What Are Uncle Sam's Largest Assets?

Pop Quiz! Without recourse to your text, your notes, or a Google search, which line item is the largest asset in Uncle Sam's financial accounts?

- A) Checkable Deposits and Currency

- B) Total Mortgages

- C) Taxes Receivable

- D) Student Loans

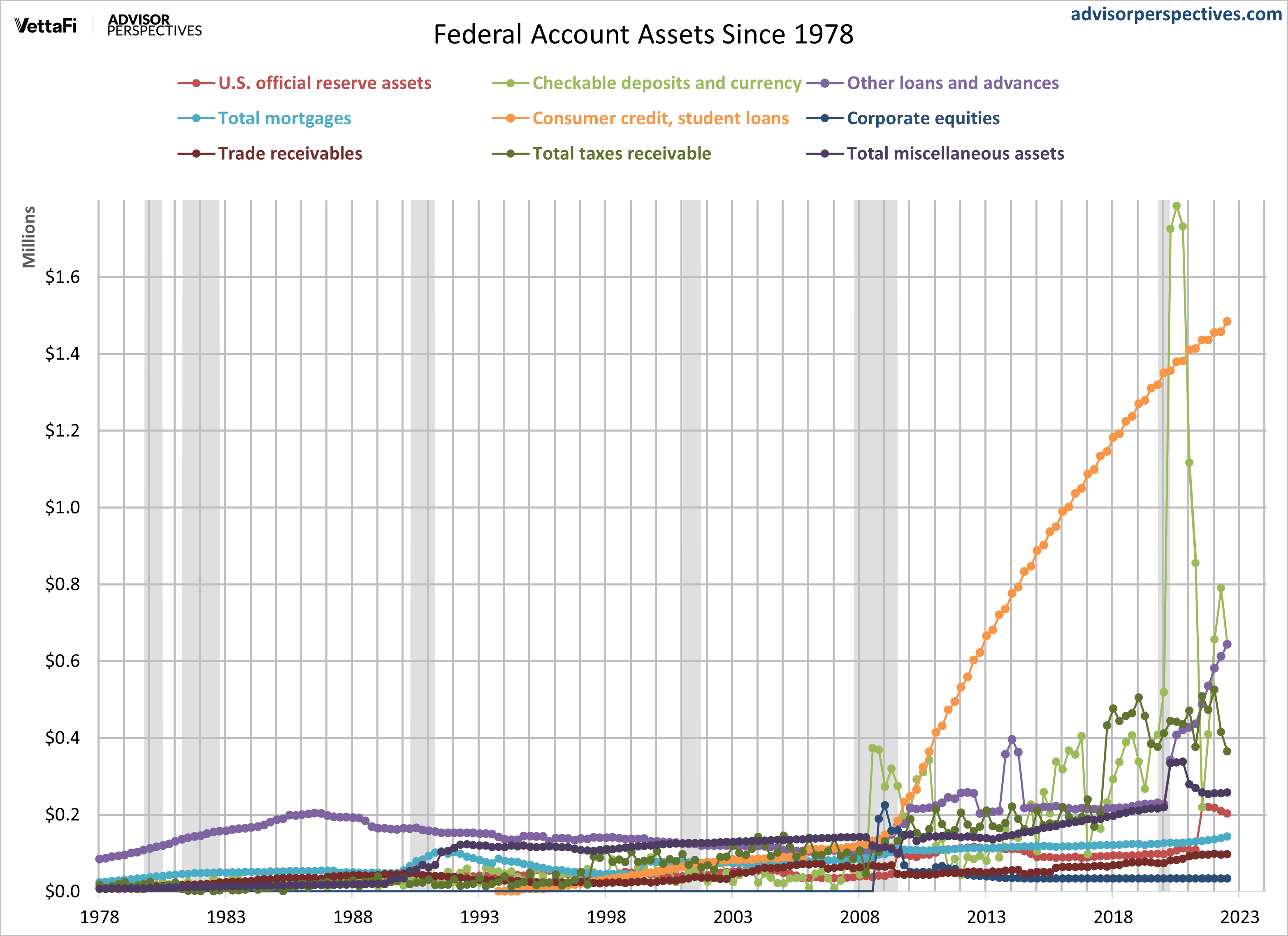

The correct answer, as of the latest quarterly data, is D) Student Loans. Last quarter the answer to this was A) Checkable Deposits and Currency for a brief period due to a decline in student loan balances because of CARES Act forbearances. Checkable Deposits and Currency soared as a result of massive stimulus and reduced consumption from the COVID pandemic.

