Not much unless it breaks 54.58 or get back over 56 and holds

SMH (Semiconductors) No harm no foul

IYT (Transportation) 171.16 the high. Must take that out to keep going. 164.50 key support

IBB (Biotechnology) 277 and above would get interesting

XRT (Retail) Held 42. Now, over 42.83, today’s high, could get this back to 43.90 next test

IYR (Real Estate) 76.34 the month moving average like to see hold if good

GLD (Gold Trust) 113.50 now closest support to hold

SLV (Silver) 16.00 support and 16.50 still the number to clear

USO (US Oil Fund) Held 11.23 the 50 DMA

TLT (iShares 20+ Year Treasuries) Looks weak but hard to gauge

UUP (Dollar Bull) 25.80 support. Key

FXI (China) 36.24 the 50 DMA to hold. Still looks good

Disclosure: None.

Thanks dear for your information