We’ve Seen This Show Before. Read Data. Analyze Data. React To Data.

Image source: Pixabay

Anyone dizzy yet? Tariffs on. Tariffs off. Fire Jay Powell. Don’t fire Jay Powell. I am not even sure what day it is anymore. But in investing just like life, we play the hand we are dealt, not the hand we want. I see our aggressive models swinging heavily long to short to neutral to long and on and on. The news is the news, just like we saw with COVID in 2020 and, well, everything, in 2008. Markets are hostage to headlines, at least for now. That will change. I know that from doing this for 35 years.

On my personal Facebook account, I saw a friend emotionally posting about the stock market decline, bemoaning the losses he had endured, liquidating his portfolio and blaming Donald Trump and his policies in a very disparaging manner. Hey, it’s a free country. Post what you want as long as it’s not hate speech. My friend is super smart, but when emotion enters investing, it’s usually a one-way street to bad decisions. I asked him how he felt in 2022 which was the single worst year for diversified investing in history. He said that he lost, “just like everyone else”. I asked him if he ranted about Joe Biden and his policies. He said that “the market didn’t go down because of the president. It went down for other reasons.”

I hate that economics and investing have become partisan. It’s awful. For four years, folks complained to me about how Biden was ruining the economy and markets. Before that I heard how Trump did it, just like today. Ya know what I tell me people in a nutshell? Read data. Analyze data. React to data. Leave politics out of it.

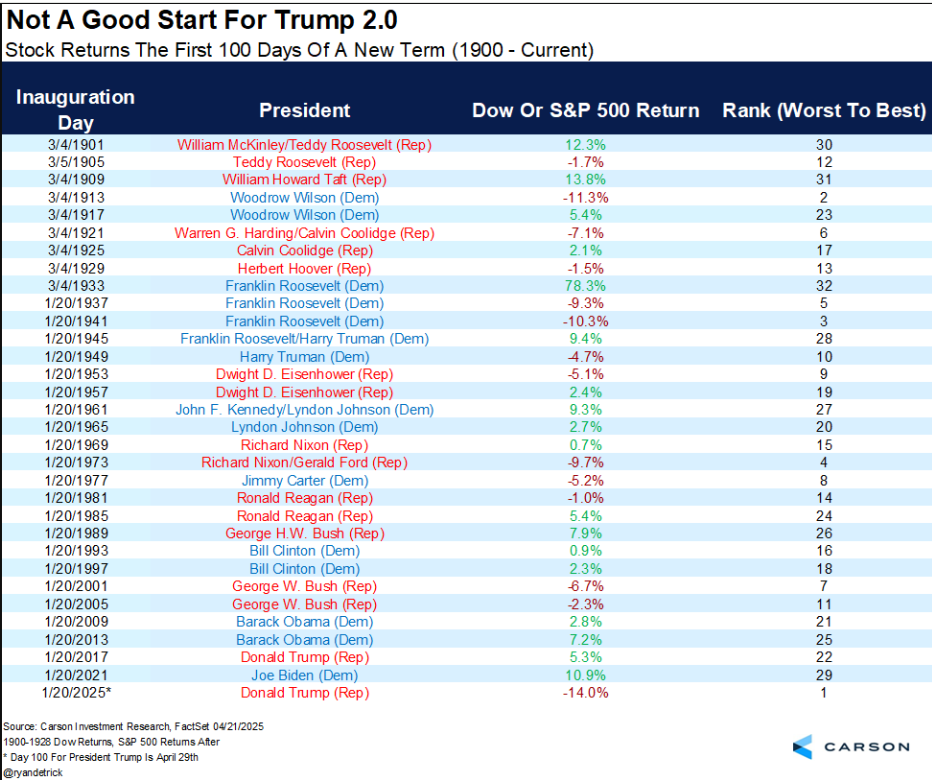

And keeping with data and leaving narratives out of it, I thought this was an interesting chart from my buddy, Ryan Detrick of Carson Wealth. It simply shows the stock market’s return over the first 100 days of all presidents.

(Click on image to enlarge)

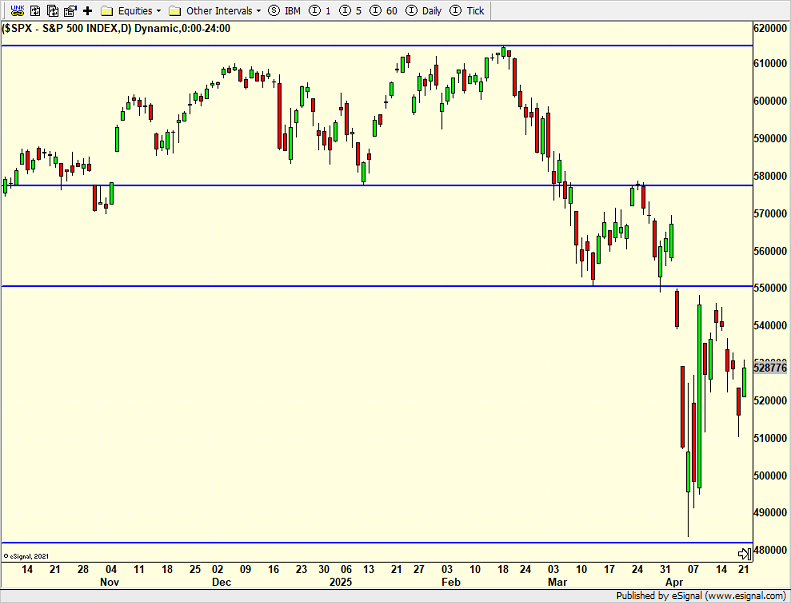

The stock market fell hard on Monday. So many people were chirping about a decline to new lows. My readers know I just saw a pullback coming last week. On Tuesday, stocks raced higher and pre-market today looks like a big up opening. Let’s take a step back and realize that the price action remains inside the range from two weeks ago on that huge 10% day. Markets continue to build a bottom. Bottoms need time and price. The latter has been met. The former has not.

(Click on image to enlarge)

As I mentioned before, more than 80% of the studies I am running forecast that the stock market will be at new highs by Q1 of 2026. I don’t have high conviction in the path to get there, but I will follow the data. I still think the markets need another 3-6 weeks to rebuild the foundation, but that’s not absolute.

On Monday we sold SDS, PCY, MC, TAN, some QQQ and some QLD. On Tuesday we bought EMB, LHX, SDS, more QLD and more ITA. We sold UWM, some NEM, some SII and some QLD.

More By This Author:

Markets Cranky To Start New WeekLooking At Other Similar Crashes As Stocks Target All-Time Highs In Less Than A Year

“A” Significant Low Is In For Stocks – “THE” Bottom Likely 4-8 Weeks Off

Please see HC's full disclosure here.