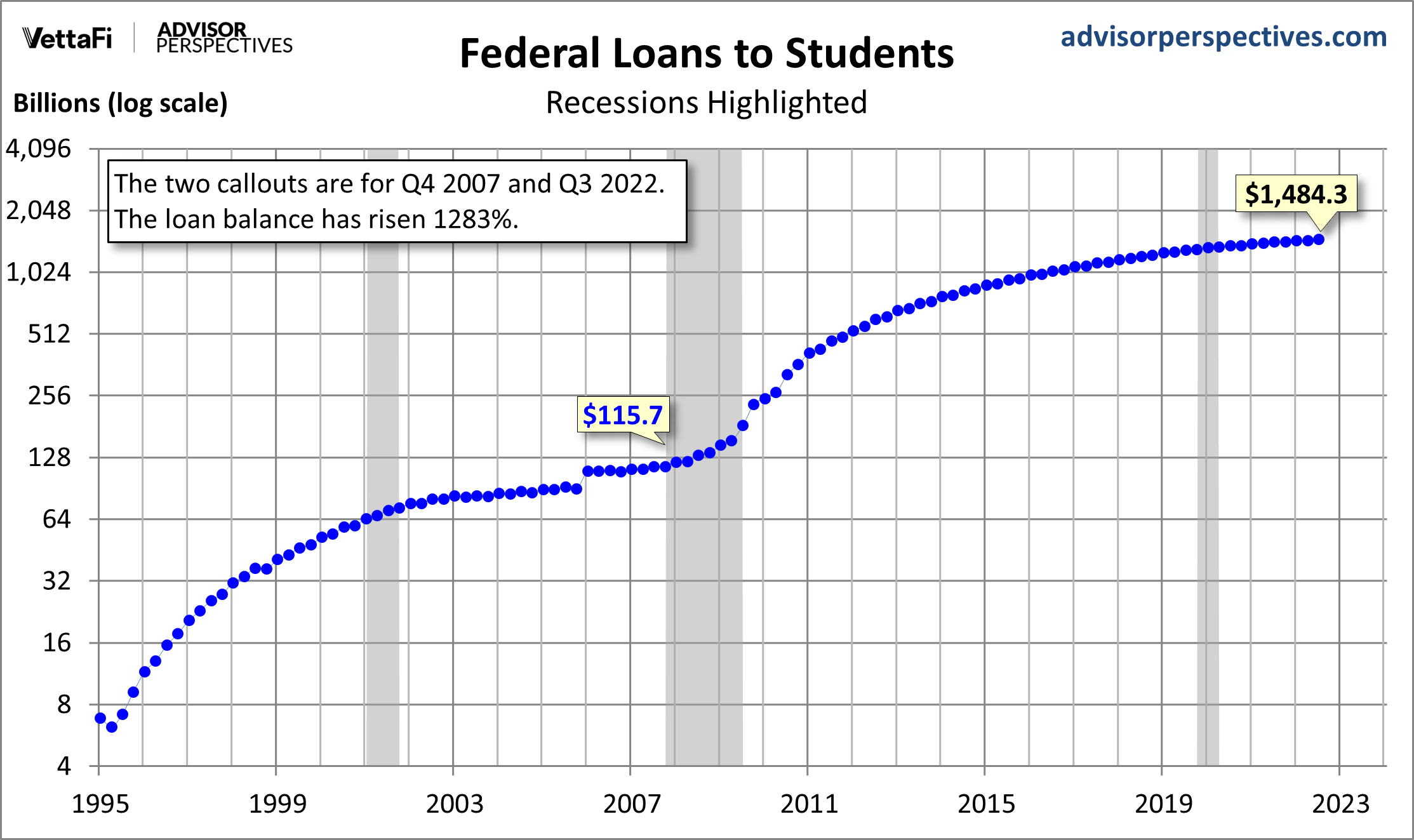

The rapid growth in student debt has been an ongoing topic in the financial press. A stunning chart that continues to haunt us illustrates the rapid growth in federal loans to students since the onset of the great recession. The chart is based on the Federal Reserve's Financial Accounts data (available here) for the government's assets and liabilities. We've used a log-scale vertical axis.

For a more dramatic look at the same data, here it is with a standard linear axis.

As we point out on the chart, the two callouts are for Q4 2007, the quarter in which the Great Recession began (December 2007), and the most recent quarter on record, Q3 2022. The loan balance has risen an astonishing 1,261 percent over that time frame, most of which dates from after the recession.

This chart only includes federal loans to students. Private loans increase the debt burden. The Federal Reserve Bank of New York regularly tracks household debt and credit. In their most recent update, they calculate student loan debt to be $1.59 trillion.

