What Exactly Is The Fed Thinking? Avoid Catching Falling Knives

Fed Talk

Today, the much anticipated FOMC press release was as this author expected: the Fed stalled on raising rates again, claim everything is being monitored. In December, Yellen was bullish enough on the economy to raise the Fed Funds Rate by a paltry .25% and voiced expectations of gradually increasing the rate higher throughout 2016.

But in January the Fed didnt raise rates further - this is what was said: "Given the economic outlook, the Committee decided to maintain the target range for the federal funds rate at 1/4 to 1/2 percent. The stance of monetary policy remains accommodative, thereby supporting further improvement in labor market conditions and a return to 2 percent inflation."

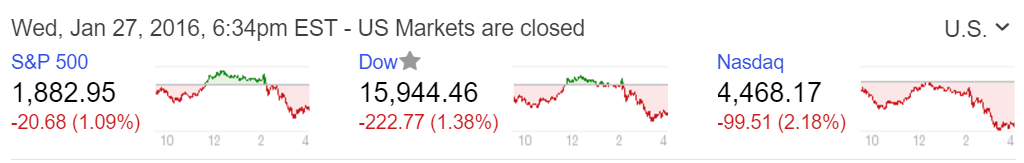

Stocks quickly turned red, pushing the DOW, SP500, and NASDAQ lower.

One question that has this author scratching his head: shouldn't markets be rallying? Yellen did say that the economy was recovering and will continue to do during the historic Fed meeting which resulted in the first rate hike in almost a decade. Thus, 4 weeks later, stocks are being slaughtered. Why? Wouldn't a rate hike imply that the all knowing Fed feels confidence in the US economy - which is bullish for capital markets? In fact in her own words when questioned about the chance of a recession in 2016, she said less than 10% chance.

A brief history lesson: during the Ben Bernankes testimony infront of the U.S. Congress during March 2007, he was also quite optimistic about the economy himself: "Overall, the economy appears likely to continue to expand at a moderate pace over coming quarters. As the inventory of unsold new homes is worked off, the drag from residential investment should wane. Consumer spending appears solid, and business investment seems likely to post moderate gains." How did his forecast turn out? The economy collapsed into the greatest depression since 1929. To be fair, Bernanke did warn that housing risks could be much more severe than first thought - and in that case he was prophetic.

Today: The lesson for investors? The Fed is not a crystal ball. They cannot see the future. Anyone's guess is applicable. Thus, to watch the mainstream cling to their words as if it is holy scripture is frightening. In fact, the Fed has a notoriously horrible track record with very poor forward guidance.

Yellen is really underestimating the potential crisis the banks are facing because of the junk bonds and oil related companies. Since 2009 Subprime mortgages fell out; junk bonds stacked with oil related debt was in.

In the 100 years prior to the establishment of the Federal Reserve, there were 18 distinct recessions or depressions:

1815, 1822, 1825, 1828, 1833, 1836, 1839, 1845, 1847, 1853, 1860, 1865, 1869, 1873, 1887, 1890, 1899, and 1902.

Since the establishment of the Federal Reserve, there have been 18 recessions or depressions:

1918, 1920, 1923, 1926, 1929, 1937, 1945, 1949, 1953, 1958, 1960, 1969, 1973, 1980, 1981, 1990, 2001, 2008

So in other words, the economy experienced just as many recessions with the ‘expert’ management of the Federal Reserve as without it.

And this doesn’t even begin to capture all the absurd panics (the S&L scare), bailouts (Long-Term Capital Management), and ridiculous asset bubbles that they’ve created, said Simon Black.

Public Fallacies:

Many investors blame China and oil prices for the distress in capital markets and economy. But aren't these also symptoms, not the disease itself?

Oil collapsing has affected junk bonds, employment, and oil states such as Texas (which is imploding itself), but what caused oil to collapse? Same with China - yes it is true that if China has slowing growth then all countries will feel it, but what is causing their slowing growth? Oil is controlled mostly by OPEC and supply/demand, but also affected by a strong dollar. And Chinese central bank policy mirrored the US until recently (China kept the Yuan pegged to the dollar, thus if the Fed kept rates low and liquidity sloshing, so did the Chinese central bank to maintain the peg - thus the U.S. exported inflation).

The Feds rate rise affects both of these markets. As many are aware - China was in free fall during Summer 2015 and oil was also suffering. The U.S. markets were dropping (the DOW shed more than 1,000 points in a single morning - that has never happened before). And what else? The Fed was all but assured to raise rates in September. But they didnt. And stocks rallied higher even though nothing was fundamentally or structurally fixed with China nor oil.

Parting Words:

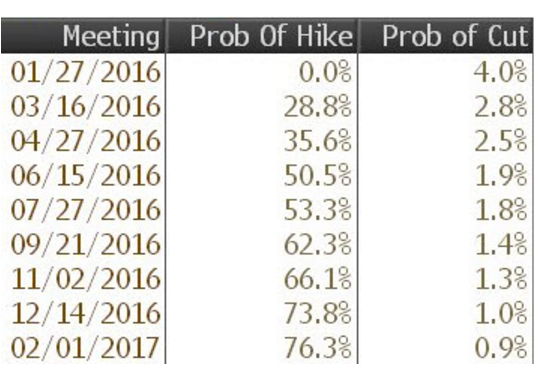

What too expect going forward? Investors and economists are all but positive rate hikes will continue:

As a contrarian, this author expects a rate cut before another hike.

Time will tell, but the US economic data is souring and its not getting better anywhere abroad either. The IMF is warning of iliquidity and potential international crisis which is worrisome. Who knows, these economists change their minds daily anyways.

But what usually goes up; must come down. And investors should steer clear of trying to catch a falling knife. Things will likely get worse before better.

Given the provable fact that there is no crystal ball and no one can predict anything in financial markets, what exactly are we doing here? The strategy in a perfectly random situation should be to not participate unless you enjoy a bet

You make an excellent point. That being said, I like a good bet, especially when I can improve my odds with some good intel.

I think of it as more of a carefully approached speculation, similar to chess, about the only options the Fed has.

Recession is here this they need to cut/go negative/QE

Or they try to not embarrass themselves after touting how well the economy is doing, warranting a rate hike, and keep the hikes going to keep confidence in them - and plunge he economy into a great recession.

Either or both roads lead to the same path.