Who Better Predicted The Transitory Inflation Surge Of 2021-24?

Consumers, CEO’s, or economists?

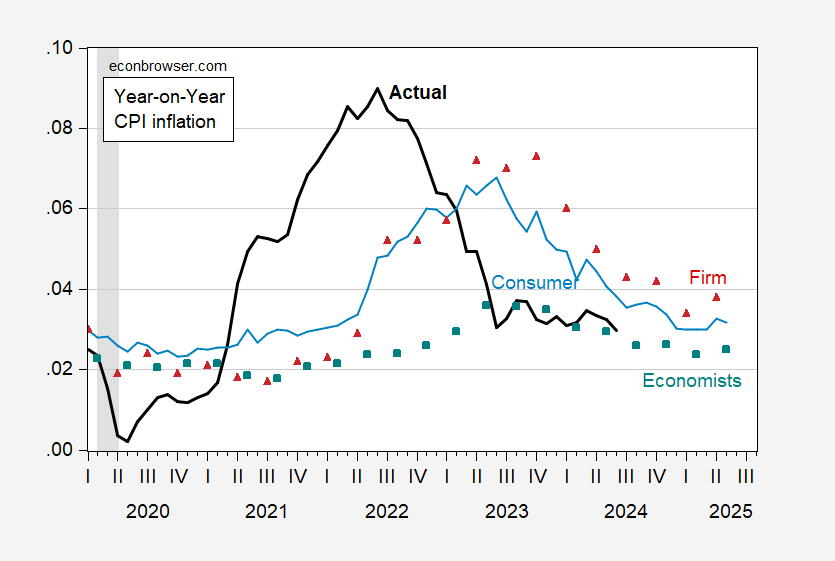

Figure 1: Year-on-Year CPI inflation (bold black line), corresponding 1 year ahead inflation expectation from NY Fed consumer survey (blue line), from Coibion-Gorodnichenko firm survey (red triangle), from Survey of Professional Forecasters (teal squares). NBER defined peak-to-trough recession dates shaded gray. Source: BLS via FRED, NY Fed, Cleveland Fed, Philadelphia Fed, NBER.

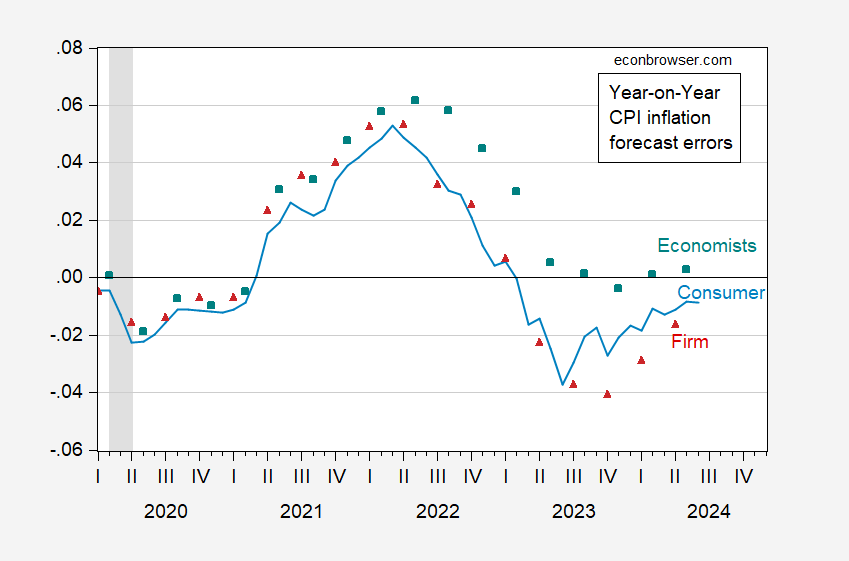

The forecast errors look as follows:

Figure 2: Forecast errors for Year-on-Year CPI inflation and corresponding 1 year ahead inflation expectation from NY Fed consumer survey (blue line), from Coibion-Gorodnichenko firm survey (red triangle), from Survey of Professional Forecasters (teal squares). NBER defined peak-to-trough recession dates shaded gray. Source: BLS via FRED, NY Fed, Cleveland Fed, Philadelphia Fed, NBER, and author’s calculations.

While professional forecasters missed the inflation surge, they have hit the actual inflation from May 2023 onward.

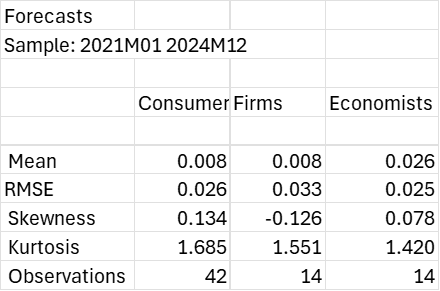

While economists were substantially biased in their expectations in this period, underpredicting y/y inflation at the one year horizon, the root mean squared error (RMSE) of economists' forecasts was lower than that of firms, and about the same as that of consumers. Of the three measures, only the firm expectations fail to reject the no-bias null.

On the other hand, firm CEOs overpredict inflation into the latest period.

In terms of adjusting forecasts in response to errors, consumers are the slowest (as measured by the AR(3) of errors, at near unity). Firms are next, at 0.89, and economists fastest at 0.81.

More By This Author:

An Eventful Week – Interest RatesBusiness Cycle Indicators, With Employment, Monthly GDP

Employment: Different Measures