While The US Economy Was Extremely Strong In Q3, Slower Growth Is In The Offing

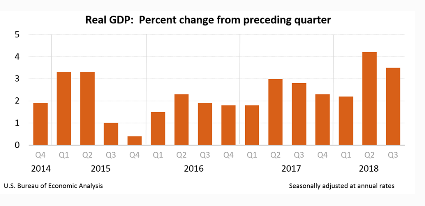

America’s real GDP increased at a 3.5% annual rate in Q3 and at a 4.2% pace in the second quarter.

The revised third quarter growth rate was unchanged from an earlier estimate published in October.

The American economy is still expanding well above the economy's estimated potential growth rate, thought to be about 2%. As well, after-tax corporate profits increased at a 3.3% rate last quarter after rising at a 2.1% in the second quarter.

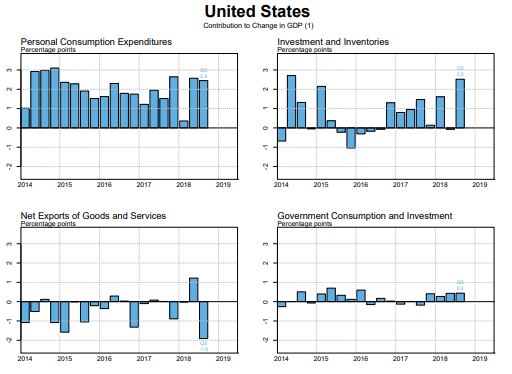

The pattern of growth which emerged in Q3 was dominated by a rapid expansion of inventories and a strong spending on business investment. Indeed, the unusual pattern of spending, inventory accumulation and net exports which emerged in the third quarter suggest that the trade war was having a distorting affect on the growth rate figures.

While recent growth has been very strong, there are a series of signs on the horizon signaling slower growth is in the offing. Among such signs, there are the following:

- America’s economic expansion is currently nine years old, and is also the second longest expansion in recent history;

- Higher interest rates have softened final demand, and are expected to negatively affect the housing sector, consumer spending, and business investment;

- Current indicators are foreshadowing a weakening of business investment and housing construction;

- Lower oil prices are expected to dampen investment spending, even though lower oil prices also benefit for consumer spending;

- There is the shock impact of the GM announcement that it will cut thousands of jobs in the US and Canada; and

- Finally, for the fourth time this year, low unemployment and the bullish growth estimates will likely probably prompt the Fed to raise interest rates in December.

In closing, this year’s strong economic growth rate was escalated by the government’s huge $1.5 trillion tax cut package, which boosted consumer spending, business investment, and corporate profits.

Nonetheless, the growth and job creation benefits from the fiscal boost will start to fade next year and will be completely gone by 2020.

While US Growth Was Strong In Q3, Inventory Accumulation Was Unusually Huge

Disclosure: None.

another scary headline article that's nothing but conjecture. Oil is no longer the harbinger of future growth as it once was. the tax breaks are still kicking in good for the likes of buybacks. Companies have never been richer. The consumer is finally back from the dead. Give it up already. Anybody worrying about the market is really just worried about themselves and their portfolios losing money and they project that angst using the usual laundry list of risks to the market.