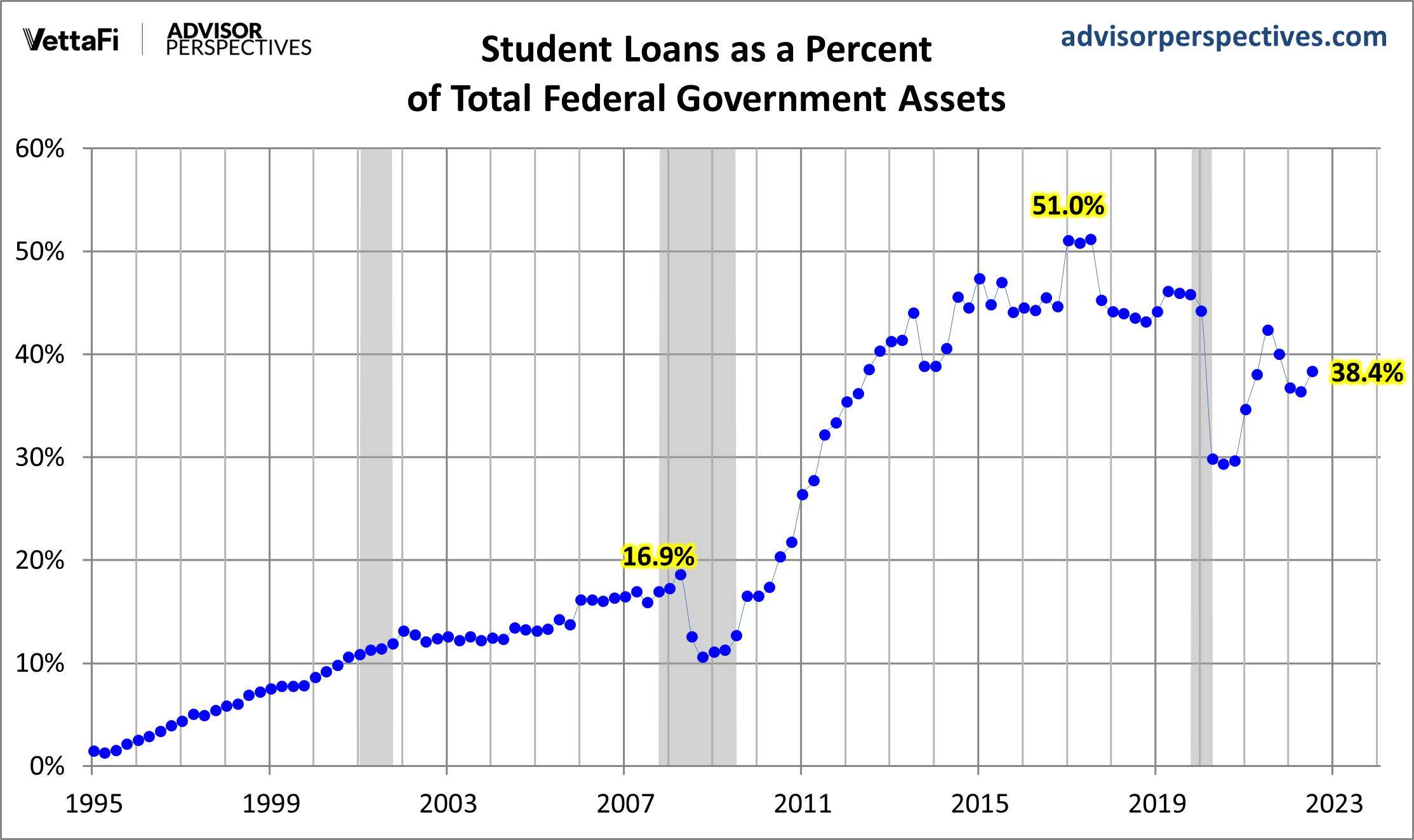

But back to our quiz. Student loans may be a liability on the consumer balance sheet, but they constitute an asset for Uncle Sam. Just how big? It's about 38.4 percent of the total Federal assets. This is about 10.4 times larger than the 3.7 percent for the Total Mortgages outstanding and 4.1 times the size of Taxes Receivable at 9.4 percent.

The 36.5 percent referenced is below its peak. Here is a look at how this metric has changed since 1995.

Here's a look at each of the assets over time from the pie chart above. You can see that Checkable Deposits and Currency spiked in 2020. The CARES Act has clearly had a massive impact on the money supply and the Fed's assets overall. Clearly, the Fed has injected money into the economy in order to maintain liquidity in the current recession, but the repercussions are yet to be seen.

Of course, assets are, sadly, the trivial side of Uncle Sam's Financial Accounts balance sheet — about 3.9 Trillion. The liability side totaled over 29 Trillion at the end of Q3 2022.

Closing note: For a fascinating perspective on student debt repayment, see this article by a team of economists at the Federal Reserve Bank of New York.

More By This Author:

December 2022: Market Valuation, Inflation, And Treasury Yields

S&P 500 Snapshot: Strong Start to 2023

Treasury Snapshot Friday, Jan. 6