What To Expect In The Fourth Quarter

As we head into the final quarter of 2022, I wanted to take a few minutes to review where things stand in the economy, in the stock market, and with our trading models.

As you know, 2022 has been an incredibly challenging year for most investors.

Yes, the broad stock market has pulled back sharply. But on top of that, bonds have also experienced one of the worst bear markets in modern history.

So conservative investors who held “balanced” accounts to help protect their wealth have been hurt on both sides of traditional investment portfolios.

Add in a 40-year high for inflation and you have a very challenging environment for investors.

This is why I think it’s so important to implement non-traditional strategies that can generate profits that aren’t tied directly to the direction of the broad stock (or bond) market.

While all investment strategies carry some level of risk, diversifying that risk between different investment approaches can help reduce the destruction of wealth that can occur during a challenging period like this.

Let’s take a look at how our model portfolios have performed. And then I’ll share some thoughts on what to expect in the fourth quarter.

Q3 Performance

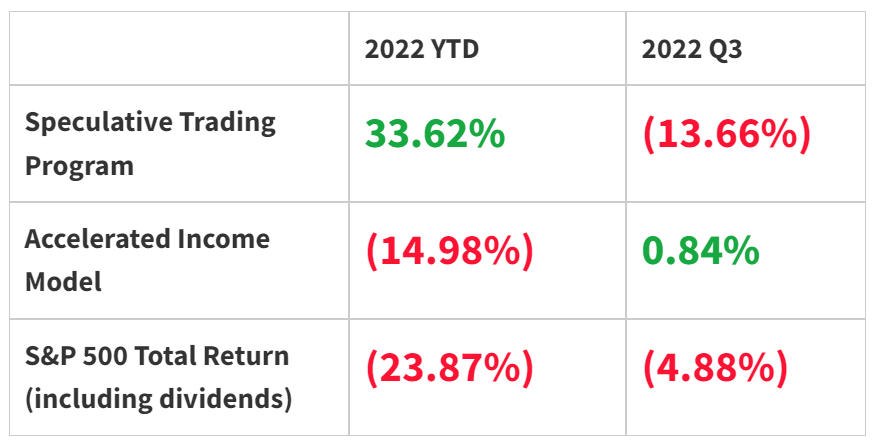

The table below includes official stats for our trading models.

If you’re following our positions in the Speculative Trading Program or the Accelerated Income Model, your results may differ. Depending on your execution prices, and the timing of capital contributions and withdraws, you may have higher or lower returns.

Speculative Trading Program

The Speculative Trading Program uses in-the-money option contracts to take aggressive positions on individual stocks. The program can profit from both rising stocks (using call contracts) and from falling stocks (using put contracts).

This is an aggressive trading strategy that accepts a high amount of risk in exchange for large potential profits. Because of this risk, I recommend only using a small portion of your investment capital with this strategy.

We generated strong returns in the first quarter – largely through bearish positions on speculative tech stocks.

The program has been less successful during the second and third quarters. Part of the challenge has been the choppy nature of the market — with significant bear market rallies followed by new lows.

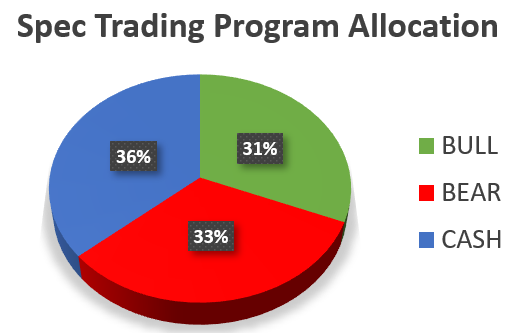

We’ll discuss expectations for the fourth quarter in more detail below. The model currently holds a balanced allocation of bullish plays, bearish plays, and cash available to use for new opportunities in the coming weeks.

Accelerated Income Model

The Accelerated Income Model collects income from individual stocks from selling put contracts. With this approach, we agree to buy shares of stock at a certain price, and we’re paid up front for our agreement.

This strategy is inherently bullish (for each individual stock we use). So it can be more challenging to generate positive returns during a bear market.

However, this conservative approach has a number of safety buffers built into each position. This helps us protect capital even during a negative period for the broad market.

When stocks fall quickly, these buffers can be overrun. In late April and early May, this scenario drove several of our stocks sharply lower, hurting performance.

But as the market has become more orderly, our income approach has been more predictable. Plus thanks to more fear and uncertainty, new positions can be set up with either more income for each transaction, or a wider safety buffer to help protect our capital.

I’m encouraged by the model’s positive performance during Q3 despite the decline for the overall market. And looking forward to Q4, I expect many opportunities to generate more reliable (and safe) income payments.

As of Friday’s close, we have roughly 75% of the portfolio allocated to individual income plays, with 25% of our capital available for new opportunities.

Looking Forward…

Heading into the fourth quarter investors have no shortage of concerns:

- Inflation is hurting both consumers and individuals. And while there are signs of inflation moderating, expectations continue to paralyze business and personal spending decisions.

- Slowing global economic growth will weigh on future earnings. Many countries are already in deep recession. The U.S. likely entered recession during the third quarter — or will over the next few quarters.

- Geopolitical risk has continued to escalate. After invading Ukraine, Russia is now making thinly veiled nuclear threats. Meanwhile, tensions are rising between China and Taiwan (and the U.S.).

- An energy crisis has pushed oil and natural gas prices higher. And while there has been a short-term pullback for energy commodities, an imbalance between limited supply and strong demand remains.

- Rising risks of policy mistakes could exacerbate existing economic challenges. The democratic leadership continues to pump various forms of stimulus into the economy (which is inflationary). At the same time, the Fed is raising rates to fight against inflation.

Despite these challenges, the probability of a bear market rally is high. We could even begin a brand new bull market period.

September is statistically the worst month of the year. And October has historically been a strong month for investors. This is especially true for mid-term election years.

The stock market is currently oversold and sentiment is near extreme lows.

During periods like this, both individual and institutional investors keep a lot of cash on the sidelines.

Any positive news (or lack of negative news) can lead to a rebound. Investors with cash on the sidelines have fear of missing out (FOMO) and start to put capital back to work.

This can lead to a positive feedback situation where more capital drives stock prices higher — resulting in short covering and more buy orders from sidelined investors.

So there is potential for the stock market to “climb a wall of worry” heading into the end of the year.

Our Positioning

Looking forward to Q4, I expect a tremendous amount of opportunity. But at the same time, there is a significant amount of uncertainty.

This type of environment requires us to be nimble, while keeping our options open (no pun intended).

As I mentioned earlier, we’re currently holding more cash than normal in both of our models. This helps to protect our capital as we wait for more clarity on the market direction. And it also gives us dry powder to invest as new opportunities arise.

I continue to be bearish on speculative technology and high-valuation growth stocks. This, despite the fact that many of these names have moved significantly lower this year.

Even after sharp declines (80% to 90% drops in some cases), many of these stocks still trade at a premium price compared to expected profits. And in many cases, profits are not expected for the next year — or for the foreseeable future.

Our Speculative Trading Program holds bearish positions on Amazon.com (AMZN), Carvana Co. (CVNA), Atlassian Corp. (TEAM) and Tesla Inc. (TSLA). All four of these plays look vulnerable as stock prices are expensive compared to earnings (or lack thereof).

Stocks in the energy and defense sectors have great potential for the next several months.

Global demand for oil and natural gas could increase. A relaxation of China’s “zero covid” policy could drive prices higher. And as the U.S. shifts from depleting the Strategic Petroleum Reserve to rebuilding storage, energy stocks should surge.

New geopolitical developments in Eastern Europe or between China and Taiwan could also drive defense stocks higher. New government contracts to re-supply U.S. weapons and ammunition could also be a catalyst for stocks in this sector.

Dividend stocks and deep value plays are also high on my watch list.

During uncertain periods, investors flock to safety — buying stocks of stable companies that generate reliable profits. Also in an era of high interest rates, investors will do well to focus on stocks that generate immediate profits (instead of future growth opportunities).

More By This Author:

Nike’s 44% Bomb Is Good News For These Two StocksHere’s What I’m Watching This Week - Sept. 12, 2022

How To Profit From The Strong U.S. Dollar